A state-by-state guide to fire levies

State governments have been paying more attention to fire levies, as questions have been raised about funding fire services. This issue concerns the community as well as bringing up tax issues for property owners and investors.

Victoria is implementing a new fire levy system, called the fire services property levy, as of July 1, 2013. Property owners will now pay for the fire services property levy as part of their council rates notices, which will be issued by councils from July 2013.

New South Wales is also looking to move from an insurance-funded fire service to a broad-based property tax.

Queensland has also implemented plans to re-brand the fire levy to an “emergency management, fire and rescue” levy as of January next year, which will be applied to all rateable properties. The levy will also be increased by 6.5% at the same time.

ACT will increase the levy amount to $120, from $104.80 previously.

In WA, the minimum charge for the emergency services levy will increase to $60, from $57 previously.

South Australia’s emergency services levy will see the prescribed levy rate change from 0.001027 to 0.001108 for the 2013-14 financial year.

Northern Territory residents do not pay a fire levy as fire services are funded directly from consolidated revenue.

Tasmanian residents can expect to pay an additional 4% in the coming financial year for fire service contributions.

--

Victoria

The Victorian Government implemented a new fire levy system as of July 1 2013 after recommendations from the Victorian Bushfires Royal Commission.

The current Victorian fire services levy will be removed from insurance premiums. The fire services property levy will be in its place, and property owners will pay for it through their council rates notices.

All property owners will need to contribute a minimum of $100 a year to fund Victoria’s fire services. Previously, only those with adequate insurance contributed to the fire levy.

A charge of $100 will apply for residential property owners, and $200 will apply to non-residential properties. On top of this, a variable cost calculated according to the property’s capital improved value and the area’s designated fire service will apply.

The levy rate will vary for residential, industrial, commercial, and farming properties, while separate levies will be charged in the Metropolitan Fire Brigade (MFB) and Country Fire Authority (CFA) areas as there are different costs associated with funding each service.

MFB variable rates (cents per $1000 of capital improved value)

Property Sector | MFB |

Residential | 6.9 |

Commercial | 60.7 |

Industrial | 95.0 |

Primary production | 17.3 |

Public benefit | 6.9 |

Vacant (excluding vacant residential land) | 6.9 |

CFA variable rates (cents per $1000 of capital improved value)

Property Sector | CFA |

Residential | 11.5 |

Commercial | 109.2 |

Industrial | 170.9 |

Primary production | 31.2 |

Public benefit | 11.5 |

Vacant (excluding vacant residential land) | 11.5 |

Residents will pay the levy according to the capital improved value of a property. According to the Department of Planning and Community Development, the capital improved value of a property is “the total market value of the land plus buildings and other improvements”.

The levy will be paid through council rates, and not from insurance premiums as previously implemented.

Non-rateable properties will be issued a separate notice. GST and stamp duty will also no longer be charged on the levy.

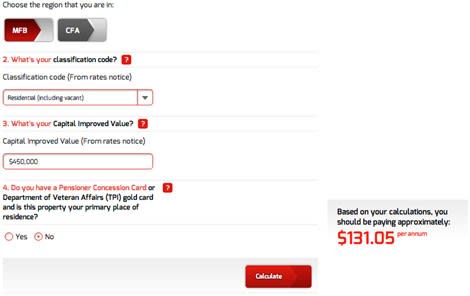

First, determine if your property is located in the MFB or CFA region.

Then select your classification code, which is included in your rates notice.

Then enter your Capital Improved Value, also included in your rates notice.

For instance, if you live in a region that requires the services of the Metropolitan Fire Brigade (MFB), in a residential property whose capital improved value is $450,000, and do not currently hold a Pensioner Concession Card, based on the calculator available on the Victorian Fire Levy website the fire levy will cost about $131.05 per annum.

More information is available on the Victorian Fire Services Property Levy website.

--

New South Wales

Similarly, the NSW government is looking to move the point of payment from insurance premiums to a broad-based property tax.

With the introduction of the proposed fire levy, every property owner will now have to contribute to the total cost of running the Fire & Rescue service.

A report by Fairfax Media estimated that some 36 per cent, or 810,000 households who currently do not have home contents insurance will have to pay the fire levy for the first time.

The main difference between New South Wales and Victoria’s fire levy comes from the base on which the levy is calculated.

The NSW government has announced there will be no move to capital-improved valuations. A discussion paper on the fire services levy released last year proposed an annual charge of up to $267 on land valued at $250,000, based on applying a rate of $1.07 per $1000 of land value.

At present, people contribute to the Fire and Rescue NSW when they pay their insurance. The insurance company shows a separate amount on their invoice notice, which they call "fire service levy".

