Victorian property values defy gloomy price predictions: REIV

Victorian property values are continuing to defy gloomy price predictions and are holding firm, the Real Estate Institute of Victoria president Leah Calnan says.

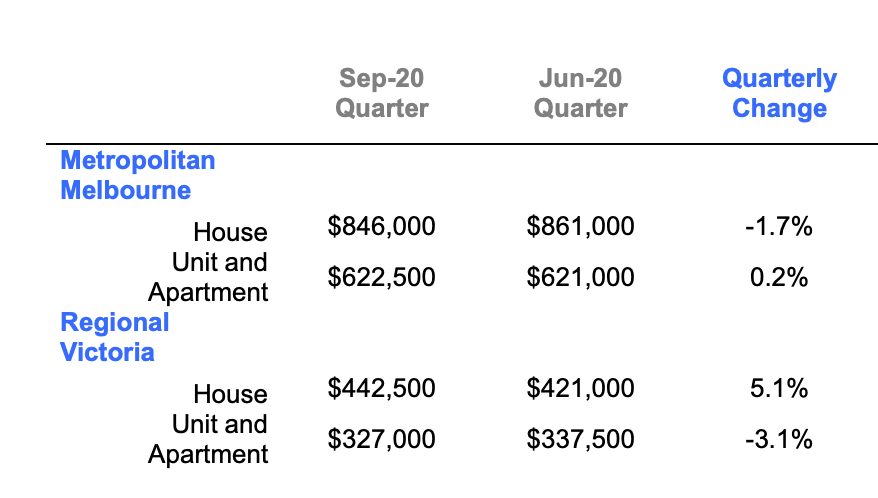

The REIV's September quarter statistics suggest only metropolitan houses and regional units contracted over the quarter.

"Despite six months of COVID-19, lockdowns and moratoriums, the Victorian Property Market continues to prosper with properties remaining more valuable than they were in 2019” Ms Calnan said.

“Our members have faced so many challenges in 2020, their work and efforts are evidenced in the September Quarter results.”

“REIV market statistics are based on results directly sourced from agents and government records and provide a true picture of Victorian real estate”

Apartments in Melbourne rose 0.2 per cent over the September quarter, to a $622,500 median, up 5.4 per cent over the last 12 months.

Melbourne house values declined -1.7 per cent, down to a median $846,000, but are still 7.4 per cent up over the last 12 months.

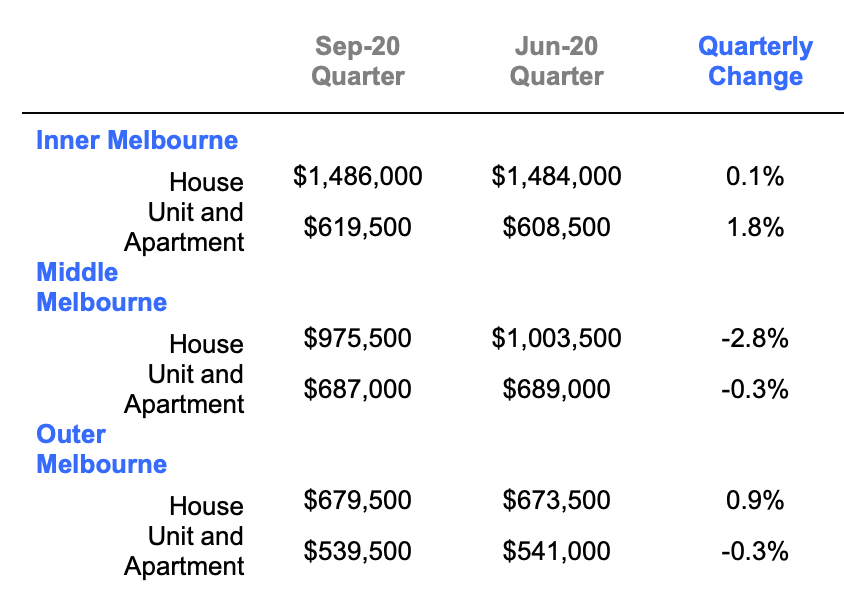

It's been Melbourne's middle ring which have suffered the greatest losses, down -2.8 per cent on the quarter to take its median below then $1 million mark.

House values in inner Melbourne and outer Melbourne rose over the September quarter, but units went backwards in outer Melbourne (-0.3 per cent), compared to a big jump in inner Melbourne (+1.8 per cent).

Houses in regional Victoria were the best performing market, recording 5.1 per cent growth for the quarter, taking houses to a $442,500 median.

Regional units fell -3.1 per cent over the quarter, to a $327,000 median, but are eight per cent up over the last 12 months.

Transactions in Melbourne plummeted by 31 per cent compared to the June quarter due to the tighter restrictions in place, however sales in regional Victoria soared by 15 per cent.