The RBA will still have to cut again: Shane Oliver

GUEST OBSERVER

The global share market correction continued over the last week as worries intensified regarding emerging countries, their currency rout and the impact on global growth along with the ongoing fall in commodity prices. Even Greece and tensions between North and South Korea got a look in.

Messy profit results also didn’t help Australian shares. For the week US shares fell 5.8%, Eurozone shares lost 6.7%, Japanese shares fell 5.3%, Australian shares fell 2.7% and Chinese shares lost 11.5%. Reflecting investor nervousness, oil and metal prices remained under pressure and bonds benefitted from safe haven demand. Emerging market currencies fell further and weak Chinese economic data put renewed pressure on the $A.

From their highs earlier this year US shares have now lost 7.5%, Japanese shares are down 7%, Australian shares are down 13%, Eurozone shares are down 14%, Asian shares have lost 20% and Chinese shares are down 32%. With US shares only having just broken down technically they likely have more short term catch up ahead.

Is this 1997-98 all over again?

The past week has seen a further intensification of concerns regarding the emerging world with a range of general and country specific factors coming together including the ongoing plunge in commodity prices, more falls in emerging market currencies (with Vietnam devaluing and Kazakhstan abandoning its currency fix) as China's 3% devaluation continues to reverberate, the bombing in Thailand, a reference by the Fed to global weakness presumably mainly in emerging countries and worries about China with the explosion in Tianjin not helping.

Fears of a re-run of the 1997-98 Asian-emerging market crisis are building again. Such fears are of course not new - we saw similar worries early last year with talk of the fragile five - and emerging market (EM) currencies have been plunging since 2011 (now down 36% on average) and their share markets underperforming over the same period. The EM world is arguably much stronger than it was is 1997-98 with stronger current account balances, higher foreign exchange reserves and mostly floating as opposed to fixed exchange rates (which mean they don't have to be defended from speculative attacks). However, some of the emerging world is suffering from a return to populist policies and a reversal of economic reforms so the EM crisis could go on for a while yet.

What may be needed to end the negative feedback feeding through global currency and share markets at the moment though is a policy easing. This came in 1998 with Fed monetary easing. While it’s now looking unlikely the Fed will tighten in September, a circuit breaker policy easing this time around ideally needs to come from China – so keep an eye out for further Chinese stimulus measures. Expect China to cut its benchmark interest rate below 4% from 4.85% currently and step up fiscal stimulus.

Greece worries back again, but maybe not really.

With Greece’s third bailout program now in place, Greek PM Tsipras has called a new election, likely for September 20. Such a move was expected. With the bailout locked in Tsipras wants to take advantage of his popularity and purge Syriza of far left MPs who didn’t support the bailout. Most recent polls indicate he remains popular and that Syriza would be the first placed party with a comfortable margin. While it would likely need to form a coalition with other centre left parties it would be committed to the bailout. Alternatively the main opposition party is committed to the bailout anyway. So expect some more noise regarding Greece, but it’s unlikely to be a major threat.

