RBA's owner-occupiers LVR breakdown

The Reserve Bank of Australia has noted lower deposit requirements may have only partly offset the increase in house prices relative to income in its recent submission to the House of Representatives standing Committee on Economics Inquiry into Home Ownership.

In the submission the RBA wrote the latest data from mortgage lenders suggest that around 15% of new lending to owner-occupiers involves LVRs above 90%, and most of these borrowers would be first home buyers.

"The deposit required of a first home buyer is no longer necessarily around 20% of the purchase price, but rather, more often in the 5–10% range. This shift would have eased the accessibility constraint imposed by the deposit requirement more than would be apparent from a simple comparison of a fixed percentage of the median purchase price over time," the submission noted.

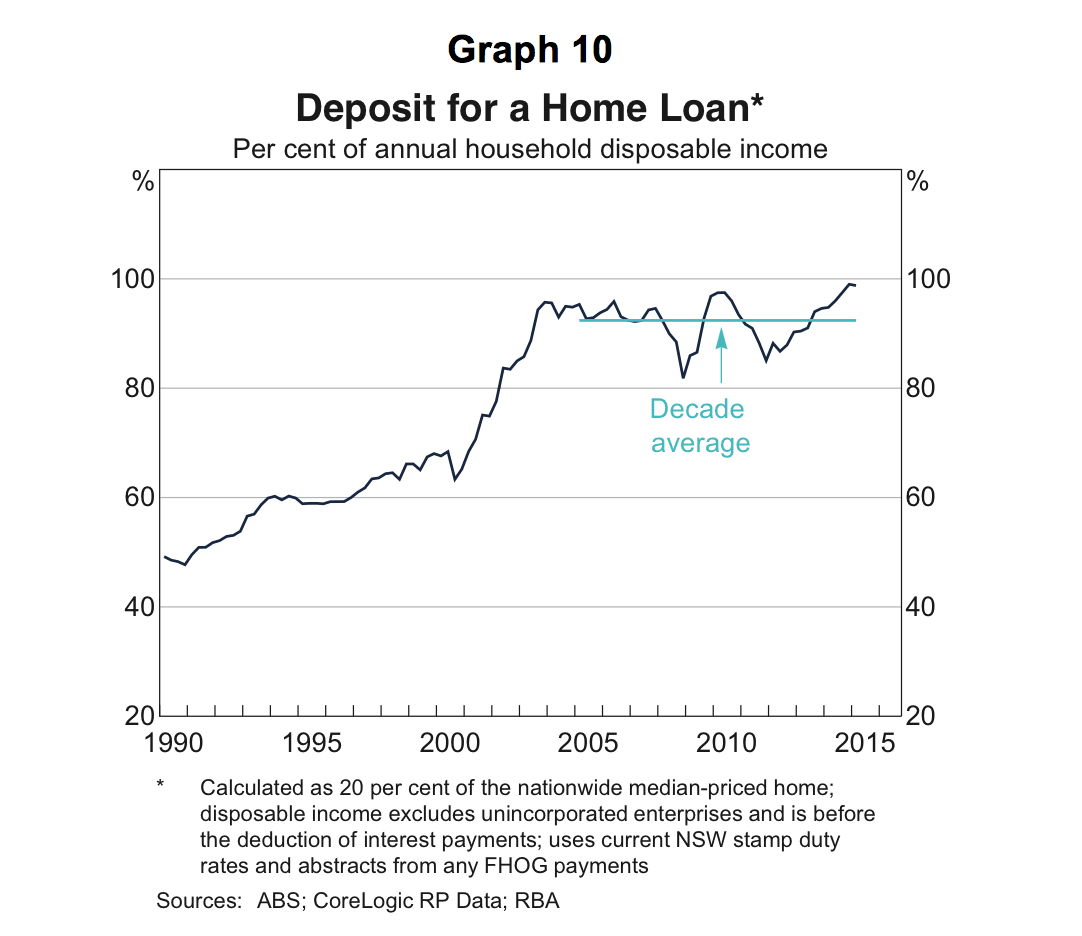

"The rise in housing prices relative to income has also increased the size of a deposit of any given fraction of the purchase price. At first glance, this would seem to imply that housing ‘accessibility’ has declined; previous studies have found that the savings required for a deposit seems to be more important for the transition to home ownership than the ability to service a mortgage from current income thereafter (Bourassa 1995). However, financial deregulation and increased competition in the mortgage market has partly offset this effect, by reducing minimum down payment (deposit) requirements.

"The maximum loan-to-valuation ratio (LVR) available in the Australian mortgage market has increased noticeably over recent decades, from the 80% typical in the pre-deregulation period to around 95% at present."