RBA says Sydney supply kicking in: CommSec's Craig James

GUEST OBSERVER

When a couple of gloomy reports are produced on the housing market, it is always good to get a calm, reasoned view from the Reserve Bank. Reserve Bank Deputy Governor Philip Lowe believes we are at the point “where supply is kicking in” in the Sydney housing market.

In other words, demand for homes has been strong, exceeding supply, and resulting in strong growth of home prices. But now Lowe believes that more homes are being built to meet the strong demand and that should lead to more modest growth in home prices.

The Reserve Bank Deputy Governor does warn that “people need to be careful” when it comes to the housing market – and that is always useful advice. But the Deputy Governor has clearly distanced the RBA from some of the housing market ‘gloom and doom’ stories.

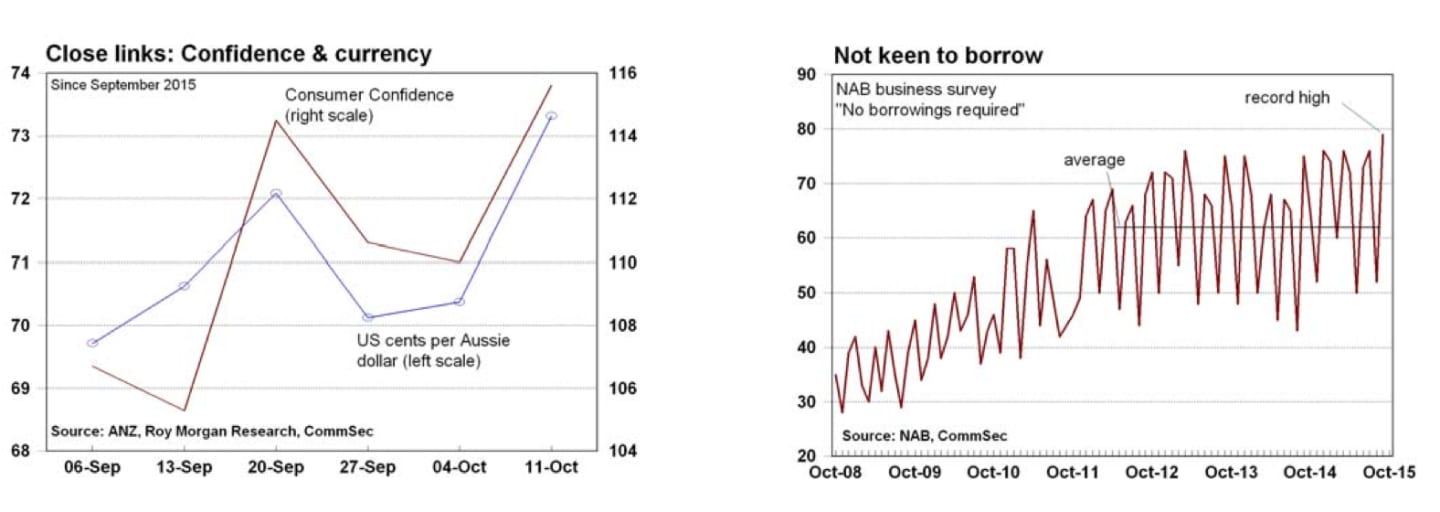

The Reserve Bank Deputy Governor dismissed assertions that business and consumer confidence were weak (“that is just not right”). And with exquisite timing, consumer confidence lifted 5.1 per cent in the latest week while business confidence also improved. But we shouldn’t be under any illusions – consumers like a stronger Aussie dollar and the dollar soared last week. We can wrap it up in different ways, but the dollar no doubt had a lot to do with boosting sentiment levels.

