Insurance customer hubs open amid skyrocketing catastrophe-related claims, the Insurance Council of Australia (ICA)

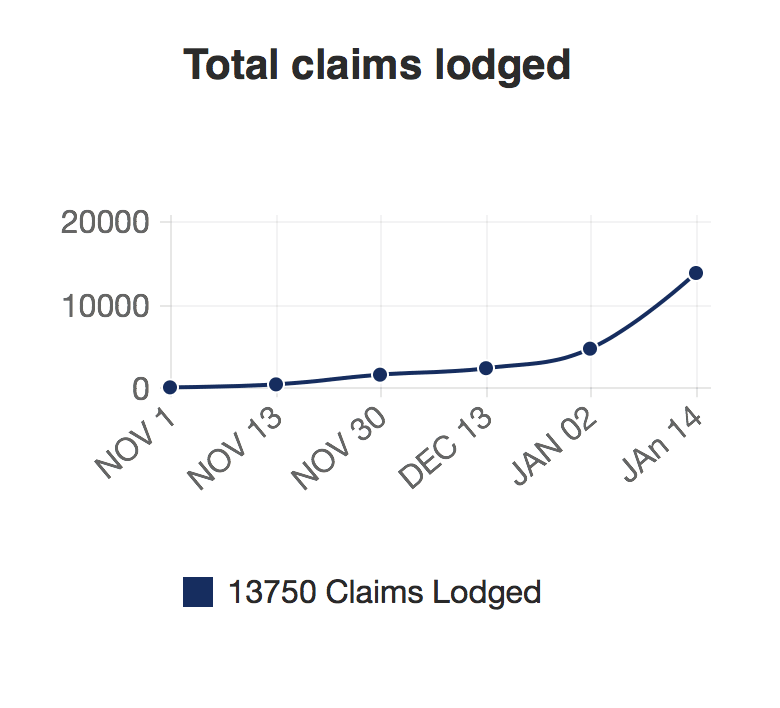

The Insurance Council of Australia (ICA) forecasts a sharp increase in catastrophe-related claims this week as household property assessments are undertaken and large commercial claims are lodged.

Source: Total claims lodged, ICA.

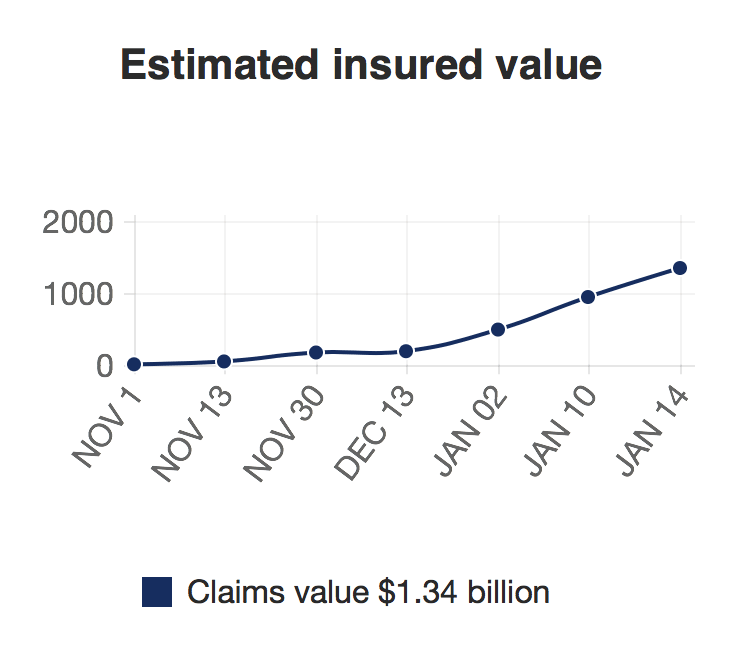

Insurers have received 13,750 bushfire catastrophe-related claims since November 8, 2019 with an estimated loss of $1.34 billion.

Source: Estimated Insured Value, ICA.

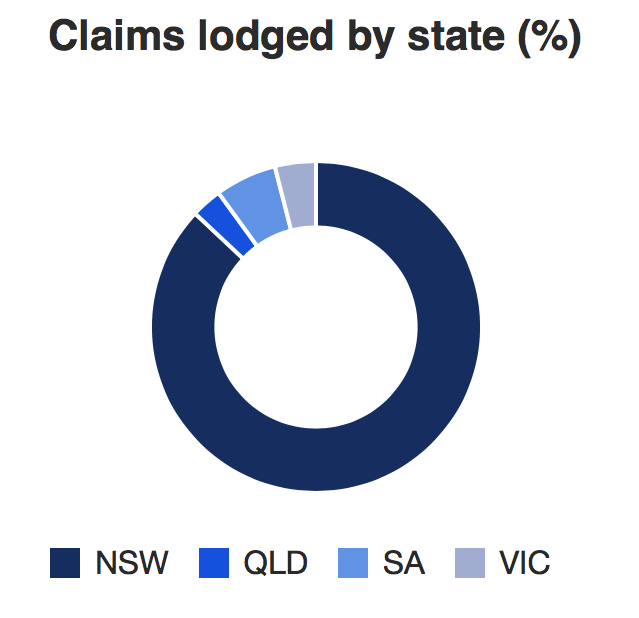

New South Wales has by far recorded the most claims since November making up 87 per cent of all catastrophe-related claims. Meanwhile, South Australia records 6 per cent, Victoria records 4 per cent and Queensland records 3 per cent.

Source: Claims Lodged by State, ICA.

The ICA calls for all hands on deck as it launches a local trades register to aid bushfire recovery. ICA Head of Risk and Operations, Karl Sullivan encourages traders and builders to register and urged residents to heed last week's warning from the Australian Securities and Investments Commission to be aware of unscrupulous tradespeople and repairers, or firms offering to assist them with insurance claims.

The Consumer Action Law Centre has also called for a crackdown on exploitative claims management services.

The ICA is hosting insurance hubs to assist customers in southern New South Wales. Disaster recovery specialists from the Insurance Council and insurance companies will assist policyholders with insurance questions and help with the insurance claim process.

Venues are subject to change depending on capacity and availability.Hubs will also be established in bushfire zones in South Australia and Victoria in the next week.

Main Photo: ICA