National property market outlook wrap: CBRE

Continued growth in the Sydney market is being felt across the entire market however buyers are now becoming picky.

Conversion rates on Sydney property have increased from one in five visitors to a display centre to one in seven or eight according to CBRE managing director, residential projects, David Milton.

Presenting at a recent CBRE Sydney Market Outlook breakfast which reviewed the outlook for the office, retail, industrial and residential sectors for Australia and the broader Asia Pacific, Mr Milton said sales hadn’t slowed overall, with total sales 11% higher in the first half of 2015 relative to the corresponding period in 2014.

"Buyer enquiry rates were 29% higher in the first half of 2015, underpinned by a pick-up in offshore buying, with 19% of sales in the first half requiring FIRB approval as opposed to 13% in 2014," Mr Milton said.

The presentation also highlighed:

19% of sales from Jan to June 2015 were from FIRB purchasers, as compared to 13% in 2014

Enquiries from Jan to June 2015 were 65k - an increase of 29% on the same period in 2014

In 2015 owner occupiers have accounted for 50% of purchasers, up from 40% in 2014

- Sales numbers from Jan to June 2015 were up 11% on the same period in 2014

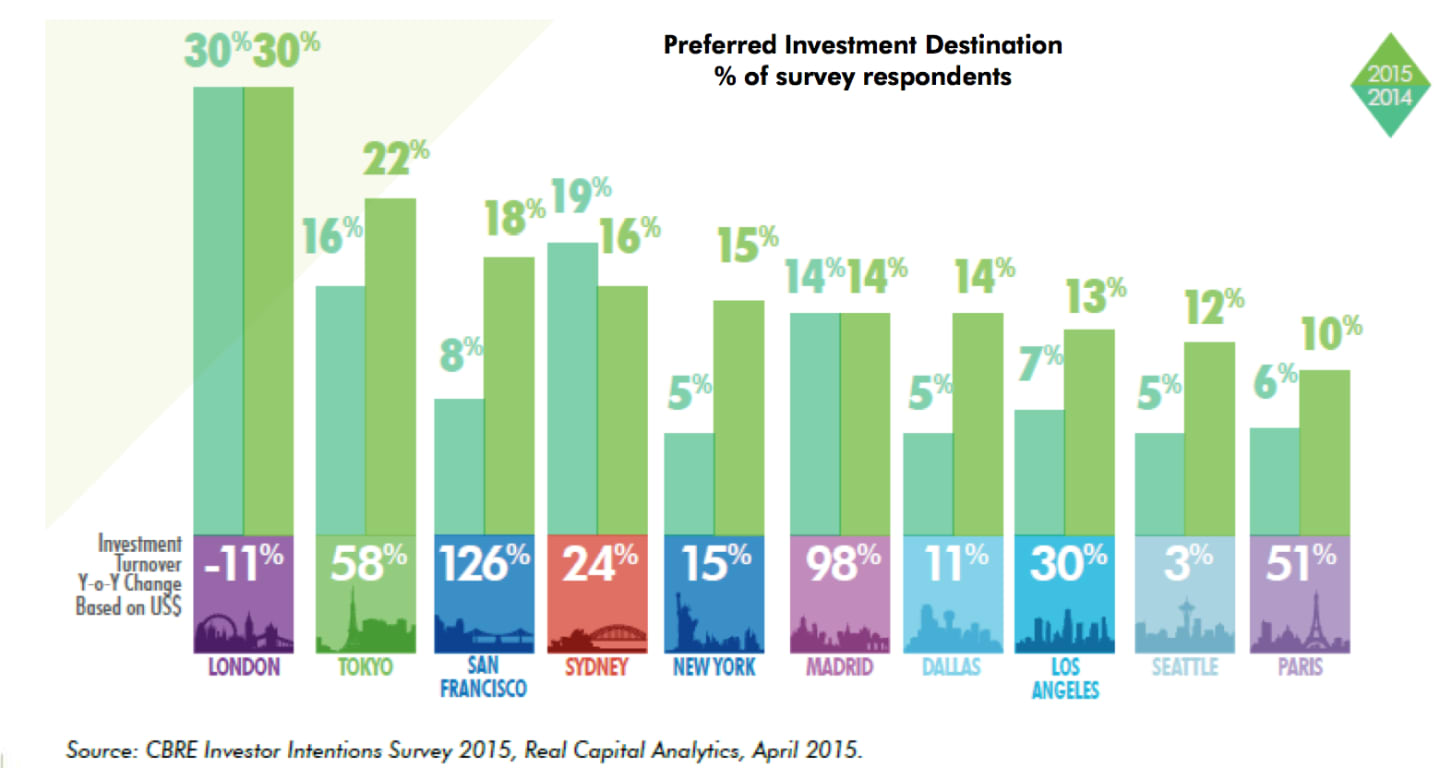

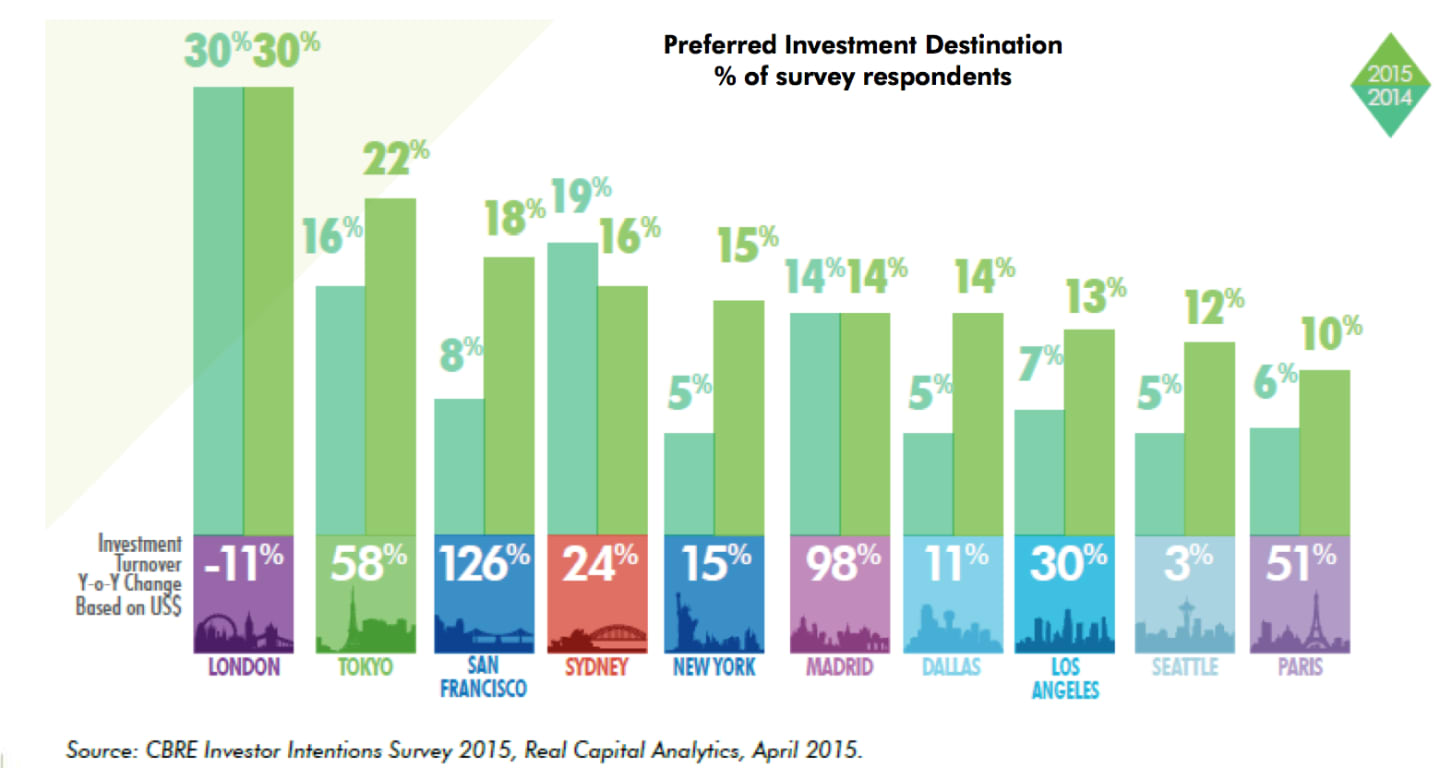

Is Sydney is attracting new business as an investment destination?

