Solid dwelling prices, but September quarter has many ‘unknowns’: Westpac's Justin Smirk

GUEST OBSERVER

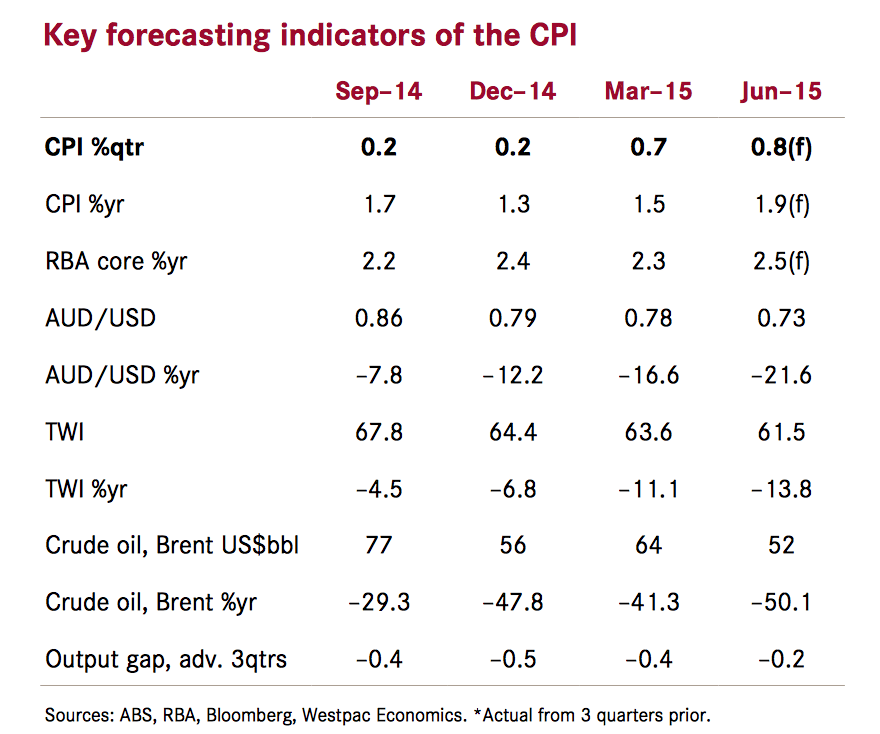

The headline CPI lifted 0.7% in Q2 compared to the market’s expectation for 0.8%. The annual rate was 1.5%yr. Despite a downside surprise on food, the CPI came broadly in line with expectations as housing continued to underpin modest outcomes for core and non-tradeable inflation.

The core measures, which are seasonally adjusted and exclude extreme moves, rose 0.5%qtr right on Westpac’s estimate. In the quarter, the trimmed mean gained 0.56% while the weighted median lifted 0.51%. The annual pace of the average of the core inflation measures is now 2.3%yr, a slight moderation from the 2.4%yr pace of Q1.

In Q2 petrol prices surged (12.2%qtr), but the big surprise was the soft print on food, –0.2%qtr, in part due to a –1.2% for fresh fruit & vegetables. Also surprising on the downside was a –3.5% fall in holiday travel. Clothing & footwear was as expected at 1.3%qtr.

Housing costs continue to underpin both core and non-tradeable inflation, rising 0.7%qtr, driven by a solid 1.5% gain in dwelling purchase prices. To this was added solid gains in hospital & medical services (3.4%qtr) and alcohol & tobacco (1.2%qtr). The modest offsets came from pharmaceuticals (–1.8%qtr), audio visual & computing services (–1.6%qtr) and communications (–0.6%qtr).

The September quarter has many ‘unknowns’ (as always).

For the September quarter we have identified three large forces pushing the CPI in one direction with few significant offsets. But,

as always, a large number of unknowns remain. We don’t have access to a lot of the data the ABS uses and, in many cases, it is not possible to replicate the survey process the ABS uses causing many small errors along the way.

