Australia's persistent two tiered housing market: Onthehouse's Eliza Owen

In spite of high growth in Sydney and Melbourne, growth in Australia as a whole is significantly lower than other housing markets around the world – according to the latest Knight Frank Global House Price Index.

onthehouse.com.au data reveals that the annual median capital growth rate for Australia’s houses and units was just 5.7% and 5.6% respectively. It is likely that nationally, houses and units are similar in their growth rate because there are more units in dense, high growth areas.

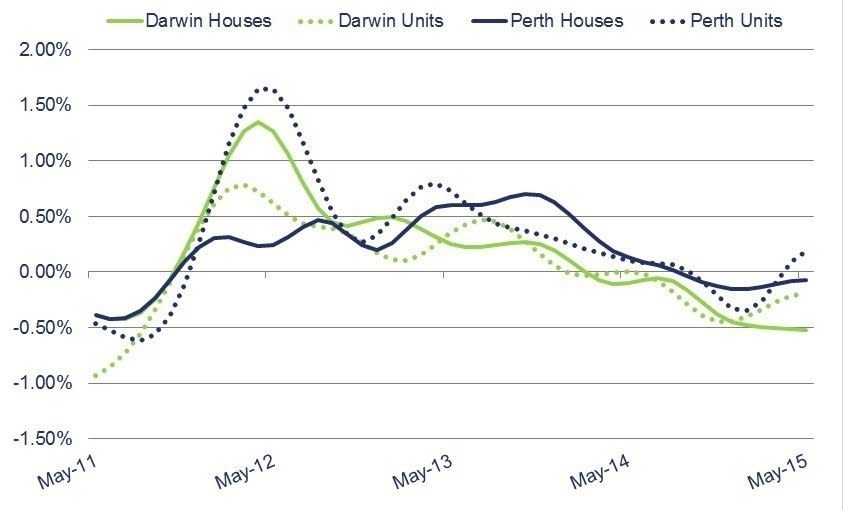

The two significant resource markets – Darwin and Perth – have showed poor performance over the last year. Houses in Darwin fell -3.74% in the last year, from $575,000 in May 2014 to $554,000 in May 2015.

The deepening downward trend for these markets can be seen below.

The differing trends represent the persistent, two tiered housing market that makes growth across the board seem stable. The Iron Ore price remains low at just US$60 per dry metric tonne, a commodity which averaged over US$100 per unit this time last year. Little has been done to create sustainable employment following low resource prices, and the end of the construction phase in the mining boom.

It is therefore misleading to look at data in such aggregation. The two tiered housing market makes it difficult for policy makers and Reserve Bank to influence housing growth.

With a boom on the south east coast that sets a higher deposit hurdle, and a bust in the resource states that has an unclear future, the state of the Australian housing market seems dismal. However, sustainable house and unit growth are an indicator of the strength of the economy. Though we present a summary of statistics by city metropolitan regions, there are suburbs with idiosyncrasies that make them a promising for investment. These include diverse employment opportunities, planning regulation, quality properties and affordability. Exploring such places outside of the major cities could present a more accessible growth or high yield strategy.

ELIZA OWEN is a market analyst for Onthehouse.com.au.