Focus on the property investment fundamentals, not the name: Simon Pressley

How are these for solid property investment fundamentals: detached houses cost well under the national average price of $475,000 ~ rental yields of 6% plus ~ population growth rate in line with the national average ~ controlled rates of new housing supply ~ average household income well above the national average ~ average age lower than the national average. How many locations can you think of with better credentials?

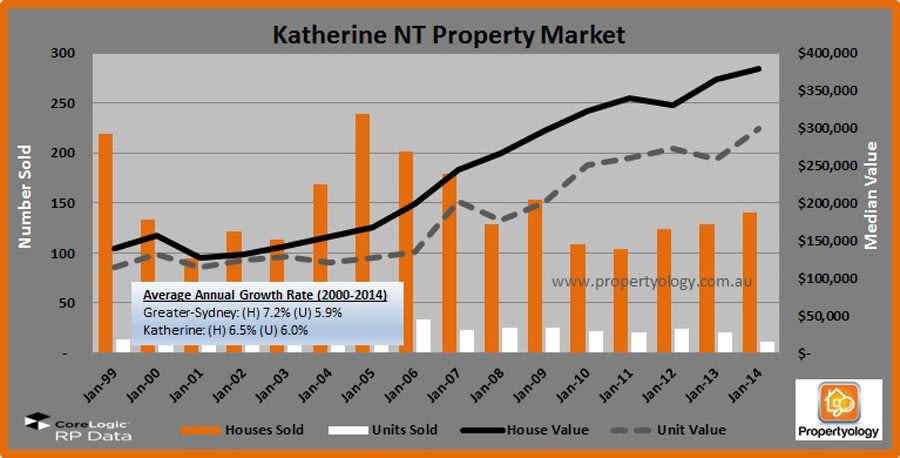

For the fifteen year period ending December 2014, the average annual change in median house values in this location was 6.5% and, when combined with median yields of 6.4%, the total return gives this location a ranking which puts it amongst Australia’s Top 40% (209th out of 550 local government jurisdictions). In fact, the historical performance of this property market since the year 2000 was on par with Sunshine Coast and Ballarat, better than the highly desirable South Perth, equal to or better than twenty-nine of Melbourne’s thirty-one LGAs, and better than all of Sydney’s forty-three LGAs.

Keen to know where this location is?

The main industries supporting the economy of this location are tourism, agriculture, and the defence force. The outlook for these economies at this juncture in the Asian Century, where an unprecedented rise in the number of people about to enter the middle class beckons, is super exciting. It’s little wonder that the Australian federal government and lots of wealthy foreign investors are actively pursuing funding options for new infrastructure investment in the region.

With current rents all but covering the holding costs on an investment property in this location, just imagine the potential for future capital growth.

If this hasn’t got the motivated property investor licking their lips I don’t know what will!

World champion athletes Cadel Evans and Leisel Jones were born in this location is probably insufficient information for people to correctly guess the name of this location. Ok, I’ll cease with the suspense. The location that I have described is the Northern Territory regional town of Katherine!

Now, I bet your investment appetite has suddenly dissipated.

I have just created a real-life set of circumstances to illustrate that too few property investors have an ability to understand and remain focused on the important fundamentals that count most when selecting a location to invest in. The fundamentals described above are real; they are impressive. And if, when I revealed the name of this location, it was a suburb within a capital city I suspect this report would be promptly shared with so many family and friends that it would accelerate within Google’s search engine faster than one could say ‘hotspot’.

Instead of making decisions on investment fundamentals, almost all property investors will immediately be drawn to a map and their personal feelings upon receipt of the name of a location. Often without even realising it, the heart immediately over-rules the head and we begin to ask ourselves questions like ‘would we live there?’ Whether we personally would live in Katherine, Kingston or Kogarah is as subjective as selecting T-bone, trout, or tofu from the restaurant menu.

Located 320 kilometres (a 3 hour drive) south east of Darwin, Katherine is positioned along the nationally significant freight link connecting Darwin to Adelaide. In addition to the national highway, a railway line connects also runs past Katherine.

Katherine is the Northern Territory’s fifth most populous local government authority (after Darwin, Palmerston, Alice Springs, and Litchfield).

Katherine has developed in to the primary service centre for a total regional population of 24,000 and an area almost the size of Victoria. Essential social infrastructure is well established, including modern retail facilities, hospital, schooling, sports grounds, parks and gardens as well as several Commonwealth and Territory Government services.

The main industries supporting Katherine’s economy are agriculture, tourism, defence, government (primary industries), and mining.

RAAF Base Tindal, located adjacent to Katherine civilian airport, is significant for Australia’s air combat defence and fast jet base. The RAAF personnel and families contribute approximately 2,200 people to Katherine’s population and this is expected to increase with the potential of the Delamere Bombing Range and the Bradshaw Range.

The region is adventure territory, offering unique attractions such as Kakadu and Nitmiluk national parks, Katherine Gorge, ancient (indigenous) rock paintings, caves, fishing and camping experiences. Katherine is exceptionally popular for the ‘grey nomads’ (the fast growing number of baby boomers who enjoy long and affordable holidays while taking in the unique sights that Australia offers).

With approximately 300,000 visitors per year, the retail facilities of Katherine are more than adequate.

Plentiful water supply and vast open planes makes this prime agricultural land. The environment consists of a warm, tropical climate, spectacular gorges and rainforests, and heavy monsoonal rains in summer. Flash flooding from the Katherine River can occur although it is quite sheltered from the potentially destructive cyclonic winds.

This is one of Australia’s biggest beef cattle regions. Vegetables, mangoes, hay and other field crops are also grown. The NT Department of Primary Industries employs approximately 40 people in Katherine in predominantly research-related roles. With the rapid rise of Asia’s middle class and the resultant huge demand for agricultural products (especially proteins), the Top End is attracting increasing interest from the federal government and foreign investors for investment in primary infrastructure such as irrigation, roads, and rail.

Once a prime gold mining region, the main mined commodities today are lead, zinc, limestone and gravel.

Several primary schools, a 600-student public high school, an expanding Catholic college, and Charles Darwin university campus cater for the educational needs while the Katherine District Hospital services the health needs of the region

Katherine has already outperformed most high profile property markets over the last fifteen years. Current fundamentals would suggest that the potential for the next fifteen years is better again. Property investors who are unable to challenge the status quo and focus on fundamentals, not the name, are only short-changing themselves.

SIMON PRESSLEY IS MANAGING DIRECTOR OF PROPERTYOLOGY, AN REIA HALL OF FAME INDUCTEE, PROPERTY MARKET ANALYST, ACCREDITED PROPERTY INVESTMENT ADVISER, AND BUYER’S AGENT. PROPERTYOLOGY WORKS EXCLUSIVELY WITH PROPERTY INVESTORS TO PURCHASE PROPERTIES IN STRATEGICALLY CHOSEN LOCATIONS ALL OVER AUSTRALIA.