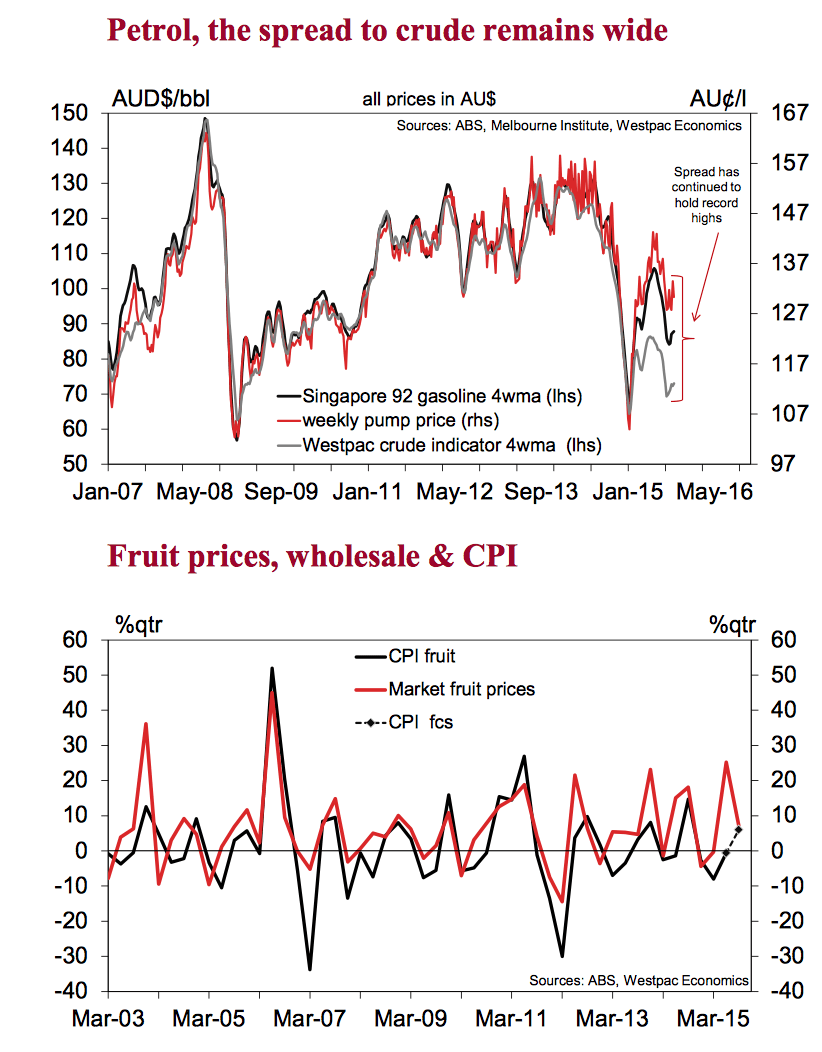

Automotive fuels are a modest negative.

One of the most obvious events in the last few quarters has been the extreme volatility in the pump price of automotive fuels. From a peak at the start of the quarter of $1.42/l, the pump price fell to a low of $1.27/t before ending the quarter around that level. In terms of the quarterly averages, we forecast that the price of automotive fuels will fall 2.4% in the quarter producing a very small —0.09ppt drag on the CPI. Fuel is the most significant negative we have found for the September quarter CPI. All others are estimated to be individually worth –0.03ppts or less for the CPI.

A number of meaningful positives are setting the foundations ...

