Melbourne apartments the weak link in its price growth baton change with Sydney during 2015: Propell

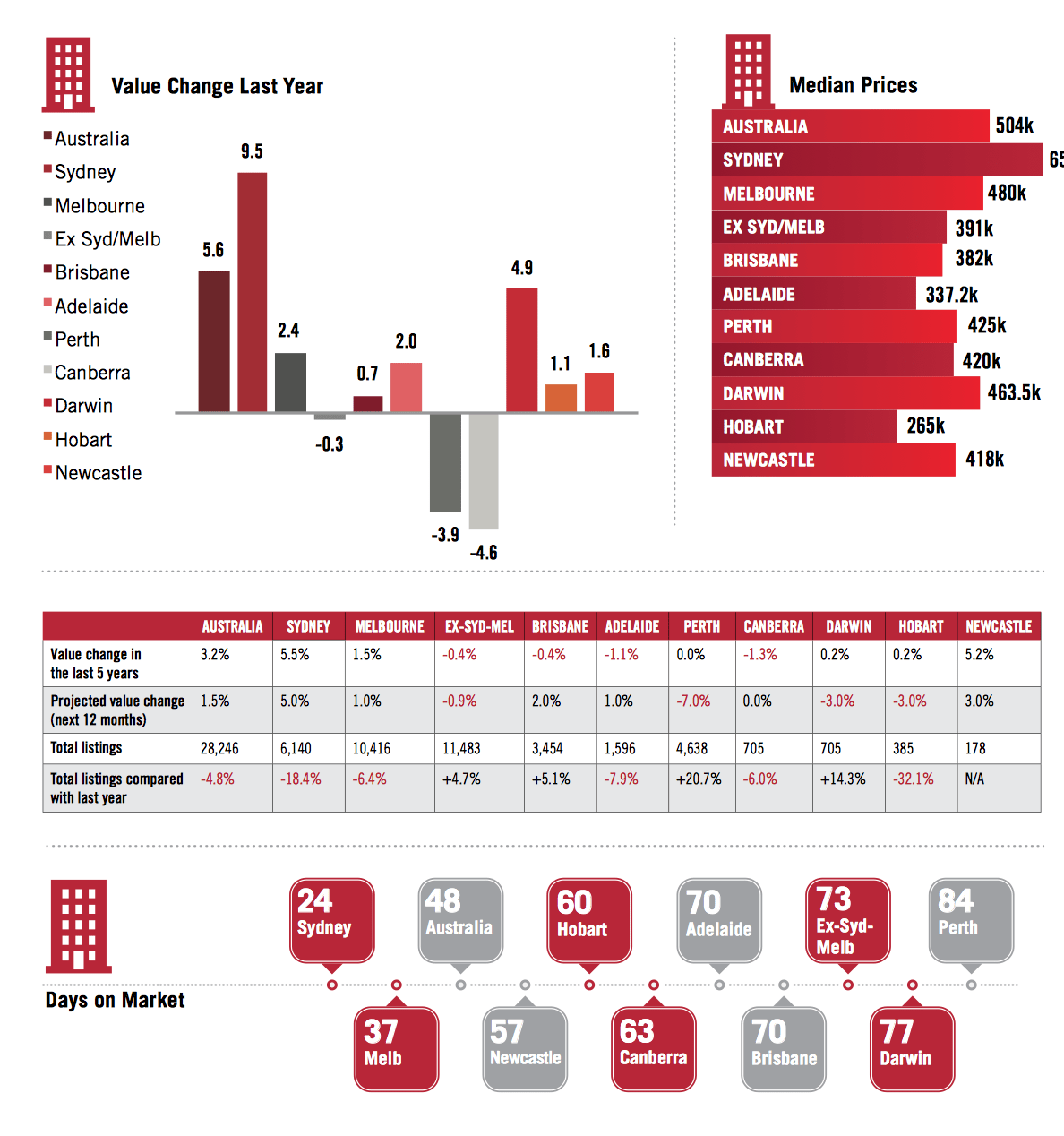

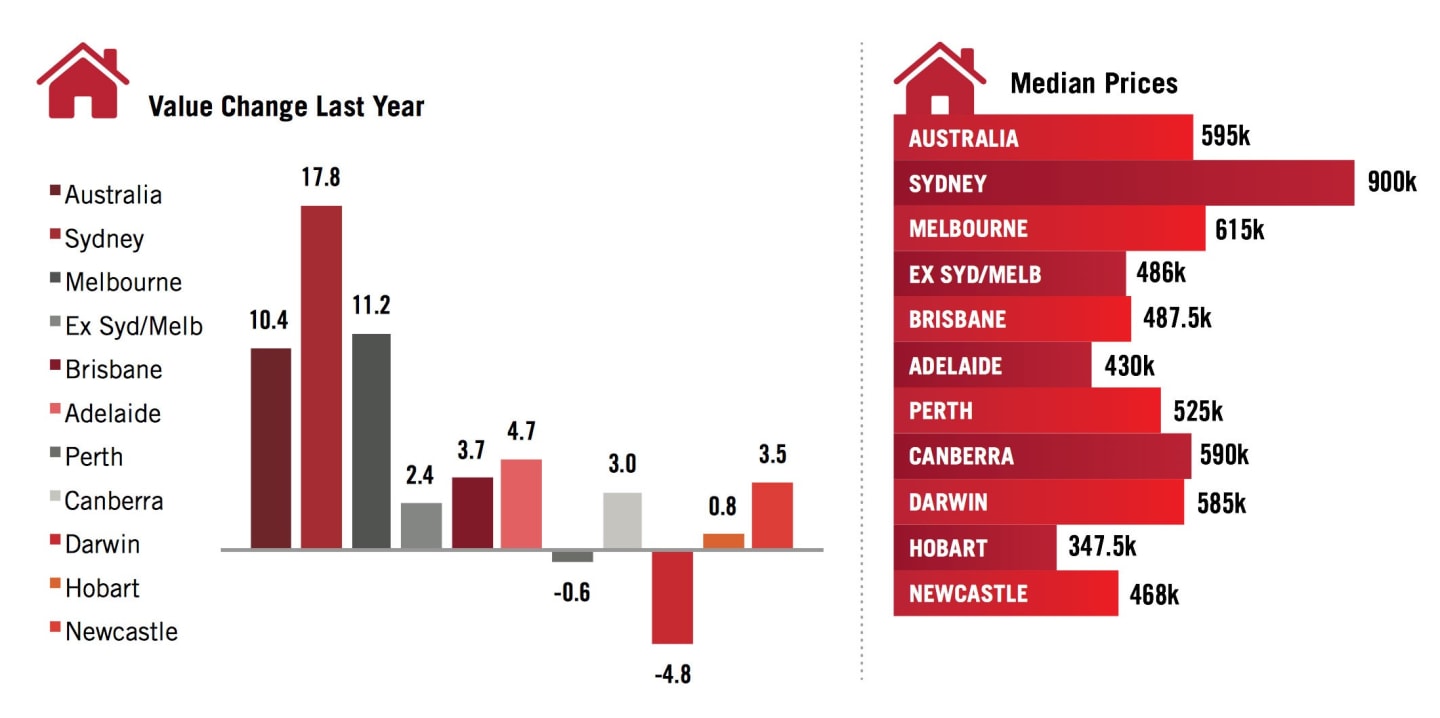

House prices are booming again, unless you live in Perth or Darwin, national valuers Propell suggest. After a hiatus in May, buyers returned strongly in June to most markets, setting fresh records and igniting comments about booms and warnings about the pace of growth.

In June alone, Sydney prices were up 2.4%, but for the first time in a while, the percentage increase was eclipsed by Melbourne which was up 3%, it noted.

