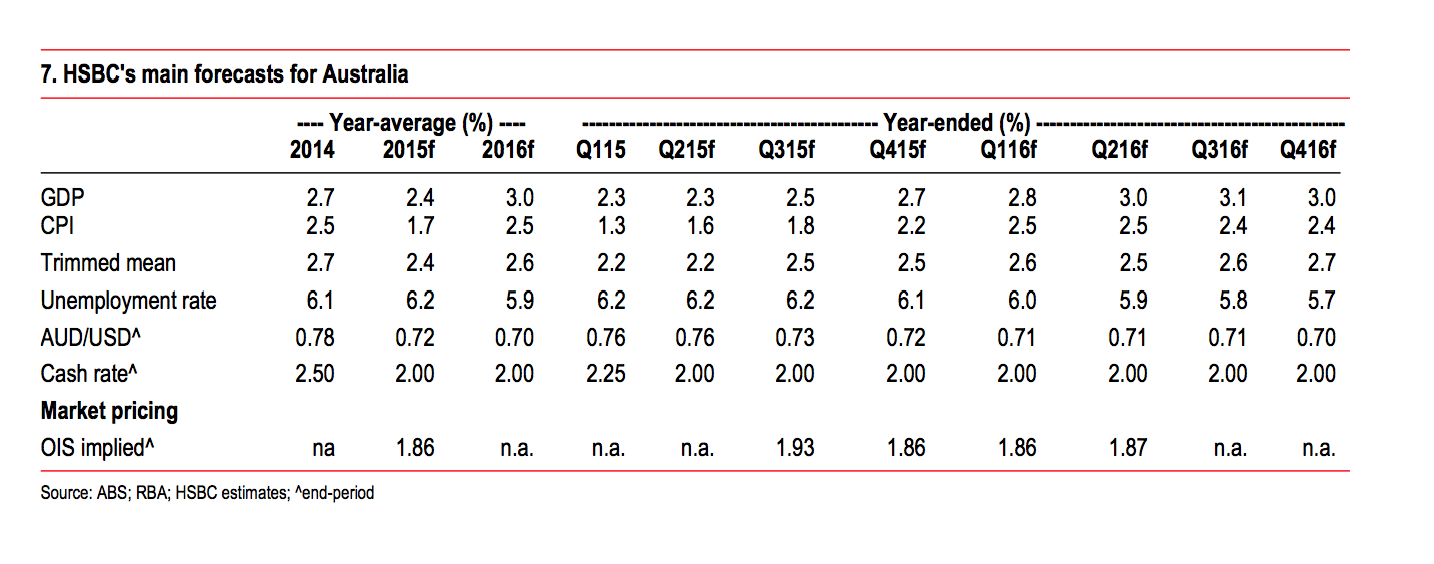

The RBA's rebalancing act continues: HSBC's Paul Bloxham

This month brought more evidence that the rebalancing act is continuing. Q1 GDP confirmed that household consumption is growing solidly, dwelling investment is in a strong upswing and resource export volumes are ramping up, as new capacity comes on line. The lift in these areas has more than offset the drag from falling mining and public investment, leaving solid GDP growth in the first quarter (0.9% q-o-q), although it was still below trend over the year (2.3% y-o-y).