OFFICE RENTAL MARKET

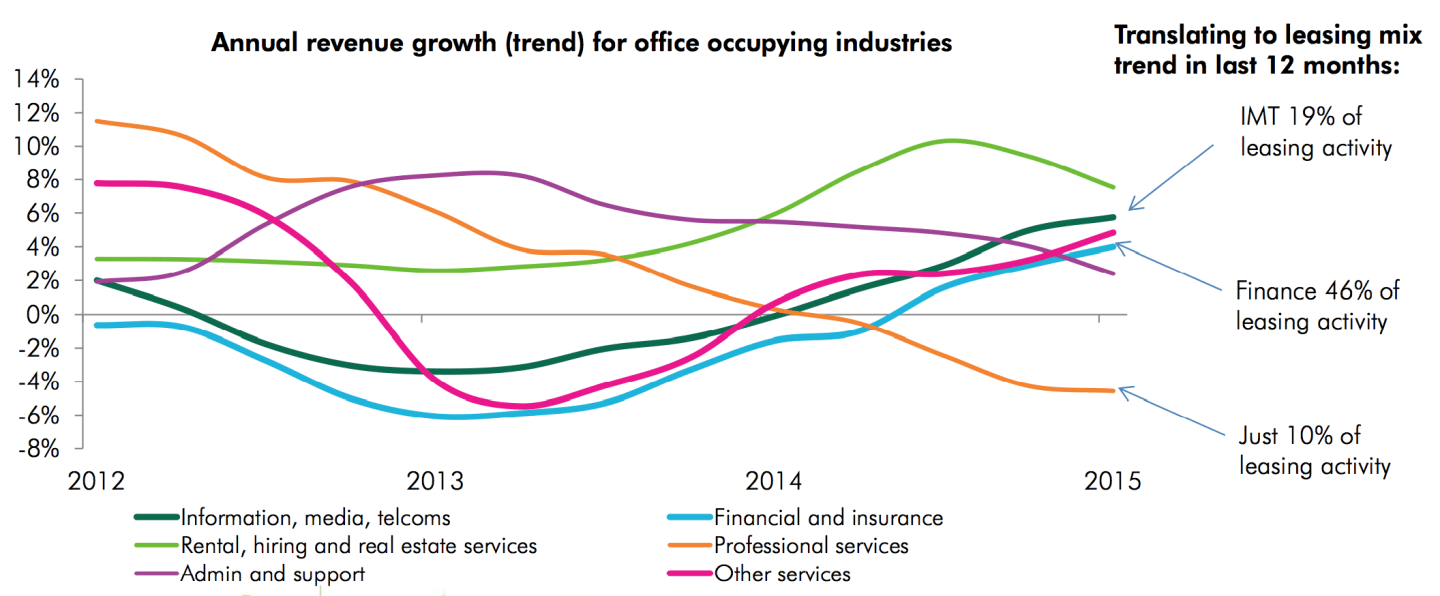

Adapting to a change in the marketplace was key to attracting iss the key for landlords given that “change is the new business as usual”, according to CBRE’s national director of transaction management Emil Joubert.

Mr Joubert said tenants were increasingly examining their lease expiries well ahead of time – with some tenants whose leases expired in 2020/21 already examining if now was the right time to consider a move given the current vacancy forecasts.

CBRE senior director of office services, Jenine Cranston, said landlords need to consider flexibility to accommodate growth from tenants.

“In 20 Martin Place, the major tenants we’re speaking to all want growth rights,” Ms Cranston said.

“It’s been a long time since we’ve seen that. For seven years, the discussions have mostly been around contraction, so this is a nice challenge for the market to have.”

Incubator IT companies needing short term space for six month growth was different to the usual tenant growth expectations of 18 months to two years.