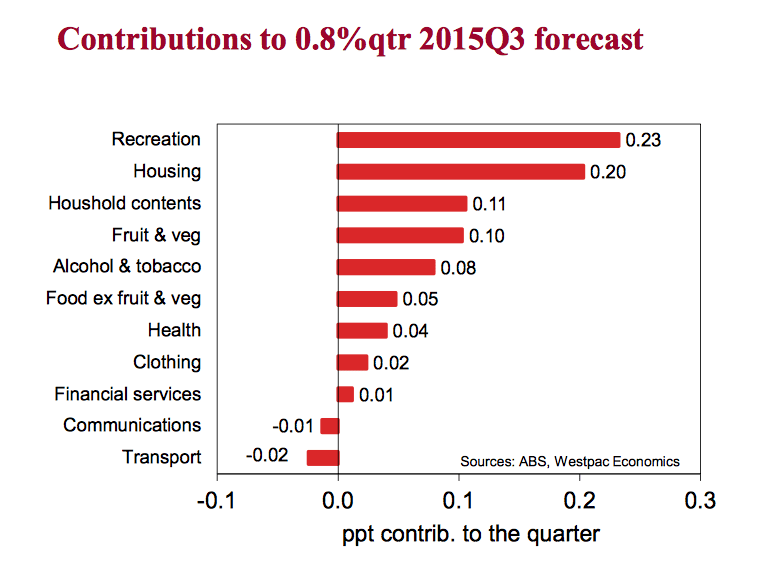

The most significant positives in the September quarter are fresh fruit & vegetables (+0.10ppts), the indexing of the tobacco excise to the CPI (+0.08ppts), new dwelling purchases (+0.11ppts), household contents (0.11ppts) and holiday travel (0.21ppts).

... such as fresh fruit & vegetables ...

The wholesale price of vegetables rose 1.2% in Q3 following a solid 1.8% in Q2. For Q3 we have pencilled in a small 0.5% rise in the CPI measure of vegetable prices; they fell 1.7% in Q2 and we suspect the larger than usual seasonal fall in potato prices may have had a role to play. Nevertheless, we can’t be sure how movements in the wholesale price have been passed on at the retail level.

Wholesale fruit prices jumped 7.2% in Q3 following a 25.2% surge

in Q2. Despite this, fruit prices in the CPI fell 0.7% in Q2 so we are expecting some residual catch to appear in Q3, but are cognisant that increased competition in the supermarket sector may limit this, hence our forecast for just a 6.0% increase in CPI fruit prices in Q3.

All together, we are forecasting fruit & vegetable prices to rise 3.5%qtr contributing 0.10ppts to the CPI.

... tobacco excise re-indexing ...

In the month of September the tobacco excise is indexed to the annual increase in the CPI to the June quarter. This means that

one third of the increase appears in the September quarter and two thirds in the December quarter. For the September quarter we estimate that this re-indexing, along with normal seasonal retail price increases, lifted tobacco prices by 2.6% and is worth 0.06ppts for the CPI.

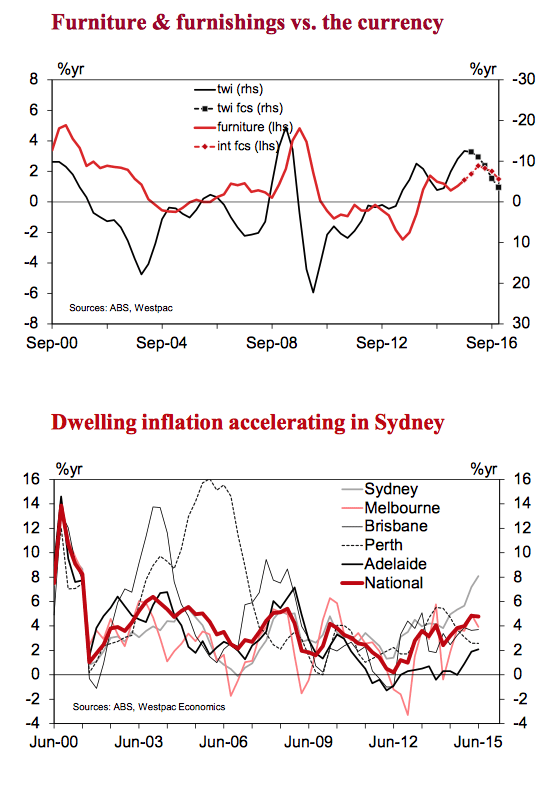

... dwelling price gains in NSW & Vic ...