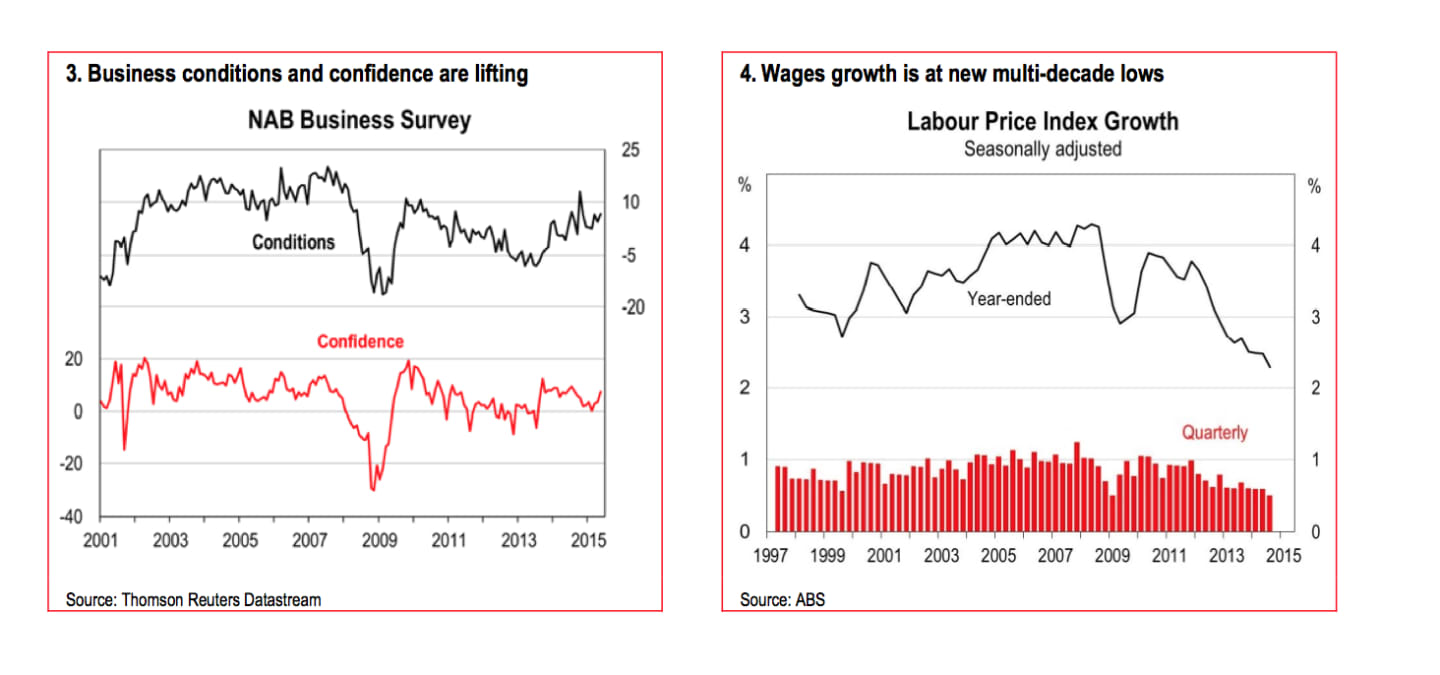

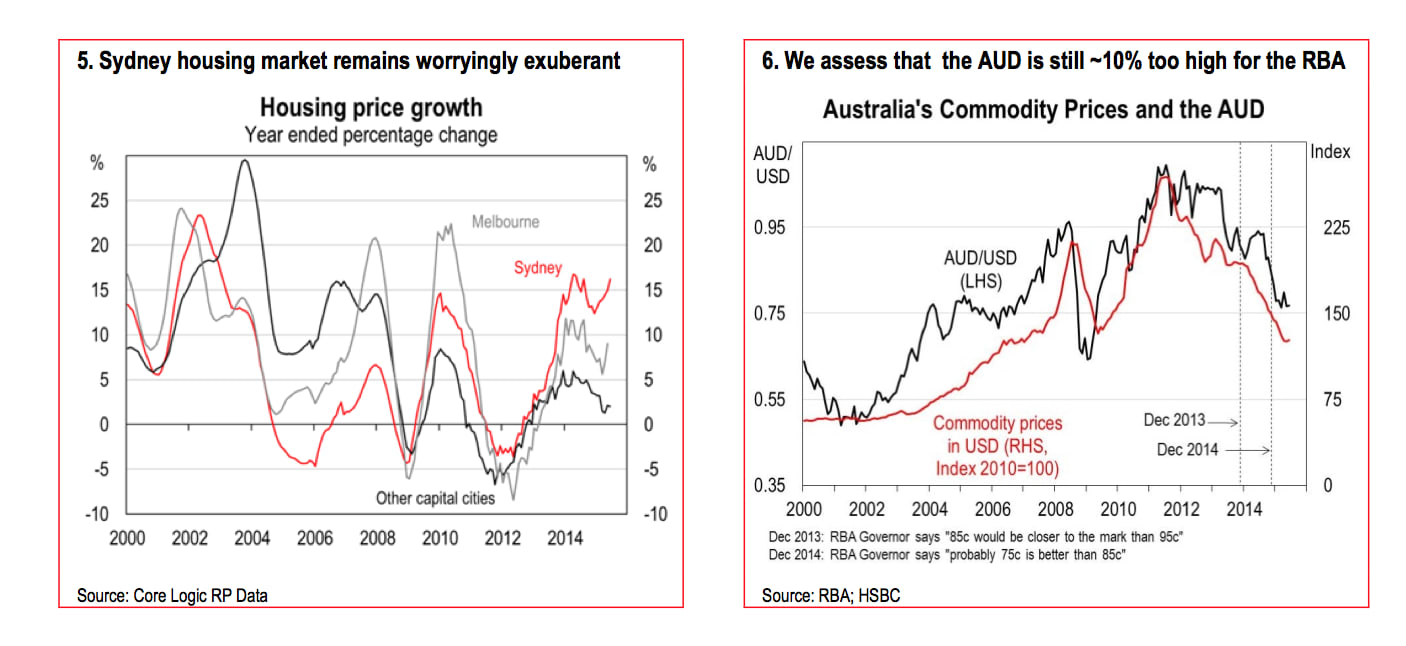

More timely indicators provided signs that the RBA's February and May rate cuts have been feeding through to a further lift in the housing market. Housing prices rose by 9.8% y-o-y in June and building approvals reached a new record high in May. Business surveys showed improving conditions and confidence in May, which could reflect the impact of this year's rate cuts as well as the government's more pro-growth budget. On a less positive side, retail sales were quite weak in April.