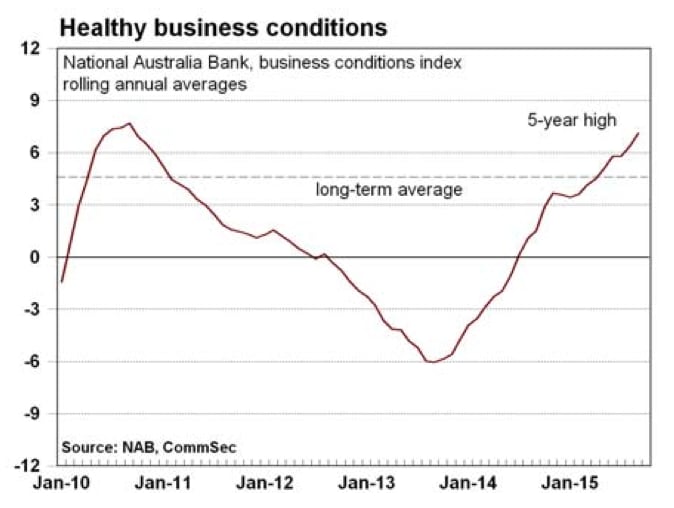

The latest business survey was solid. Business sentiment rose and operating conditions are well above “normal” – in fact the smoothed measure of business conditions hit 5-year highs. In addition, the employment component of the survey hit a 4-year high and there were more signs of inflationary pressures.

The one area of concern is that businesses still aren’t keen to borrow. Almost 80 per cent of firms indicated that no borrowing was required in September. This may mean that businesses are living within their means. But with interest rates at record lows, the absence of borrowing is surprising.

What do the figures show?

National Australia Bank Business Survey:

The NAB business conditions index eased slightly from +9.2 points to 9.1 points in September but the rolling annual average hit a 5-year high. The business confidence index rose from +0.8 points to 5.1 points. The survey was conducted from September 24 to 30.

NAB noted: “There remains, however, a notable divergence in business conditions across industries. Services industries continue to outperform, while the mining industry trails well behind. It is promising though that mining and manufacturing were the only industries to report negative conditions – just the second time only two industries have been negative since mid-2011.”

“Not all industries saw a lift in confidence, however, with the improvement largely concentrated in transport/utilities (up 14) and personal services (up 12). Both these industries are enjoying the highest confidence levels (at +13 and +16 points respectively); while unsurprisingly mining firms were least confident (at -14).

Components. The index of trading conditions fell from +19.1 to +15.4; employment rose from minus 0.8 points to a 51-month high of +4.5 points; profitability eased from +10.4 points to +7.6 points; forward orders fell from +4.6 points to +2.8 points.

Inflationary indicators were higher in September. The monthly reading of labour costs rose at a 0.6 per cent quarterly rate in September, up from 0.5% in August. Purchase costs rose at a 1.0% quarterly rate in September, after a 0.8% rise in August. Final product prices were up 0.2% in September. And retail prices were up by 1.2%t in September after a 0.7% rise in August.

Capacity utilisation rose from 81.2 to a 44-month high of 81.3%, matching the result in June. Capacity use is above the long-term average of 81.0%.

The proportion of firms reporting that they did not require credit rose from 52% in August to a record high of 79% in September.