Dwelling prices can be very volatile from capital city to capital

city and quarter to quarter. Melbourne dwelling prices have been particularly volatile of late, rising 0.8%qtr in the December quarter, falling 0.1%qtr in the March quarter then rising 2.0% in the June quarter. By comparison, Sydney prices have been trending higher and rose 2.4% in the June quarter. In the June quarter, dwelling prices rose 1.5%qtr, the strongest rise in dwelling prices since the 1.6%qtr print in June 2014. Westpac is expecting some moderation from Melbourne and Brisbane, which will see dwelling prices rise 1.3% in September quarter contributing 0.11ppts.

... and housing overall making a positive contribution.

For housing costs there is a small offset from the fall in electricity prices, we estimate around –4.0%qtr on average across the country, as regulated electricity prices fall. This is worth –0.08ppts on the CPI. Other housing components such as rents, other housing costs and non-electricity utilities, are set to continue to rise, resulting in a 0.9%qtr lift in total housing costs, contributing 0.20ppts for the CPI.

We are also looking for a very modest AUD depreciation boost to the usual seasonal Q3 rise in household contents and services. Our forecast 1.2%qtr rise follows on from a 1.0% rise in the June quarter and will contribute 0.11ppts to the Q3 CPI.

The Q2 fall in holiday travel costs will be reversed in Q3

Holiday travel surprised in the June quarter falling 3.5% due to a –5.4% print from domestic holiday travel. The BITRE (Bureau of Infrastructure, Transport & Regional Economics) data on the best price economy airfares was pointing to a flat print in Q2 followed by a large fall in Q3; but as you can see in the chart, the timing when the BITRE data price moves and when it appears in the CPI appears to have shortened. As such, we are looking for a 2% bounce in domestic holiday costs, which will add to the 7.2% rise in international holidays. The rise in international holidays is due to both seasonal factors and a trickle through impact of the depreciation of the AUD.

Overall seasonality is a reasonable positive in Q3

Using the ABS’s seasonal factors, the seasonally adjusted CPI rises 0.6%qtr compared to our headline forecast of 0.8%. There is an important caveat however; the ABS conducts concurrent seasonal re-analysis, and the revisions to the seasonal factors can sometimes be quite significant. As such, we caution that we can’t be sure what the ABS will estimate as the seasonal impact in Q3. This matters as the components of the CPI are seasonally adjusted before they are trimmed for the core measures. As such, revisions to the seasonal factors can impact the historical estimates of core inflation.

Core inflation to remain within the band

Westpac is forecasting the average of the core measures to rise 0.5% in Q3, lifting the annual pace to 2.4%yr from 2.3%yr in Q2. More importantly, the six month annualise pace of core inflation is forecast to drop to 2.1%yr in Q3, from 2.5%yr in Q2 and a recent peak of 2.8%yr in Q1.

Traded goods & services are forecast to rise 0.8%qtr, lifting the annual pace to 0.2%yr from –0.3%yr; non-traded prices are also forecast to rise 0.8%qtr, but this takes the annual pace to 3.0%yr from 2.6%yr. Domestic, non-traded prices remain the key source of inflationary pressures, with housing and recreation remaining the key factors in the quarter.

Conclusion

A solid Q3 headline print is due to rising fresh fruit and vegetable prices, the re-indexing of tobacco excise and a bounce in holiday travel costs which add persistent gains in housing. While this is keeping inflation ticking along, the annual pace remains below the band and the six month annualised pace for the core measure is forecast to ease back to the bottom of the band. On balance, Australia does not face the risk of an inflation breakout nor the commencement of a significant disinflationary impulse. Inflation remains neutral for monetary policy.

Justin Smirk is senior economist, Westpac, and can be contacted here.