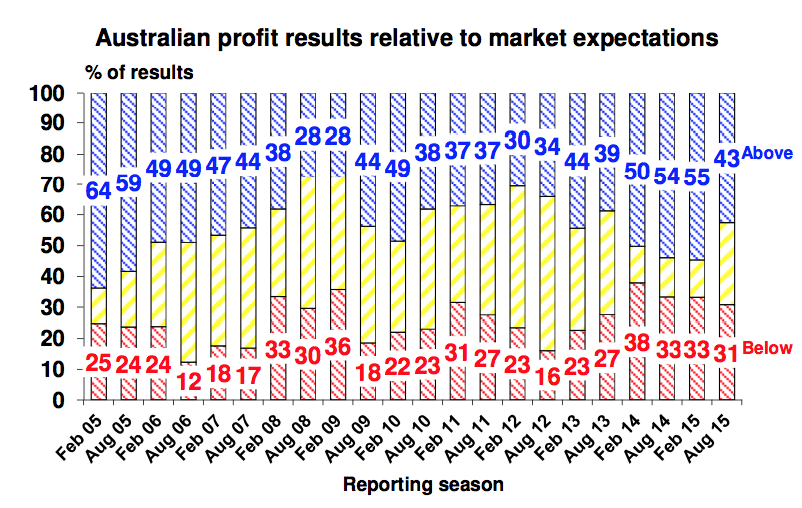

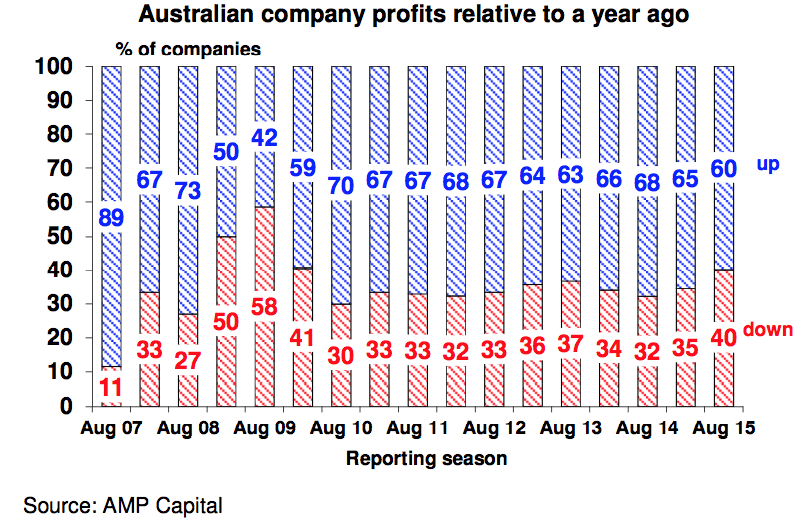

The Australian June half profit reporting season is now almost two thirds done and overall the results have been a little disappointing. 43% of results have beaten expectations and 60% have seen their profits rise from a year ago which is okay, but it’s well down on what we have been seeing in the last few reporting seasons. Resources companies have remained under pressure, industrial profit margins have been weaker than expected and the banks have been mixed and guidance for the current financial year has been a bit downbeat.

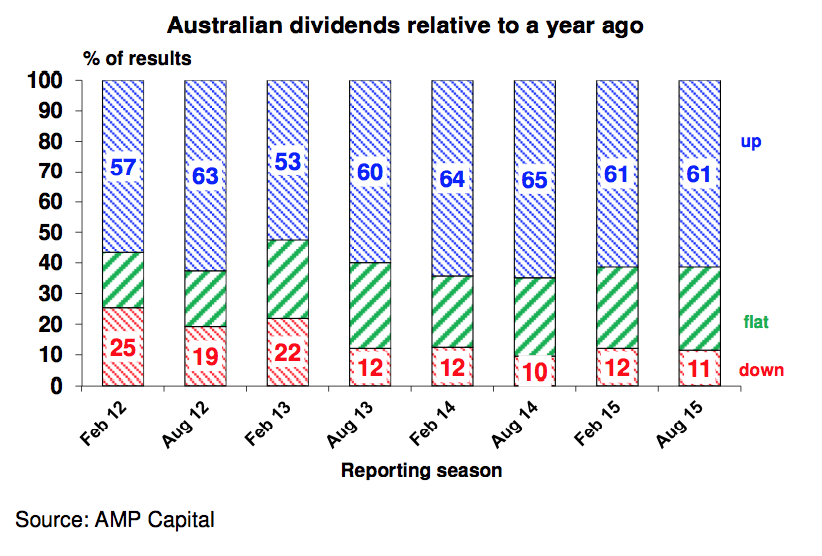

As a result profits now look to have fallen by around 2% over the last financial year and expectations for the current financial year have been downgraded to around 2%. However, it’s not all doom and gloom. Profits are still growing outside the resources sector by around 7% with companies exposed to housing and NSW and Victoria generally doing well, the lower $A should provide and dividends are continuing to rise solidly. So there is a bit of light at the end of the tunnel.