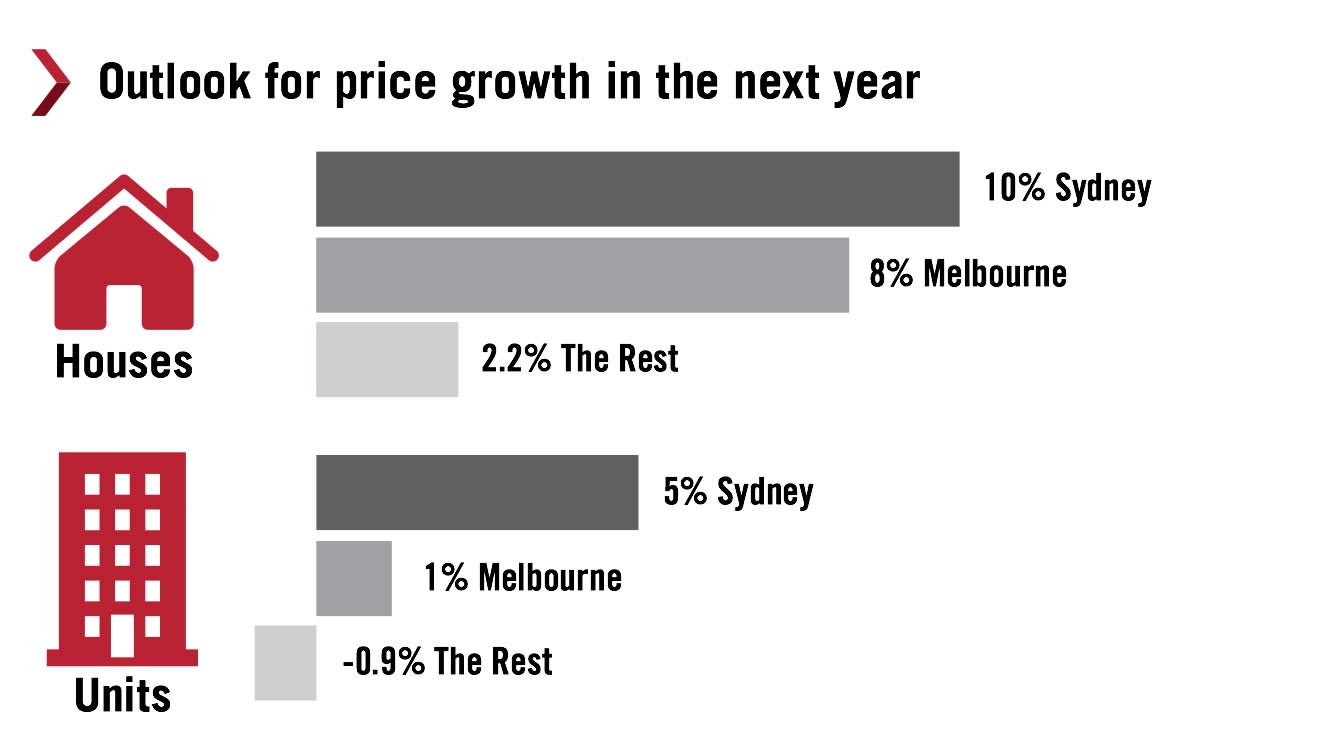

"Given the big price differential, it raises the prospect that Melbourne growth rates may start to overtake those of Sydney in the next year," Propell said.

"We can imagine a scenario where Sydney price growth eases back into single digits while Melbourne growth rates are well into the teens."

