Underquoting or industry ignorance - it can only be one or the other: Edwin Almeida

It’s no secret that the topic of underquoting gets under my skin and it should get under yours as well - many property buyers have fallen victim to this trap.

But let's set aside the practice of underquoting for a short moment and discuss other sleight of hand illusions of achieving high prices at auctions.

There are three schools of thought when it comes to achieving above the reserve for properties sold by auction.

Firstly, there is the thought that market forces are at work and have an uncontrollable bearing on the day of the auctions. Secondly, there is the marketing and methods of underquoting. Finally, last but by no means least, is the sheer ignorance by the industry experts when it comes to understanding property values. These points can be summarised as follows:

- Market forces

- Underquoting

- Industry ignorance

Number 1: Market Forces

A competent agent can and will gauge these external forces. This is one of the main reasons why vendors hire the “professional real estate agent” in the first place, isn’t it? The vendor wants to make sure they get the most value for their property. After all, we are on the field; we eat and breathe real estate for a living.

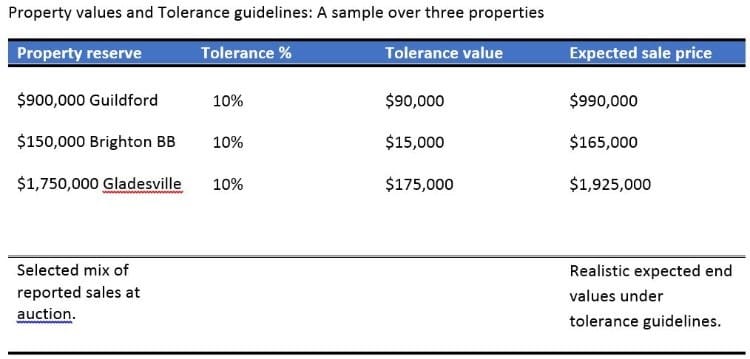

When Jonathan Chancellor wrote, to expect to pay 11% above what was being quoted as a price guide, we could say market forces were at play. Beyond the 10% tolerance prescribed by Fair Trade NSW or the Victorian Estate Agents Act however, it all becomes questionable. An example of how the 10% tolerance works, is shown below.

Number 2: Underquoting

Without going into too much detail, please read my last article which references underquoting and focused on the cost to the real estate industry (REI), real estate agents (REAs) and most importantly, the unnecessary cost to the public.

I have been vocal about the Valentines Day $1 Auction from the very first day. Now, another novel auction graces the media, the Brighton Bathing Box sale with a price-guide of $150,000. That’s all it’s worth you say? Truth be told, late last year one sold at $215,000. A price-guide of 30% lower? Is this a deliberate ploy to draw a crowd and to entice buyers? Where are the Victorian regulators on this?

It’s now sold, as you may know, for $276,000 - 84% above price guide.

Now, you may not be “personally offended” by campaigns with notions of underquoting, as in the case of the CEO of the REINSW. You, may also blame the “greed of the market” and the vendor as in the case of the President of the REINSW Malcolm Gunning.

It is however, simply illegal to underquote and no REA that values their licence and reputation should be encouraged nor coerced into this illegal practice. More to the point, even if the vendors tell the REAs to break the law, must we?

Most of the industry would like the public to believe we have no choice, when deciding whether to break the law or not. The REI bodies seem fit to shift the blame away from the agents or the industry and instead want to blame the public and vendors.

Blaming the vendor seems to be the common thread among the RE Institutes around Australia; see article posted below. Blaming the vendor however, will not rid the industry of the practice of underquoting. It just seems to be a case of blame shifting – blame the vendor and greedy market, at will.

Source: Australian Financial Review, 9 October, 2012

Education, be it Gunning’s instinctive solution, is not the immediate short-term answer either. I would like to put forward a message to our valiant leaders in the Institutes: this practice of underquoting is well entrenched in the ranks of the Institute's membership.

It isn’t the vendors, nor the newly licensed REAs that came up with the novel idea of “price it low and watch it go”. Underquoting, is an entrenched culture in the industry and has been for decades.

If it’s a short, sharp and quick solution that the Institute’s are looking for to bring credibility to our industry, here are some novel ideas:

- Rid the root of the problem from the REINSW and REIV membership. Surprisingly or perhaps not, some may have even obtained their licences from the same Institutes.

- Name and shame RE Institute members that do get caught out.

- Ask the governing body, Fair Trade NSW to suspend licences and to do so immediately. Lets not protect the REI members that are creating the issues just because they appeared on national TV. Take a bold stand and clean our house before we try and sweep the streets.

