What slowdown? Demand for Australian property hits a new peak: Nerida Consibee

GUEST OBSERVER

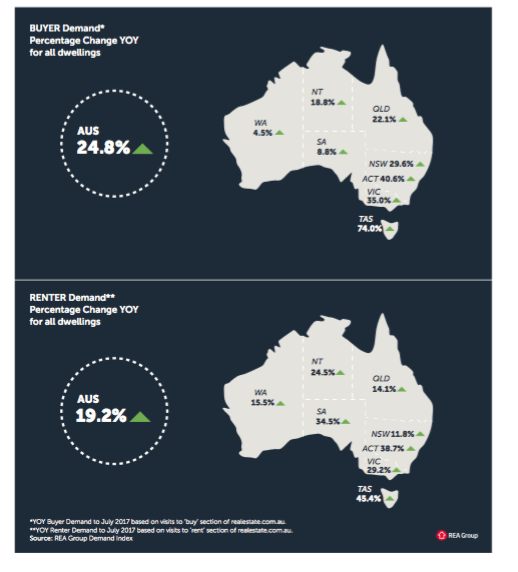

After a choppy few months, demand surged again in July with even the struggling WA market starting to hit its stride.

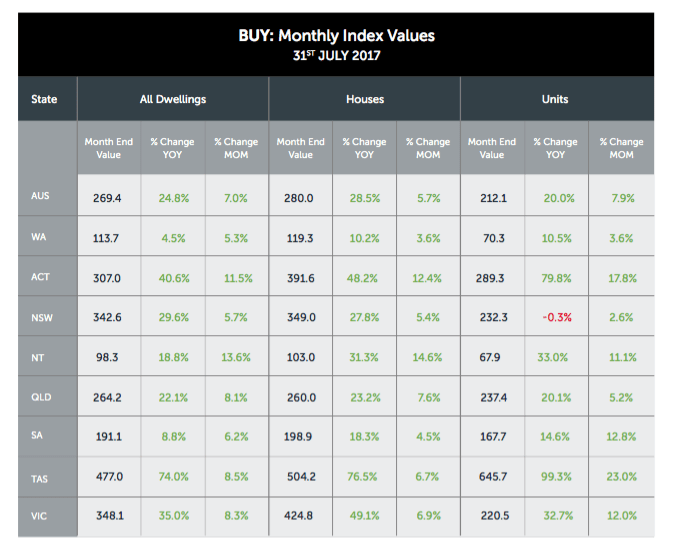

In July, the index hit another new peak, and only one section of the Australian market, NSW apartments, saw a slight drop in demand. Given that the state has been seeing decades of housing undersupply, this is surprising, but it has more to do with affordability concerns impacting demand levels, rather than people not wanting to buy.

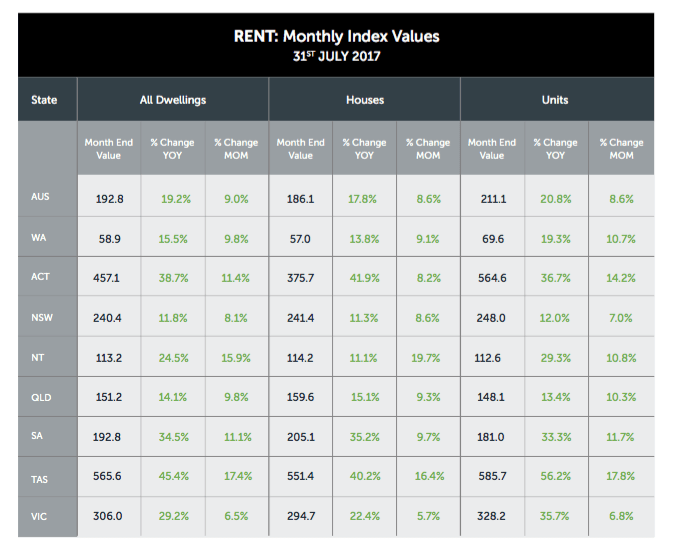

Tasmania remains the standout performer, seeing far more people looking to buy than the number of available properties. From both a buyer’s and renter’s perspective, demand is high, which may support new development in key areas. Hobart is the only capital city in Australia where we haven’t seen a building boom and demand levels suggest that now may be the time to start increasing housing supply. Given the size of the market, it may not need many projects to lead to a better balance.

