Why SMSFs invest in residential property and institutional superannuation funds do not: Paul Easton

The Australian residential property market is the largest domestic asset class, with an aggregate total value estimated at $4.2 trillion. The investor segment, where the occupants are renters with a private landlord, represents 23.7% of Australia’s 8,711,000 total occupied private dwellings. Investors equate with a market value of $985 billion. Owner occupiers retain the majority of ownership of residential property in Australia.

While the total size of residential asset class dwarfs the Australian share market (around $1.4 trillion), fixed interest market (around $1.2 trillion) and commercial property market (around $600 billion), there has been almost no investment in residential property from institutional superannuation. There has however been considerable interest in residential property from SMSFs.

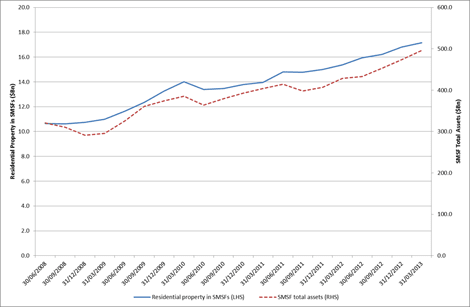

The steady growth in residential property assets and total assets within SMSFs over the past five years is shown in the chart below.

SMSFs - Residential property and total assets

Click to enlargeABS – Australian Social Trends – Housing, National Summary, 1998–2012

As shown in the chart above, SMSF investment in residential property has been growing in-line with total assets. At March 31 2013 the value of residential property assets in SMSFs was just over $17 billion, representing approximately 2% of the value of total residential property investment.

Trustees of SMSFs may be attracted to residential property for a number of reasons. There is the familiarity with the asset class for most Australians either through owning their home or investment property or both.

Property is a tangible asset that can be researched online and is accessible. Prospective investors can visit the site to gauge the desirability of the location, the likelihood of attracting good tenants and for the potential for increase in value over time. Residential property may be attractive for trustees of self-managed superannuation funds as it enables some level of participation in management of the asset that is absent from most other asset classes.

A key driver of SMSF investment into residential property is the ability to borrow, within quite strict rules, to purchase property within superannuation. Limited recourse borrowing arrangements allow trustees to purchase an asset of greater value than would be otherwise possible with an outright purchase using equity. There are costs involved in setting up a holding trust for the asset and trustees also need to consider a range of risks of investing in residential property such as tenancy risk and whether there would be appropriate diversification within the fund.

Institutional superannuation funds have not invested in residential property due to a number of factors. Residential property tends to have a significantly lower yield than commercial property which the larger funds have the scale to invest in while SMSFs do not. Commercial property also offers tenant diversification which individual residential property does not.

The lack of a geographically diversified portfolio of sufficient size to have a meaningful impact on the return characteristics of the fund as a whole has inhibited institutional investment. An efficient management structure for an asset class that requires intensive management would also be required for institutional superannuation funds to invest in Australian residential property.

Paul Easton is a senior analyst at Atchison Consultants