Jonathan ChancellorFebruary 14, 2016

The boss of the diversified property group Mirvac expects fewer Asia-based buyers, as the company delivered a 69 percent increase in profit to $472 million.

Its chief executive Susan Lloyd-Hurwitz said the residential property market had passed an "inflection point" and said the commercial property market was "nearing the end of the cap rate compression cycle."

"We are keeping a keen eye on the property cycle," Ms Lloyd-Hurwitz said last week when Mirvac Group reported its interim results for the half year ended 31 December 2015.

But she noted NSW had a "stronger for longer construction cycle" being underpinned by broad new infrastructure projects.

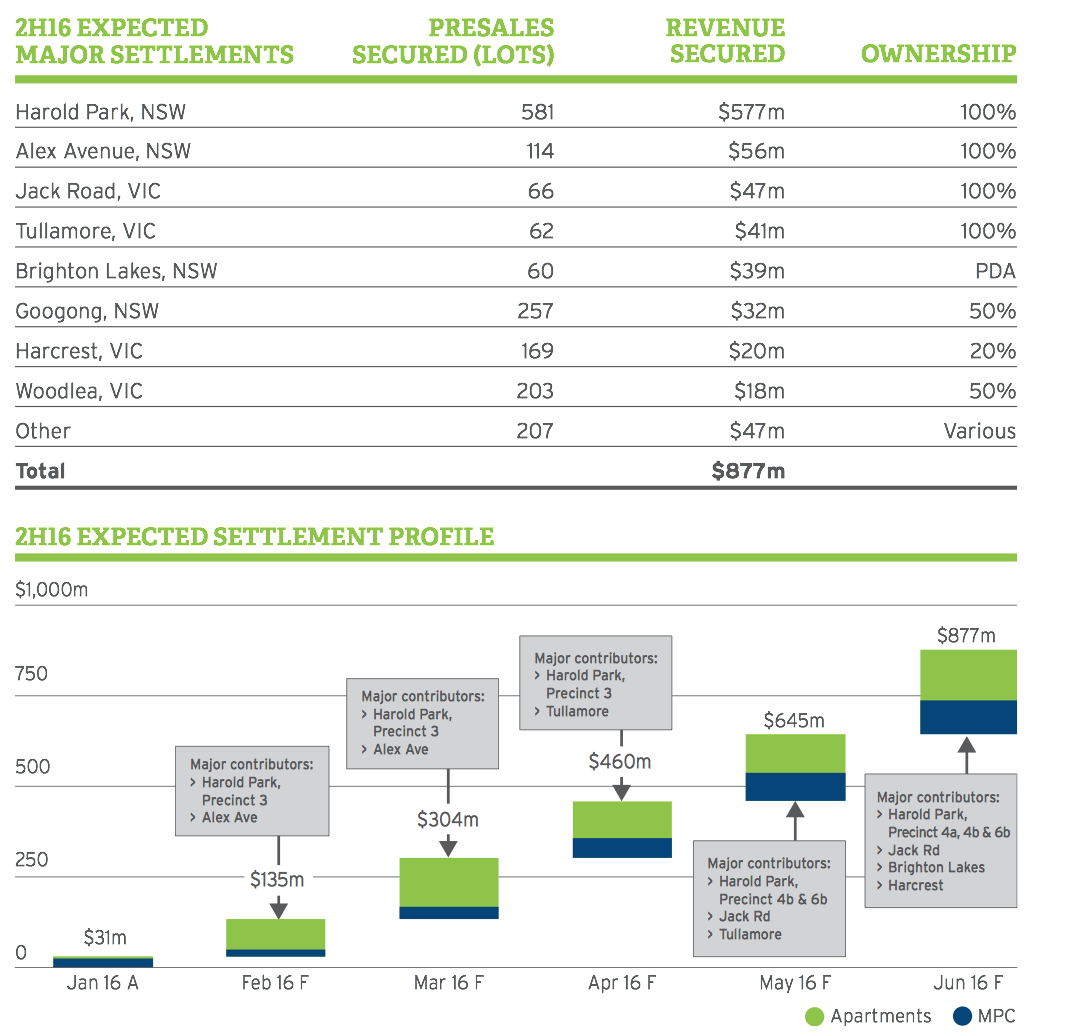

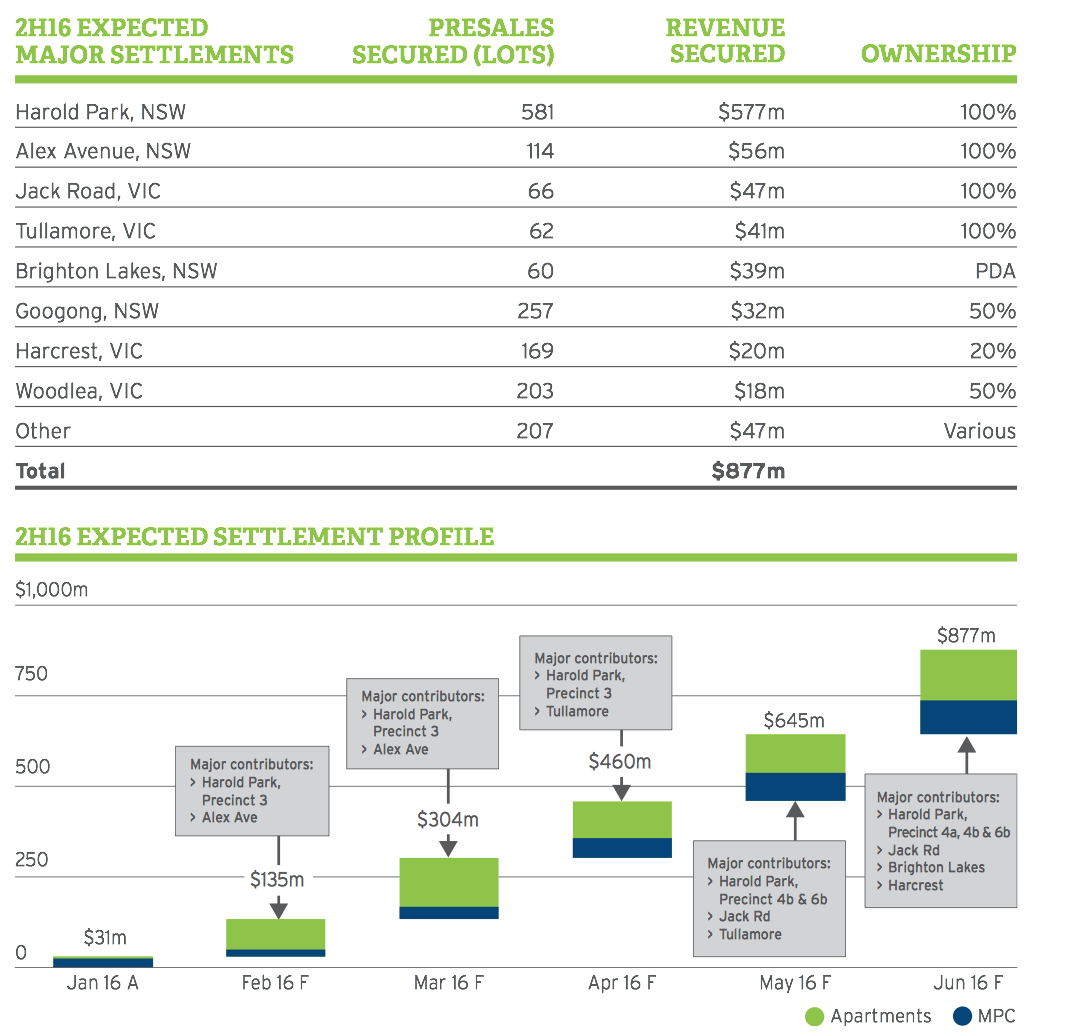

Click to enlarge

It has $877 million of residential pre-sales expected to settle in 2H16 after strong 1H16 residential gross margins of 25.3%, driven by outperformance of Sydney MPC projects and Melbourne apartments.