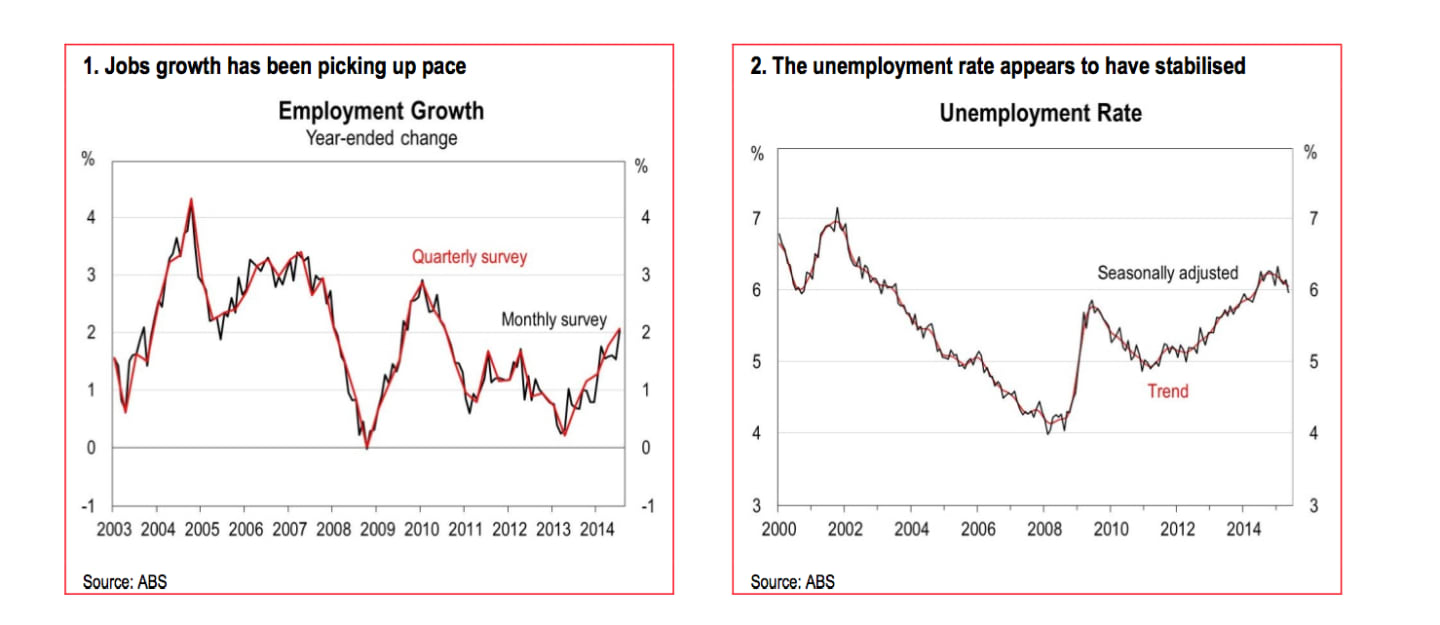

The clearest sign of improving conditions has been in the labour market, with jobs growth running at a three-and-a-half-year high of 2.0% y-o-y in May. At this rate, jobs growth has been sufficient to keep the unemployment rate steady at 6.0% to 6.2% in recent months. The services sectors are leading job creation as mining employment declines. At the same time, however, wages growth is at a multi-decade low. This weak wages growth reflects the build- up of spare capacity in the labour market, but may also explain why jobs growth is lifting, as lower wages encourage greater hiring.

The lift in activity and steadying of the unemployment rate are expected to keep the RBA on hold this month. If these improving trends continue, as is our central case, we expect that the RBA will not need to deliver further cuts in this easing phase. However, low wages growth means that inflation is likely to remain benign, which is likely to leave the RBA with an 'easing bias'. The central bank is expected to continue to express concern about strong housing price growth, particularly in Sydney, and the still high level of the AUD.

Jobs growth lifting, but wage inflation is low

Most of the activity indicators published this month showed positive results. In particular, there are increasingly convincing signs that the labour market is improving. The monthly labour force survey showed that 234k jobs have been created over the past year, implying jobs growth of 2.0% y-o-y, which has been enough to get the unemployment rate to stabilise (Chart 1 and 2). The quarterly labour market survey confirmed that although mining jobs are being cut, this is being more than offset by job creation in the services sectors. Business surveys also showed an improvement in conditions and confidence, which is likely to reflect the more pro-growth Federal budget delivered in May as well as the impact of the RBA's 50bp of rate cuts in the first half (Chart 3).

Although timely indicators suggest a lift in domestic demand and jobs growth, wages growth is at its lowest level in at least two decades (Chart 4). To some degree, this is just part of the needed adjustment to get a lift in jobs growth. However, lower wages growth should also be expected to put downward pressure on inflation, leaving the RBA with the option of cutting rates further, or at least keeping rates on hold for longer.

In 'wait and watch' mode

The combination of having already delivered 50bp of cuts in H1 and the more positive domestic numbers are expected to keep the RBA firmly on hold next week. We expect the RBA to be in 'wait and watch' mode, as it seeks more information about the full impact of the cuts it has already delivered this year.We expect the central bank to also express continued concern over the exuberance of the housing markets in Sydney and Melbourne, where price growth is still rapid (Chart 5). While the prudential regulator has been gradually tightening micro-prudential settings, the Sydney market and parts of Melbourne are still showing excessive exuberance. On the margin, this concern is likely to keep the RBA on hold.

Working in the other direction, the RBA is likely to remain concerned about the still high level of the AUD. On our assessment, the central bank would be more comfortable with the AUD at around 68-70 USD cents (it is currently trading at 76 USD cents), so it is still about 10% higher than it would like (Chart 6). As the RBA has recently pointed out, a sustained lower currency is seen as necessary to encourage a solid lift in non-mining business investment intentions, which is the next stage of the rebalancing act.

Although developments in Greece may get a passing reference in the post-meeting statement, they are unlikely to be of particular relevance to local policy. There may, however, be an increased focus on China, given recent policy moves and volatility in the stock market.