Sydney shines in Knight Frank global cities report

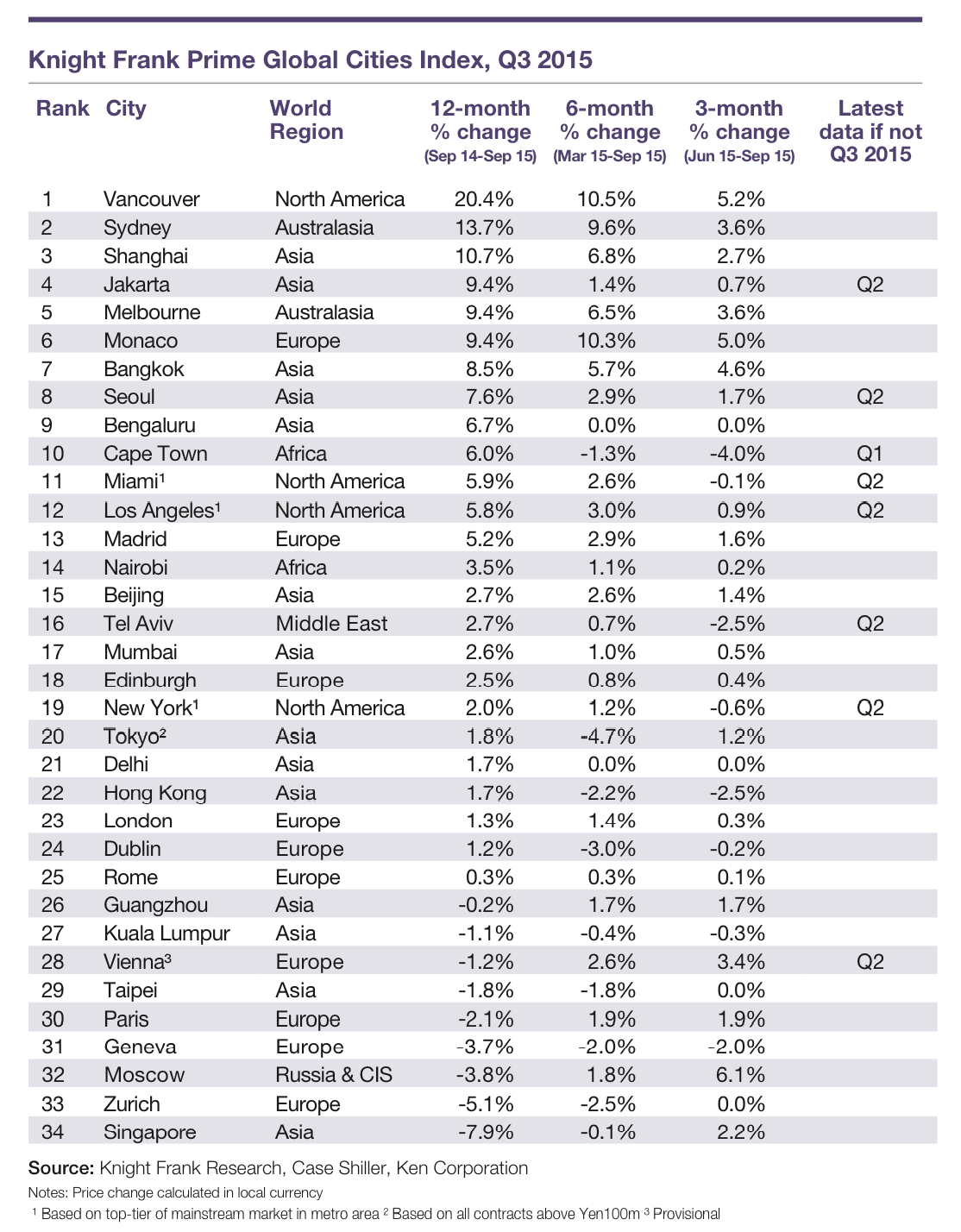

Prime property prices only increased by 1.9% in the year to September 2015 around the world, according to Knight Frank’s Prime Global Cities Index with Vancouver and Sydney leading the rankings with standout performances.

The index, which monitors and compares the performance of prime residential prices across key global cities, reports an increase of 20.4% in Vancouver in the year to September 2015. A shortage of supply and strengthening local demand alongside foreign interest are the reasons behind the strong performance.

Sydney ranks not far behind with an increase of 13.7%, while Melbourne sits in fifth place with an annual increase of 9.4%. The weak Australian dollar, an undersupply of new homes and a strong local economy are behind Sydney’s accelerating values, and to an extent Melbourne as well. In addition, Melbourne has been named ‘The Most Liveable City in the World’ for the fifth time in a row by the Economist Intelligence Unit.