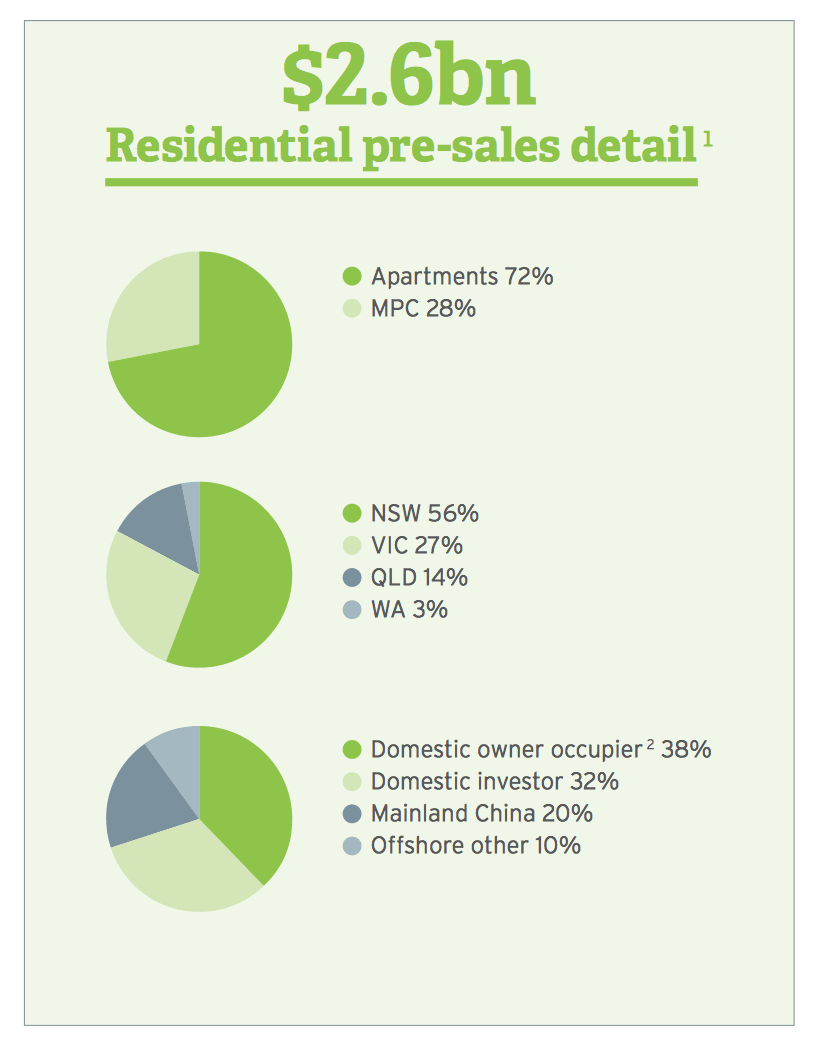

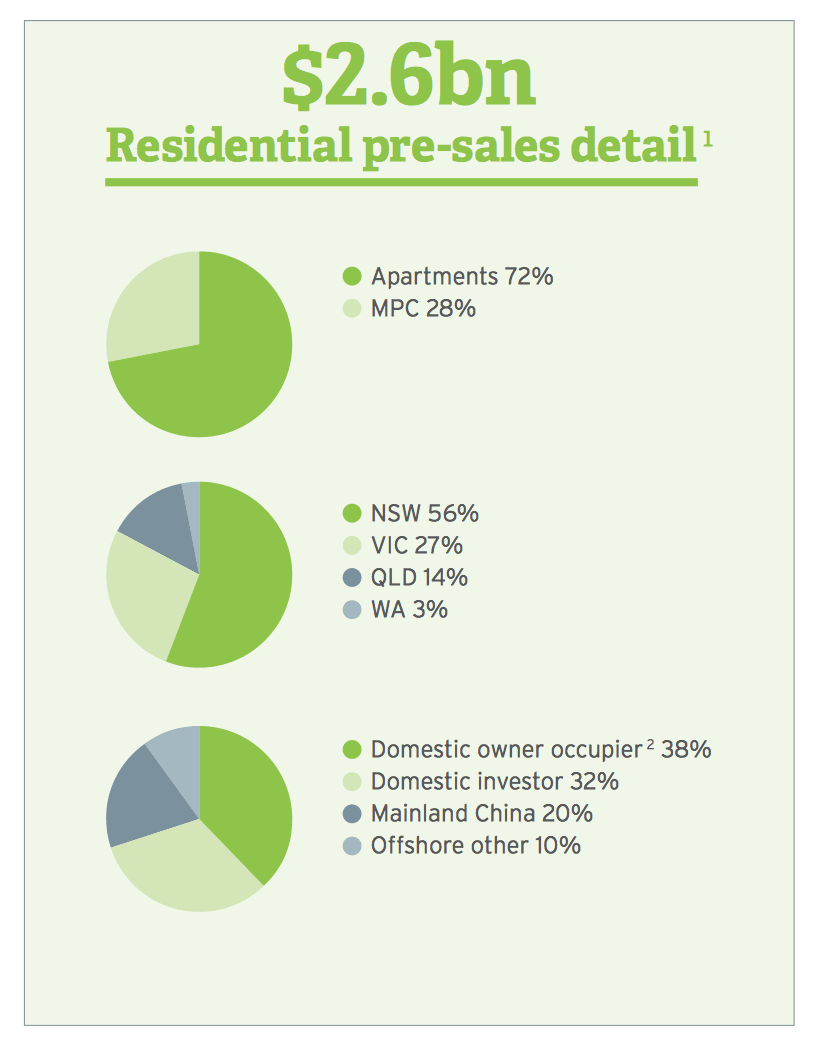

The group achieved record $2.6 billion of pre-sales, up from $2 billion at FY15 including securing 88% and 73% of expected FY16 and FY17 Development EBIT respectively, driven by record level of residential pre-sales.

Noting its resilience through brand equity — and a hgh level of repeat buyers with up to 25% of sales on some projects - the updated noted it had maintained its long-term average of less than 1% defaults.

Click to enlarge

Most analysts, according to the Australian Financial Review, focused their questions during the results briefing on the security of Mirvac's apartment settlements especially to offshore buyers.

"We do expect some moderation of offshore demand but we expect to see continued investor and owner occupier demand from Asia but at a little lower rate than last year," Ms Lloyd-Hurwitz said.

Some 14 percent of Mirvac's lot settlements went to offshore buyers and each addition purchase over 20 per cent of a project has to be given special individual approval by group executive for residential development John Carfi, it emerged.