According to the Fire and Rescue NSW, this amount is only an estimate of what insurance company itself will pay, as they are not required to reconcile what they show on premiums and the amount they actually remit.

The annual cost of running Fire & Rescue NSW is $645 million as of the 2011/2012 financial year. Three quarters of the cost was paid for by implementing taxes on insurance companies, which they passed onto home contents insurance policy holders by charging higher premiums.

The remaining one quarter was paid by the state and a tax on local councils.

--

Queensland

A change to Queensland’s fire levy was announced in May. The existing 2012-13 levy amounts saw a 3.5% increase on July 1 this year. Come January next year, the fire levy will be changed to an “emergency management, fire and rescue” levy, which will be applied across all rateable properties.

The levy will be increased by a further 6.5% from 1 January 2014.

In addition, all landholders in Rural Fire Brigade areas will pay an additional $90 on top of their existing rural fire levy.

This change comes as the Newman government announced $4.5 billion of revenue falls since coming into office. In addition, general taxation in the 2013-14 budget will be written down a further $1.2 billion.

According to the Queensland Fire and Rescue Service, about 68% of its running cost is provided by fire levies collected through local government rates, while other funding comes from the state and Commonwealth governments, as well as other fees and charges.

At present, the fire levy in Queensland applies to all properties located within an urban district, but not all rateable properties. Local government officers calculate the levy to be imposed. The urban fire levy in Queensland is dependent on the following factors:

The class of urban district in which the property is situated

The activity carried on or the use to which the land is put

The size and nature of any improvements on the land

In addition, the new levy will not support local volunteer rural fire brigades, according to a media release from the Rural Fire Brigades Association of Queensland (RFBAQ).

Pensioners will continue to receive a 20% discount on the proposed levy.

--

ACT

The Fire and Emergency Services levy in ACT is charged on all rateable properties to partially cover the cost of providing fire and emergency services.

The levy amount for the 2013-14 financial year on all rateable residential and rural properties is a fixed charge of $120, up from $104.80 during the last financial year.

Commercial property owners will pay an amount based on the average unimproved value (AUV) multiplied by 0.5041%, an increase of 0.0948% from last year.

Property owners have the option of paying their rates and levy assessment in full by the first due date and receive a 3% discount, or by four quarterly payments throughout the year.

Pensioners eligible for a rates rebate will receive a 50% on their portion of the levy.

The ACT Revenue Office has provided a Fire and Emergency Services levy calculator, which is available online.

--

WA

The emergency services levy (ESL) imposed in Western Australia has been in place since 2003. It addresses key issues and replaces an old system where insurance companies collected funding for the career fire and rescue service by placing a levy on insurance premiums for properties in WA.

At present, the ESL helps ensure a system where everyone contributes to the emergency services available, and people are more aware of the exact amount they contribute.

Major changes to the 2013-14 ESL include an increase in minimum charges, from $57 to $60.

Residents living in Alkimos, Two Rocks, Cowaramup, Wallcliffe, Witchcliffe, Yallingyup, Bridgetown, Port Hedland, Karratha, Bruce Rock, Tom Price, Dampier, and Dwellingup should take note of boundary changes made for 2013-14.

A document on Western Australia’s ESL for 2013-14 states that the cost of running WA’s Department of Fire and Emergency Services in 2013-14 is about $338 million, with $271.184 million coming from the ESL.

The ESL charge is dependent on four factors:

1. the location of the property (the ESL Category it is in);

2. the declared ESL rate for that category;

3. the property’s Gross Rental Value (GRV); and

4. Minimum and maximum charges, which are based on what the property is used for.

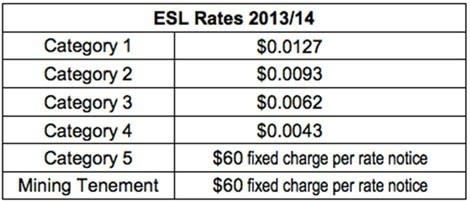

The ESL Categories are as follows:

The ESL charge for properties in categories 1 to 4 is calculated using the Gross Rental Value (GRV). The GRV is multiplied by the ESL rate for the category.

Properties located in ESL Category 5 and certain mining tenements (where infrastructure is likely to exist) receive a fixed charge of $60 per rates notice.

The Valuation of Land Act (1978) defines the GRV as "the gross annual rental that the land might reasonably be expected to realise if let on a tenancy from year to year upon condition that the landlord were liable for all rates, taxes and other charges thereon and the insurance and other outgoings necessary to maintain the value of the land..."

Pensioners who quality for a rebate on council rates will receive the same amount of rebate on their ESL charge.

The Western Australian Department of Fire and Emergency Services has provided an ESL calculator, which is available online.

