Rental yields continue downtrend: CoreLogic RP Data

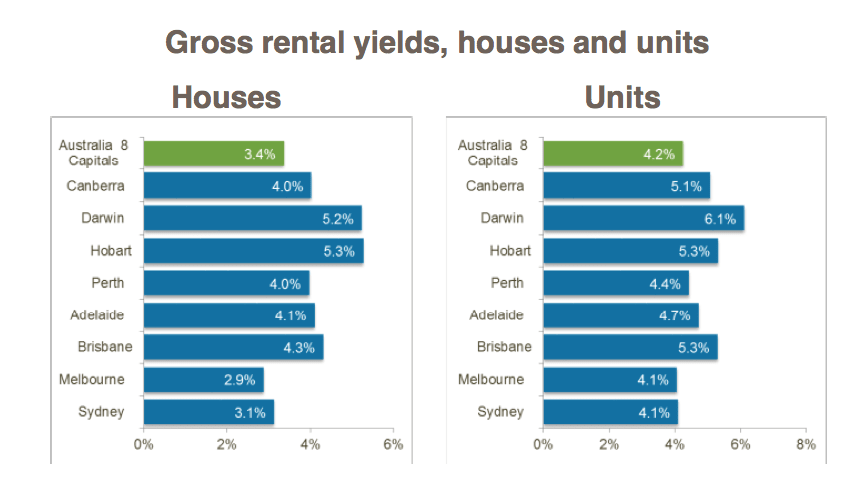

Gross rental yields have shown a consistent downwards trend towards lower returns for new investors, with the average gross rental yield for capital city houses down to a record low of 3.4% from 4.2% in May 2012, according to the CoreLogic RP Data Home Value Index.

Similarly, the average gross rental yield on a capital city unit has dropped to 4.3% from a high of 5% in May 2013.

According to Lawless, the low yield profile in Melbourne and Sydney, where the gross yield on both houses and units are at all-time lows, is likely to act as a further disincentive to investors in these markets.

“Investors are already paying higher mortgage rates, coupled with the growing acceptance that the growth cycle is peaking out at a time when rental income is at a record low which doesn’t reflect healthy investment fundamentals in these cities. Additionally, the higher deposit requirements for most new investment loans lessens the attractiveness of negative gearing benefits.”

Yield compression has been a factor across every capital city except Hobart where weekly rents have outperformed capital gains.

For the first time since 2001, the Sekisui House has relinquished the title as the city with the highest gross yields across its detached housing market with the gross yield falling to 5.2 percent in October.

"In Hobart, gross yields have held relatively firm at 5.3%. The relative affordability of the Hobart housing market, coupled with its lifestyle appeal and higher rental returns should help to revitalise Australia’s southernmost capital city housing market,” he said.

Hobart remains the only capital city where dwelling values are lower than they were at the beginning of 2009. Tough economic conditions across the state and a lack of population growth has limited housing demand in Hobart. Transaction numbers are, however, up 1.2% over the past year, suggesting buyers may slowly be returning to the market.

Several other signs indicate the housing market is starting to lose some steam.

“Clearance rates have been trending lower since April this year, with Sydney and Melbourne now showing auction clearances that are below 70 percent week to week. Additionally, monthly mortgage related activity across CoreLogic RP Data’s valuation platforms was lower when compared with the same period a year earlier; the first annual fall in platform activity since 2013.

CoreLogic valuation platforms account for nearly 98 percent of all bank mortgage-related valuation instructions and virtually provide a real time indicator about mortgage demand.

“Added to this is record levels of new housing supply now entering the market. We are now seeing a picture of reduced house price inflation over the coming year.

“We are also seeing listing numbers move higher than a year ago in Sydney. This is the first time our data has shown housing stock levels to be higher compared with the same period a year prior since mid-2012. Higher levels of housing stock means more choice for buyers which should ultimately result in some rebalancing towards buyers over sellers when it comes to negotiating on price.

“If the trend towards higher stock levels persists, we can expect Sydney buyers to face less urgency when it comes to making their purchase decision around property and higher discounting rates from vendors as they face more competition in the market,” Lawless said.