Catastrophically overleveraged as Australia’s largest housing bubble in history continues: LF Economics

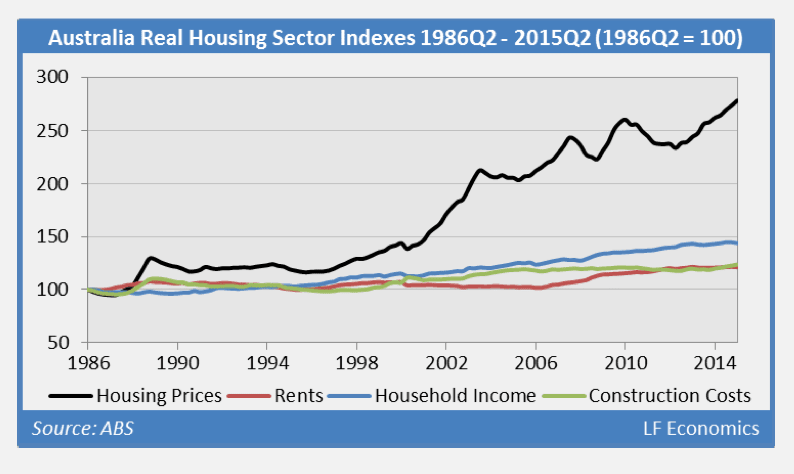

The national Australian housing market is severely overpriced relative to all the fundamental measures of value: rental incomes, inflation, construction costs, household incomes and GDP.

That is the conclusion of LF Economics duo Lindsay David and Philip Soos who conclude debt-financed speculation as the major cause of the what they describe as "Australia’s largest housing bubble in the nation’s economic history."

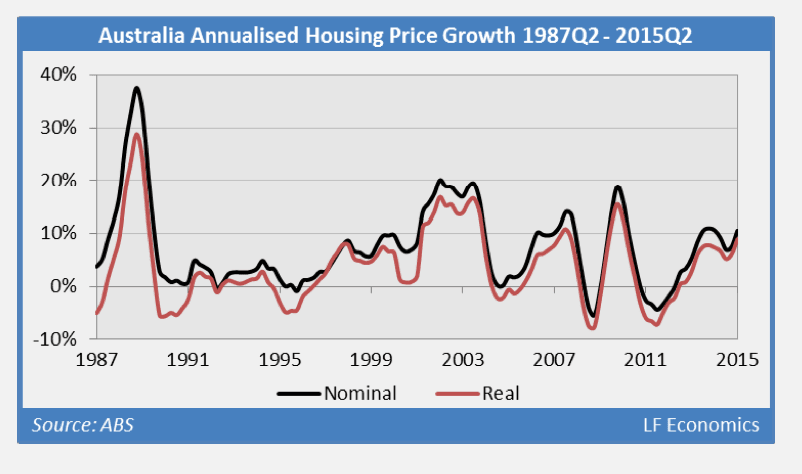

"The media and industry has warned housing price growth will begin to moderate and fall, but the latest results from the debt accelerator, Speculative Index and Kavanagh-Putland Index, however, indicates annualised real price growth of 8.9% could remain steady over the course of the next couple of quarters, inflating the bubble further.

They noted nationwide real housing prices surged by 4.3% in 2015Q2, the single largest quarterly increase since 2009Q4.

The duo calculate the price to income ratio has reached record highs in 2015Q2: houses (8.3x) and units (6.4x).

"Both historically and internationally, Australian dwelling prices are extremely expensive and unaffordable relative to household incomes," according to the LF Economics report titled Ahead of the Housing Curve, written by Lindsay David and Philip Soos.

"Australia is catastrophically overleveraged in terms of private sector debt, particularly the household sector.

"Since 1996, housing prices have outpaced economic fundamentals such as inflation, household incomes, rents, construction costs and GDP, demonstrating the housing market is in the thrall of an asset bubble.

"Australia’s economic history indicates real estate bubbles developed during the 1830s, 1880s, 1920s, mid-1970s and late 1980s.

"Contrary to the analyses of the vested interests, the data overwhelmingly demonstrates Australia is in the midst of the largest housing bubble on record, both in terms of prices to rents and household incomes.

"The government, central bank (RBA), prudential regulator (APRA), FIRE sector (finance, insurance and real estate industries) and their economists predictably deny the existence of a housing bubble, believing a severe downturn in the housing market simply cannot occur.

"The usual arguments put forward are the same as those made everywhere else a housing bubble has occurred: prudent lending practices, deregulation of finance, recourse mortgages, dwelling shortages, restrictions on land supply, low nominal interest rates and inflation, population growth, demographic change and so on.

"Today, after centuries of asset bubbles, mainstream economists have yet to determine and define what they are, so debate on the matter is kept necessarily vague.

"Housing bubbles are poorly understood, if at all, on the basis of ‘irrational exuberance’ or ‘chasing capital gain’.

"No rational explanation can be made as to why housing prices have so radically departed from fundamental factors, most notably rental prices.

"The data strongly suggests the boom in real housing prices are not caused by any commensurate movement in economic fundamentals, but rather, debt-financed speculation as evidenced by the exponentially growing stock of mortgage debt.

The report concludes there is greater awareness among policymakers and public of the housing bubble and its potential for wealth destruction.

"While there is more to say about Australia’s fascinating and quite dangerous economic experiment with financialisation and real estate speculation, the data and commentary in this report illustrates the long-term trends in the housing and debt markets, providing the necessary proof that a housing bubble does indeed exist and therefore represents a clear and present danger to the economy and banking system," the LF Economics report concluded.

For the full report from LF Economics, click here.