Price growth second-wind spurt the RBA's doing: CoreLogic RP Data's Tim Lawless

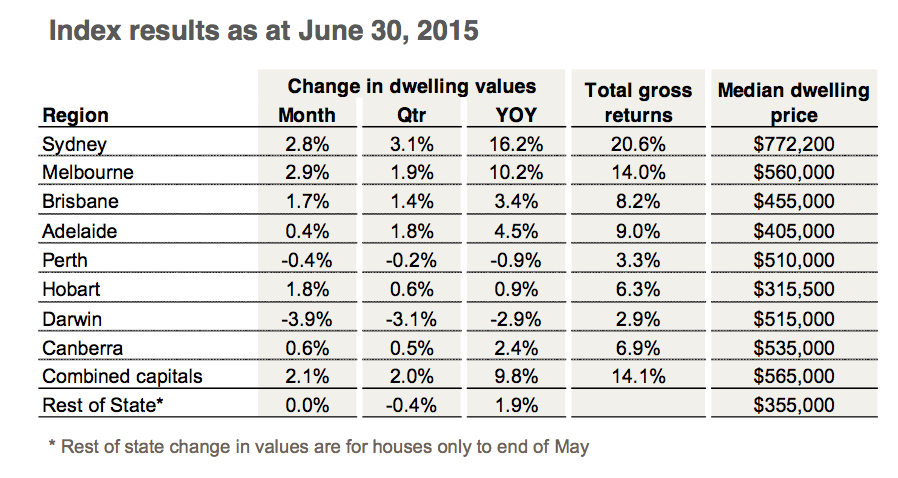

Australia's capital city dwelling values were 9.8% higher over the financial year, according to the latest CoreLogic RP Data update. The previous 2013/14 financial year recorded a slightly higher rate of growth at 10.1%.

Housing values rebounded in across the June quarter with dwelling values rising 2.0%t to be 9.8% higher over the year.

The rate of capital gain was slightly higher over the second half of the year (5.1%) compared with the first half (4.5%) highlighting that the housing market has gathered some momentum during 2015, CoreLogic RP Data’s head of research, Tim Lawless, who believes the interest rates cuts in February and May have contributed in pushing capital gains higher.

“Growth conditions had been moderating from April last year through to the end of January 2015.

"With the RBA cutting the cash rate in February, there was an instant buyer reaction across the Sydney and Melbourne housing markets where auction clearance rates surged back to levels not seen since 2009.

"Capital gains once again accelerated and we are now seeing Sydney and Melbourne homes selling in record time; Sydney homes are selling in just 26 days and Melbourne homes are selling in 32 days.”

But while Sydney and Melbourne have seen dwelling values increase by 16.2% and 10.2% over the financial year respectively, every other capital city has seen growth of less than 5 per cent and dwelling values are down over the year in Darwin (-2.9%) and Perth (-0.9%).

Since dwelling values started rising in May 2012, Sydney dwellings have seen a 43.1% surge in values and Melbourne values are up by 25.9%.

Despite emerging softer market conditions in Perth, dwelling values are currently up 12.8% over the cycle which represents the third highest growth rate across the capitals.

"Simultaneously, Brisbane’s property market has shown the fourth highest rate of growth at 12.4%, followed by Adelaide (10.4%), Hobart (9.6%), Darwin (8.9%) and Canberra (8.8%).

“The three tiers of housing market performance can be best explained by economic and demographic factors where it’s no coincidence that New South Wales and Victoria are recording the strongest economic conditions coupled with the strongest rates of migration which is fuelling housing demand.

"Looking forward to the next financial year, Mr Lawless said it is difficult to imagine Sydney maintaining such a rapid pace of capital gains.

“Not only is affordability becoming a challenge for many sectors of the market, but yields are substantially compressed, rents are hardly moving and investors are facing tighter financing conditions from lenders.

“In the absence of a trigger event, such as a sharp rise in the jobless rate, higher interest rates or an external shock, it is unlikely we will experience a significant correction in dwelling values.

"However, the longer this run of growth continues across our largest capital cities, the more susceptible the housing market becomes to changes in the economy or broadly across household finance,” Tim Lawless said.

{mijopolls 118}