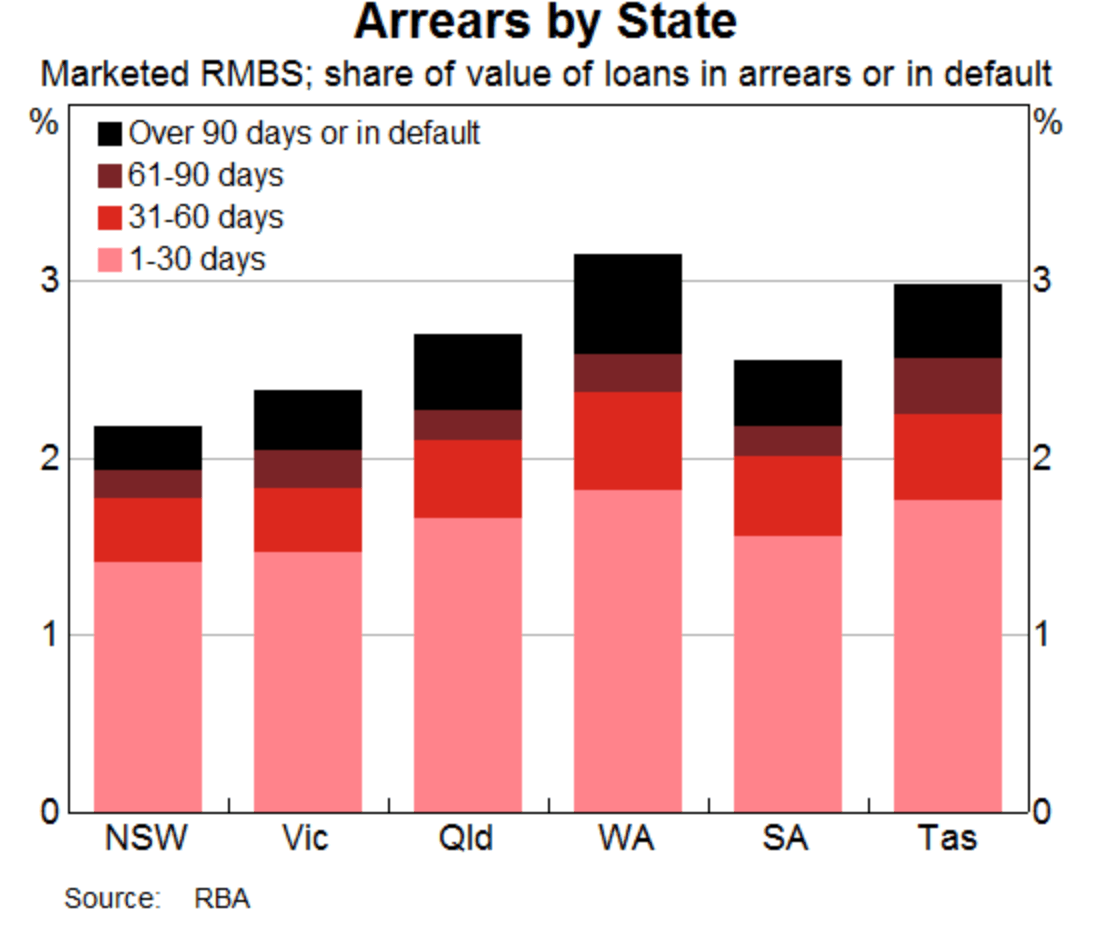

WA pinpointed by RBA as having highest residential loan arrears

The RBA has published a graph showing RMBS arrears by states.

The RBA assistant governor Guy Debelle suggests its shows that the current distribution of arrears are consistent with the variation in economic conditions across the states, though at the same time all arrears rates are relatively low in terms of credit risks.

"Of course, credit risk is not so much about the averages but the distributions," he noted.

"Having the loan level data enables an insight into the characteristics of the loans in the various tails of the distribution that warrant closer attention.

"It will also allow an assessment of the correlations between the various drivers of risk that may lead to credit deterioration."

Last month it was forecast delinquency and default rates for Australian residential mortgage backed securities (RMBS) and asset backed securities (ABS) will rise slightly from their current low levels in 2016, due to slower economic growth and a rise in unemployment, according to the report by Moody's Investor Service.

The RBA graph was presented in his speech to the 28th Australasian Finance and Banking Conference on the liquidity regime that has been in operation in Australia.

With the caveat that the data reporting is still in its infancy, it's already apparent that there are many potential benefits coming from the understanding of the data he said.

The data covers around 2 million housing loans of the total of the approximately 6 million such loans on issue currently.