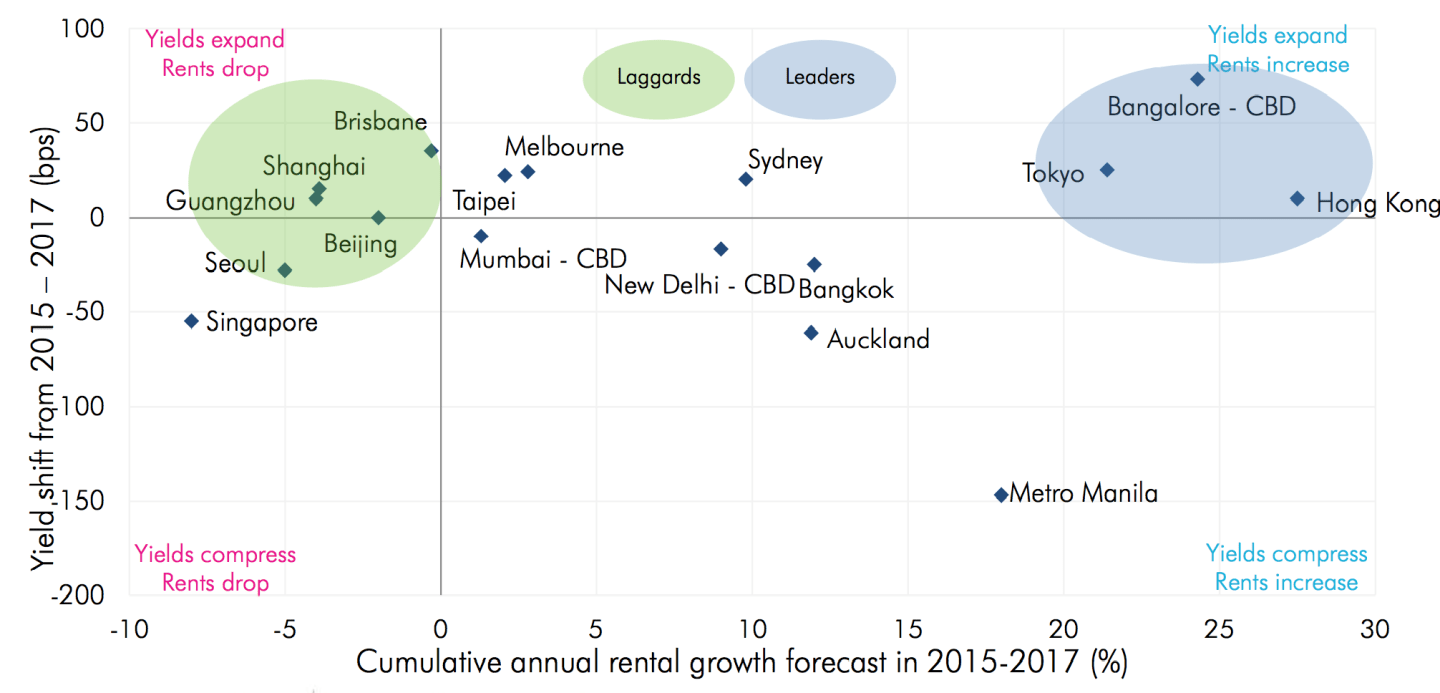

Office yields are set to move higher in 2017

CBRE’s head of research Australia, Stephen McNabb said that while most Australian office markets still favored tenants, a tighter vacancy outlook in Sydney was driving an improvement in face rents, with incentives having stabilised.

Mr McNabb noted that CBRE’s forecast for the Sydney CBD was for a below average 7% vacancy rate over the next 3-5 years, supported by a number of factors, including the withdrawal of office stock for residential redevelopment.

“We have seen rent growth in Sydney in the first half, which we haven’t observed for a long time,” Mr McNabb said.

This was one of the factors that meant Sydney was better place to withstand the office yield compression anticipated in some other Asia Pacific markets.

"In the rental market, Australia was benefiting from a continued influx of foreign entrants, with 40 new store openings last year by new or expanding retailers and a further 12 openings in the first half of 2015.

"This was helping to drive CBD rental growth, with Sydney CBD rents having increased by 20% in the past 12 months and rental growth having also been recorded in the shopping centre sector."

CBRE NSW state director, industrial and logistics services, Mike O'Neill, said Sydney leasing activity was up by 61% this year, relative to the corresponding period in 2014.

"Low supply would help drive Sydney rental growth with the new wave of speculative development not expected until next year," Mr McNeill said

"Another driver would be residential encroachments, in addition to factors such as the recent hailstorms, which had displaced a range of tenants and soaked up a considerable amount of vacant stock."