AFG suspends mortgage manager after $110 million Myra Home Loans fraud arrest

The Melbourne man arrested after an alleged $110 million mortgage fraud, Aizaz Hassan, was writing loans until his accreditation was stopped this week.

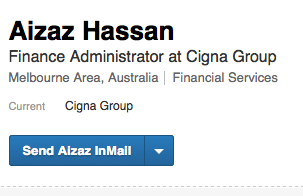

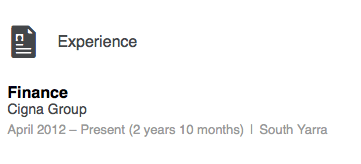

Hassan held his credit licence through several lenders since 2011, currently with Australian Finance Group, one of the country's largest mortgage brokerage networks.

His credentials were listed on linkedin.

The allegations relate to loans between 2008 and 2011, so do not relate to his recent employment.

An AFG spokesperson advised Hassan had been suspended, according to Fairfax Media.

His position was as a finance and operations manager at Cigna Financial, which is part of the AFG network.

Hassan and another Melbourne man, Najam Shah, have been arrested and charged following an ASIC investigation into the alleged use of false documents in support of loan applications valued at about $110 million.

Shah and Hassan have been charged with one count each of common law conspiracy to defraud, according to an ASIC release.

The charges relate to the men’s roles at a Footscray company, Myra Home Loan Pty Ltd trading as Myra Financial Services (no longer trading).

It is alleged that between April 2008 and December 2011, Shah and Hassan conspired to defraud 12 lenders, banks and other financial institutions, by creating and using false documents to support loan applications submitted on behalf of Myra clients.

The false documents included bank statements, payslips, citizenship certificates and statutory declarations. These were predominantly used in support of applications for home loans for house and land packages as well as for the purchase or refinance of existing homes.

At least 350 loans valued at $110 million were submitted and approved on behalf of Myra clients.

The alleged conspiracy involves submission of false documents for more than 300 loan applications to numerous banks and financial institutions, including the Commonwealth Bank of Australia, Westpac Banking Corporation, St George Bank, Bankwest, Adelaide Bank, ANZ, Bank of Queensland, Choice Home Loans, Citibank, National Australia Bank, Pepper Homeloans and Suncorp Bank.