Consumer sentiment

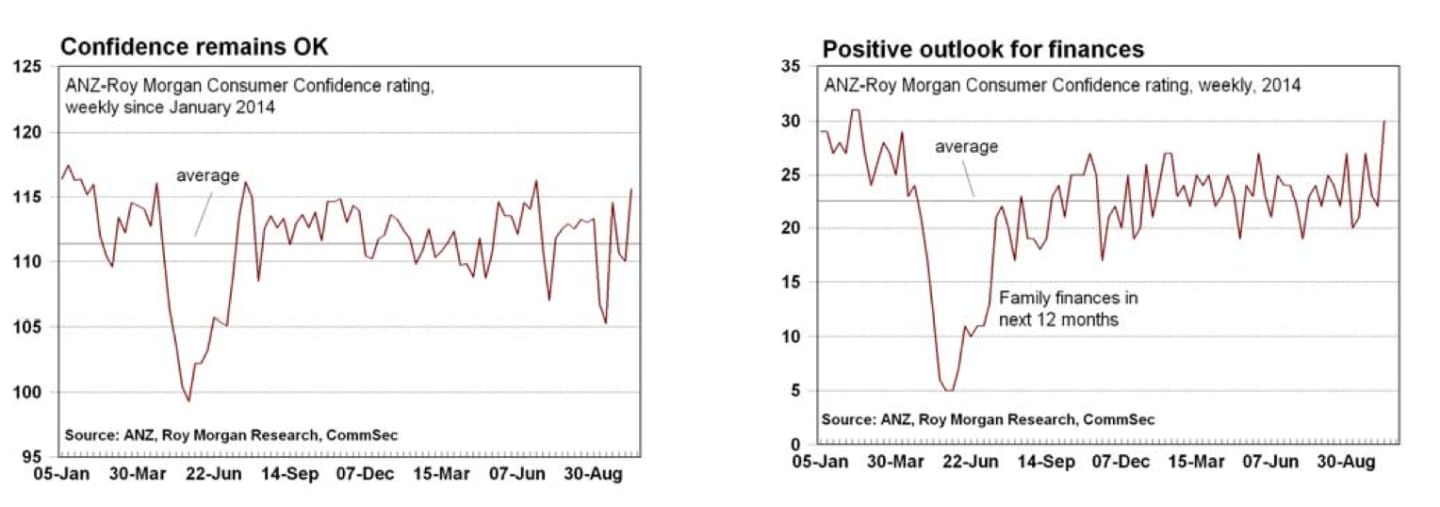

The weekly ANZ/Roy Morgan consumer confidence rating rose by 5.1% to a 15-week high of 115.6 in the week to October 11. Confidence is up 1.6% over the year and above the average of 111.4 since 2014.

All of the five components of the index rose in the latest week:

- The estimate of family finances compared with a year ago was up from +4 to +9;

- The estimate of family finances over the next year was up from +22 to +30;

- Economic conditions over the next 12 months was up from -4 to -1;

- Economic conditions over the next 5 years was up from +2 to +13;

- The measure of whether it was a good time to buy a major household item was up from +26 points to +27 points.

Speech by Reserve Bank Deputy Governor

Reserve Bank Deputy Governor, Philip Lowe, delivered a speech “Fundamentals and Flexibility”

“I would like to focus on a different set of fundamentals: that is, the fundamentals of the Australian economy. My central message is that these fundamentals are strong and that they provide us with the basis to be optimistic about the future.”

In terms of economic fundamentals, Lowe highlighted five factors: the institutional framework; “our people”; mineral resources; agricultural assets; and “our links with Asia and our expertise in delivering high-quality services.”

“Together, this combination of fundamentals should provide us with confidence that we can continue to experience advances in our living standards. It is a combination of fundamentals that few other countries enjoy.”

Philip Lowe highlighted a number of areas that affect flexibility such as exchange rates; and the financial system.

Philip Lowe highlighted four factors outside central bank control that improve flexibility of the economy: the competitive environment in which firms operate; incentives to innovate and to start new businesses; operation of the labour market; and the nature of our education system.

What is the importance of the economic data?

The monthly National Australia Bank business survey is valuable in providing a timely reading about the health of Corporate Australia. Key indicators of business conditions such as orders, employment, profitability and capacity use are covered together with a gauge on confidence levels.

The ANZ/Roy Morgan weekly survey of consumer confidence closely tracks the monthly Westpac/Melbourne Institute consumer sentiment index but the former measure is a timelier assessment of consumer attitudes and is now closely tracked by the Reserve Bank.

What are the implications for interest rates and investors?

The Reserve Bank Deputy Governor has admitted that interest rates are less effective than they used to be. So the Reserve Bank won’t be rushing to change interest rate settings. The good news is that the Reserve Bank Deputy Governor remains very positive on the outlook and that is backed by the latest economic data. In short, there are simply no reasons to be touching rates.

The environment remains positive for businesses selling consumer goods and services. The outlook for family finances – the part of the consumer sentiment survey that the Reserve Bank tracks closely – hit a 20-month high in the latest week.

No one should get too complacent on inflation. The NAB business survey notes “Consumer price pressures building” with retail prices lifting at the fastest quarterly rate for over three years.