--

South Australia

The South Australian emergency services levy (ESL) is a levy for all real estate and some vehicles, funding emergency services across SA, including the Metropolitan Fire Service and Country Fire Service.

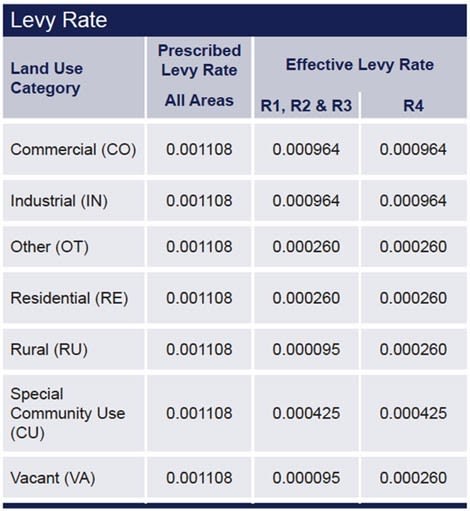

The prescribed levy rate for the 2013-14 financial year has increased from 0.001027 to 0.001108. This therefore affects the determination of the remission contributed by the government to the community emergency services fund.

The formula used to calculate the levy is detailed below:

Effective Levy Rates and Land Use Factors for 2013-14 will remain the same.

Applying the prescribed fixed charge, and the other prescribed components to the capital value of a property (variable charge) results in the Gross levy (i.e. the total amount contributed to the fund by both the government and the owner).

The main component of the government contribution is the general remission. This is the difference between calculating the ESL using the prescribed components and the effective components.

The component of the ESL contributed by the owner is calculated by applying the Effective Fixed Charge, and the other Effective components to the capital value. This amount may be further reduced by:

- any remission to certain other properties;

- any concession; or

- any reduction of the fixed charge for contiguous or single farming enterprise land.

The levy components are as follows:

Source: Revenue SA

SA’s four emergency areas are:

Regional Area 1 (R1): the areas of the cities and towns of Berri, Goolwa, Kadina, Loxton, Millicent, Mt Barker, Mt Gambier, Murray Bridge, Naracoorte, Nuriootpa, Pt Augusta, Pt Lincoln, Pt Pirie, Renmark, Tanunda, Victor Harbor and Whyalla.

Regional Area 2 (R2): that part of the State outside of “Regional Area 4” and “Regional Area 1” but still within a council area.

Regional Area 3 (R3): that part of the State not within a council area.

Regional Area 4 (R4): land within all metropolitan councils, the Adelaide Hills Council, Corporation of the Town of Gawler, City of Onkaparinga and City of Playford.

Full remission of the fixed and variable charge applies to properties with a Capital Value of $1000 or less in Regional Areas 2 and 3.

A full remission applies to levy accounts of $20 or less where property ownership is confined to Regional Area 3.

Concessions of up to $46 are available for pensioners, self-funded retirees, and other beneficiaries in respect of their principal place of residence.

SA’s Department of Treasury and Finance has also provided a calculator to help with the amount of ESL one needs to pay.

Further information is available on RevenueSA’s guide to the Emergency Services Levy.

--

NT

The Northern Territory funds fire services directly from consolidated revenue.

--

TAS

Tasmania uses a hybrid system to collect fire levies, with an insurance levy on commercial insurance and a fire service contribution (FSC) on residential rates.

For the year 2013-14, there will be a 4% increase in FSC for both commercial and residential properties, Mike Gallagher of the Tasmanian Fire Service told Property Observer.

FSC on properties for 2011-12 amounted to $32.3 million and represented 45 per cent of the Tasmanian Fire Service’s total revenue. The levels of contribution payable by ratepayers vary throughout the state according to whether ratepayers are in urban or country areas.

The FSC is based on a rate in the dollar and this is determined by the assessed annual value of land and the level of service provided.

On average the cost for a property covered by a permanent brigade with 24 hour a day and 7 day a week coverage is $241. The cost for a property covered by a volunteer brigade is $49 on average.

For commercial insurance premiums with a fire component, the percentage charged for prescribed classes of insurance is 2% for marine cargo insurance, 14% for aviation hull insurance, and 28% for other classes of insurance. The actual amount of insurance fire levy paid will be dependent on the premium charged by the insurance company.

Unlike the FSC where the State Fire Commission advises each council how much it is to collect and for what classes of land, the insurance fire levy is determined by market forces and the Commission does not set an amount to be collected, Gallagher said.

The minimum fire service levy for motor vehicles in Tasmania is $16, and $11 for pensioners.

The minimum fire service contribution that landholders are required to pay on a parcel of land is $36. Pensioners are entitled to a 20% discount.

Councils are paid a commission of 4% for collecting the fire service contributions, which is included on rates notices.