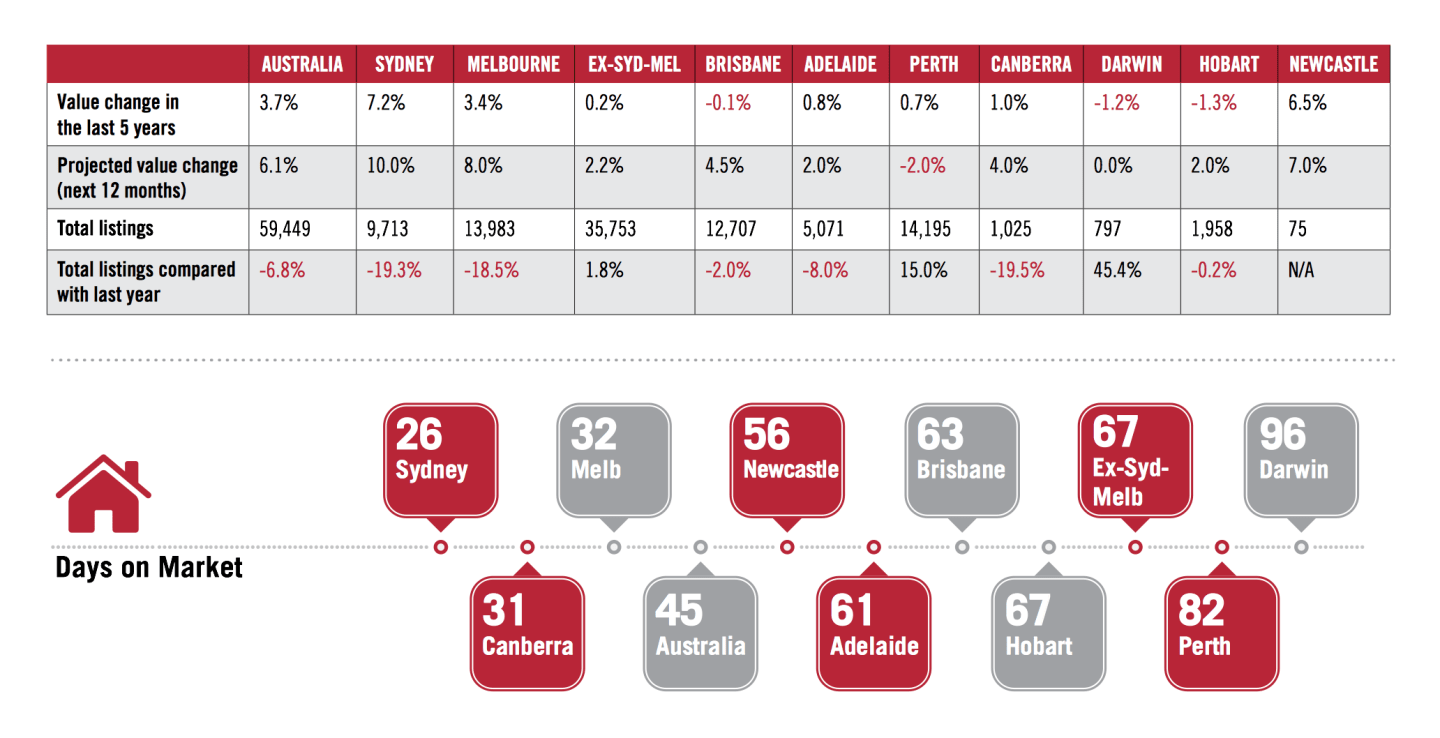

The Brisbane growth rate in prices was also strong, Propell advised up 1.9% in June after four weak months. Canberra was up 0.7% in June after a stronger May figure, and could be the surprise market of the next year showing increasing demand.

But at the other end of the scale, prices dropped in Perth and Darwin.

"Canberra is now seeing an inflection point, and prices have started increasing during 2015. Melbourne was looking increasingly attractive to investors who are otherwise getting priced out of the Sydney market.

"The Sydney housing market still leads the country in price growth, but the pace of growth appears to be moderating, although it is still in double digits.

"In contrast, house price growth in Melbourne is strengthening and there is speculation among some parties that it could match or exceed that of Sydney in the coming year… The benefit is not flowing over into the apartment market, where Sydney is the only market expected to show significant growth in apartment prices."

Other markets, including Melbourne, are oversupplied if anything, with developers competing for purchasers.

The number of investors in the market appears to be falling, even as investment demand increases.This is due to the macro prudential controls imposed on banks, which are now routinely requiring a 10% deposit, and the mortgage rate applicable for investment properties is no longer discounted, Propell noted.

"Loans for investment properties had peaked at around 44% of all loans, but early figures suggest that this could now have fallen to as low as 30%.

"This should contribute to a slower pace of price growth in the coming year. With a further cut in interest rates expected later in 2015, demand for real estate remains the bright spot in the economy."