Major global economic events and implications

US economic data was consistent with okay, but hardly booming growth. While the NAHB home builder's conditions index, housing starts and existing home sales all rose, a fall in the Markit manufacturing PMI for August and mixed regional business surveys indicate overall growth is not particularly strong. Meanwhile, CPI inflation in July was weaker than expected.

Fed backing away from a September hike. While the minutes from the Fed's last meeting recognised progress in terms of the labour market and economic activity there was a degree of wariness regarding downside risks to inflation and global economic weakness. In fact since the July meeting the downside risks to inflation have increased with further falls in commodity prices, still weak wages growth and increasing risks regarding China and emerging countries. I think the probability of a September hike is now less than 40% and it will likely slide further if the emerging market related turmoil intensifies.

Eurozone business conditions PMIs impressed in August, coming in better than expected with the composite index rising to a strong 54.1 reading which is around a 4 year high and points to improved growth in the current quarter.

Japanese June quarter GDP contracted but growth is likely to return in the current quarter. A further improvement in the August manufacturing conditions PMI to 51.9 also points up.

Chinese economic data was contradictory. While property prices rose again in July and the MNI business sentiment survey rose strongly in August, the closely watched Caixin manufacturing PMI fell to its lowest since March 2009. The latter likely reflects the difficult conditions in small and medium businesses and the need for further monetary easing.

Australian economic events and implications

The minutes from the RBA’s last meeting provided nothing new. Citing more positive economic data of late and lower unemployment than forecast the RBA looks to be in no hurry to ease. However, since then commodity prices have weakened further & uncertainty about the emerging world has increased. My view remains that the RBA will still have to cut again.

What to watch over the next week?

US economic data releases over the week ahead are expected to be positive. Expect to see further gains in home prices (Monday), a bounce back in both new home sales (Tuesday) and pending home sales (Thursday), a stronger reading for August consumer confidence (Tuesday), a further modest trend gain in underlying durable goods orders (Wednesday) and an upwards revision to June quarter GDP growth to around 3% annualised. Meanwhile, the core consumption deflator for July (Friday) is expected to show that inflation remains low at 1.3% year on year.

In the Eurozone, economic confidence indexes (Friday) will be watched to see if the solid levels of July have been sustained.

Japanese economic data for July (Friday) is expected to show continued strength in the labour market and an improvement in household spending but inflation remaining too low.

In Australia the focus will be on business investment. June quarter construction data (Wednesday) is likely to show a 2% decline with a rise in residential building being offset by the ongoing downturn in mining construction. June quarter capex (Thursday) is also likely to show a 2% decline with plans for the current financial year likely to show ongoing softness. All of which is likely to reinforce the case for a further interest rate cut and decline in the value of the $A.

The June half Australian profit reporting season will wrap up with around 80 major companies reporting including Lend Lease, BHP, Worley Parsons, Origin and Woolworths.

Outlook for markets

Share markets are likely to see a further correction in the next few months. We are still in a seasonally weak period of the year for shares, uncertainties regarding China and the emerging world are likely to intensify in the short term posing risks for global growth and the US share market has only really just joined in the correction. Worries regarding a Fed rate hike in the run up to its September meeting are certainly not helping.

But beyond the near term, the cyclical bull market in shares is likely to resume: valuations against bonds are good and are now getting even better as bond yields fall and share market earnings yields rise; monetary conditions are set to remain easy with the latest global growth scare likely to drive further global monetary easing and see the Fed delay raising rates yet again; this in turn should help see the global economic recovery continue; and finally investor sentiment is deteriorating rapidly into the sort of pessimism that provides great buying opportunities.

As such, despite the current significant setback share markets are likely to remain in a broad rising trend. Given this I am reluctant to ditch my year-end target of 6000 for the ASX 200.

Low - and getting even lower - bond yields point to soft medium term returns from bonds.

The broad trend in the $A remains down as the Fed is still likely to raise rates sometime in the next six months despite ongoing delays whereas there is a good chance the RBA will cut rates again and the trend in commodity prices remains down. Our view remains that it is heading into the $US0.60s.

SHANE OLIVER is head of investment strategy and economics and chief economist at AMP Capital and is responsible for AMP Capital's diversified investment funds.