The continued increases in demand would suggest that we will see more price growth, but it’s likely the continued lending rate rises will be the limiting factor. The RBA is clearly unlikely to increase rates in a hurry, but continued increased costs of wholesale funding, pressure from APRA and the new banking tax will mean that banks will pass these costs on to mortgage holders.

Foreign buyers are also starting to back off, and we’ve seen a slight drop in property seekers from overseas on realestate.com.au in recent months, likely driven by more taxes aimed at foreign buyers and greater challenges for them to access finance.

New South Wales

NSW remains one of the strongest markets in Australia, however demand levels have been overtaken by Victoria this month for the first time since 2013. It appears that apartment demand is to blame, which is surprising given that the level of development has been so much lower than Victoria for quite some time. The issue is affordability, with Sydney now so expensive that it is pricing out many prospective buyers. Whether these buyers are now looking elsewhere to buy as investors, or alternatively looking to move, is uncertain.

Victoria

Property demand in Victoria overtook NSW for the first time since 2013, driven by greater affordability and population growth. The Victorian market is also seeing very high demand from renters. This is partly driven by a slowdown in first home buyer activity, but jobs growth is likely to be a bigger factor. More jobs means more people and therefore greater demand for housing.

Despite massive levels of new apartment development, demand from buyers and renters for this property type remains strong. Melburnians have been largely resistant to living in apartments, but it appears the time has come for a shift. Lots of supply in the market is driving up affordability and, in many cases, apartments offer a great lifestyle when compared to a similarly priced house on the urban fringe.

Queensland

Queensland’s property market closely follows the Australian average. Not as strong as NSW and Victoria, but certainly far stronger than WA and NT. Houses and apartments continue to see strong demand which is surprising given recent concerns about oversupply in the state. There are no doubts that challenges continue in inner city Brisbane, with apartment stock aimed at investors being a problem area. This is slowing demand as buyers wait for better quality stock. In other parts of Queensland, demand remains high and the Gold Coast continues to be popular among both buyers and renters.

South Australia

South Australian demand levels hit a new peak in July and while growth is subdued and below the Australian average, it is steady. Although buyer demand growth remains fairly moderate, rental demand growth was much stronger. This is often an early sign of jobs growth, so it may be that the jobs market in South Australia s doing better than official figures suggest.

Tasmania

Is now the time for apartment developers to look more closely at the Apple Isle? Property seekers are certainly curious about apartments in the market, with apartment demand the highest of anywhere in Australia. Demand is high and there is not much to buy, which could be an opportunity for potential developers. Offshore interest also continues to grow in the market, focused mainly on Hobart.

Western Australia

Overall, Perth has been doing it tough with demand well down for some time now, but premium suburbs in the inner west and northern beaches are now seeing strong price growth, which can be considered an early sign of a wider turn. On a state level, demand appears to be rising and we have hit the highest level recorded since 2014. One could say that green shoots seem to be sprouting in WA’s property market, but buyers should remain cautious and be prepared to hold for at least two years.

Australian Capital Territory

Canberra continues to see very high levels of rental demand, making it one of the few markets in Australia where we need more investors. Buyer demand remains strong which suggests that the region’s price growth will continue. Like the rest of Australia however, rising costs of funding will likely drive a slowdown in the fast-paced growth that has been occurring of late.

Northern Territory

The Northern Territory has been showing steady growth in buyer demand for some time now and last month it continued. Although the market was hit hard by the mining slowdown, it appears that other industries have picked up the slack and are leading to increased demand from both buyers and renters. While a recovery seems to be occurring, some areas are doing better than others, with premium suburbs in Darwin in particular seeing stronger levels of growth.

Nerida Consibee is the Chief Economist at REA Group and can be contacted here.