Michelle Ciesielski, director of residential research, at Knight Frank Australia said the lower Australian dollar had influenced the number of ex-pats buying back in Sydney and Melbourne, taking advantage of buying a prime property in these ideal conditions.

Shanghai also recorded double-digit annual price growth, up 10.7% in the year. The reversal of strict housing policies and the introduction of new fiscal measures, including tax and interest rate cuts, have fuelled demand in Shanghai.

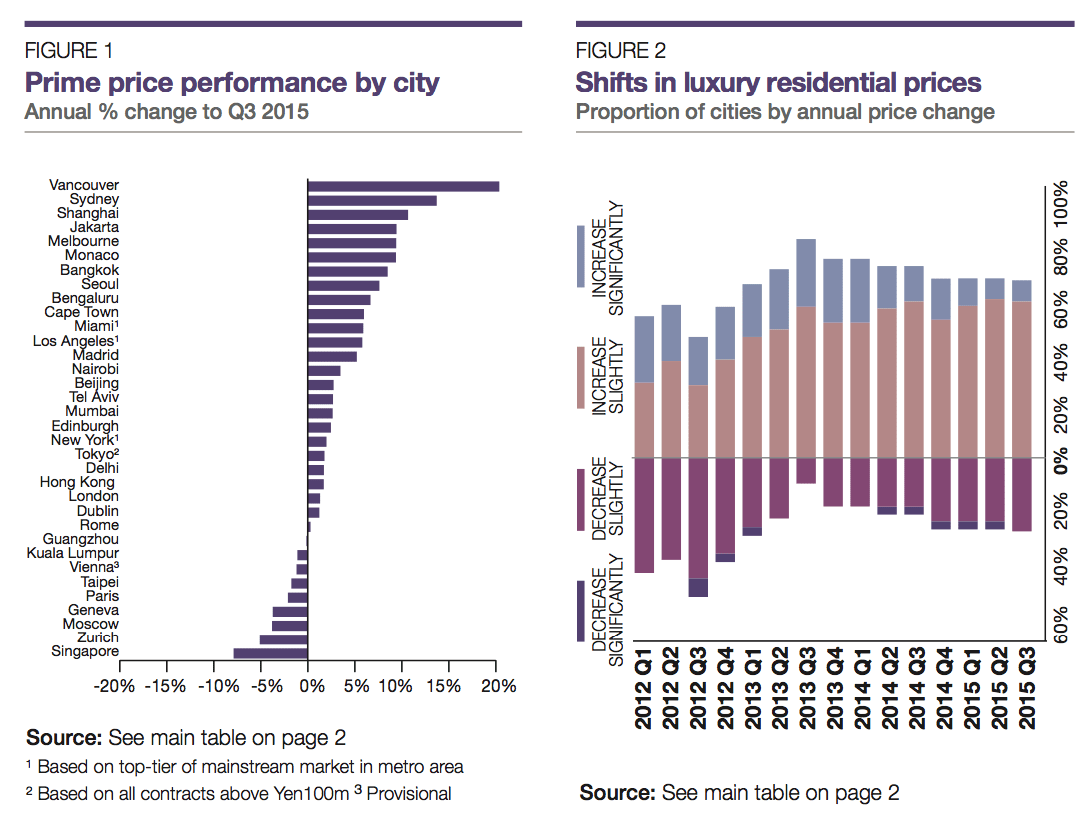

Looking beyond the top rankings, the overall performance of the index was less than robust, Knight Frank noted.

The index now stands 34.1% above its low in Q1 2009 but its annual rate of growth is slowing.

Kate Everett-Allen, residential researcher at Knight Frank noted the index’s annual rate of growth had slowed significantly from 7% two years ago to 1.9%.”

Some 73% of cities recorded positive annual price growth in the year to September down from 91% two years ago.

Singapore was the weakest performing prime market tracked by the index for the seventh consecutive quarter, but the rate of annual decline has slowed from -15.2% at the end of Q2 to -7.9% this quarter.

Analysis by world region highlights that Australasia leads the Prime Global Cities Index, with an average annual price growth of 11.6%, followed by North America at 8.5%. Europe has entered positive territory this quarter with an increase of 0.8%. However, performance here varies from an increase of 9.4% in Monaco to -5.1% in Zurich.

As QE unwinds and a US rate rise draws near, prime assets will remain on the radar of investors and HNWIs. The big question mark surrounds not Greece and the Eurozone but the slowdown in the Chinese economy. Wealth from China will continue to flow into overseas property markets with the UK, US, Canada and Australia being key target destinations.