You want partial self-regulation? This is a great start to show both, the public and NSW Fair Trade that we mean business.

"REINSW is advocating that we partner with the NSW Fair Trading to share responsibility for regulating the real estate profession," said Gunning.

Number 3: Industry Ignorance

Other than market forces, can we excuse most out of line sales and blame it on “ignorance”? Ignorance may be used as an excuse, but it is not a defence when there are legal ramifications.

Within the current property climate, it appears agents hide behind “market forces” to cover up for their ignorance of the council’s changes to local land rezoning proposals, for the out of line sales. Market forces and no comparable sales is also used as an excuse when not being able to properly determine land and home values. Or is this just another tact to draw the crowd, be it a mix of sophisticated and novice buyers.

On the other hand, when it comes to boasting about achieving high sales figures and well above reserves, they are the first in line to publicly report their achievements.

What I would surmise is that most agents don’t fathom the possible monitory loss they can cause their vendors, if the property is sold at the price-guide given or even the reserve price on the day.

In the case of a Gladesville property sale, an agent boasted about the $1,100,000 over reserve that was achieved. Further West of Sydney’s CBD, in Guildford, we had another “stellar campaign” boasting a 25% above reserve accomplishment.

It’s clear; the REAs simply and frankly, did not know the true value of the land. I am surprised the vendors allowed them to go near the property and take such a risk. Or is there really more to the story?

Perhaps, Gunning president has greater insight that explains this phenomenon? He claims vendors have more to do with this issue than not as timid and innocent agents are “lured by unrealistic expectations… and the greedy market” to underquote.

One thing is for sure, agents can run around beating their chest, declaring what stellar campaigns were run as 20%-30% sales above reserve were achieved (which can only mean the agents didn't know the values of the property in the first place). Or, the alternative is the property was deliberately underquoted in the first instance.

It has to be one or the other my friends.

Nonetheless, blaming the vendor, whether or not it comes from high up the ranks of the REINSW or the REIV, is not going to cut the mustard in the court rooms. The "greedy market lured me" and "the vendor made me do it" just won’t fly.

Ignorance versus underquoting

Ignorance from agents, of what is going on in the proposed changes to the local council environment plans will cost vendors dearly. But why don’t we hear many vendors raise their voices and complain? Simply because these sales being published and boasted about, netted the vendor a sale above so-called expectations. Vendors truly believe the agents did a wonderful job.

Now, take a moment and think about the “what if” scenario. What if, the Gladesville and Guildford sales only achieved a figure to equal what the agents set as a price guide or the reserve?

For this very reason, I am of the opinion that agents need to go back to basics if they are going to play with the future of their vendor's assets and take risks by not knowing the true value of the property. Better yet, they should consider going back to selling used cars if this is how they intend to perform in this industry.

Its a risk that may have even cost the State of NSW dearly, as noted in the first sale of the Millers Point property sales.

Not researching changes to local council planning, and not keeping up to date with property development rezoning is unprofessional, ignorant, and sheer laziness. Why exactly are you paying the agent a fee of 2.5% average? Do the math.

Therefore, either the agents are ignorant and one has to wonder why they have a licence in the first instance, or they are blatantly underquoting to draw a crowd – even if the crowd is purely made up of “sophisticated buyers”. There is no two ways about this fact.

We cannot excuse and blame market forces any longer for flirting with the law and peoples well-being. Vendors entrust our industry to uphold the regulations and guide them to the best possible outcome. An outcome that should be far removed from any notion that the REA broke the law, or was lured into breaking the law to achieve the best possible result.

Most off all, REAs cannot blame 'market forces' or 'no comparable sales' for being ignorant and gambling with the real possibility that they will undersell a property, for the person that placed full confidence in their professional expertise.

Next time you see headlines of great achievement in a sale by auction, ask yourself the question: underquoting or ignorance?

Here are the real figures achieved in the stellar campaigns run by the agents:

Property | Reserve | Sale price | $ above reserve | % Difference |

Brighton | $150,000 | $276,000 | $136,000 | 84% |

Guildford | $900,000 | $1,130,000 | $230,000 | 26% |

$$1,750,000 | $2,850,000 | $1,100,000 | 63% |

A few things that I would like to clarify, and that is; I am not forming a campaign against auctioneers. Nor am I opposing the sale of land/property by means of auction. I am also in favor of high industry standards and ongoing education.

I’m against the misrepresentation and the deceptive conduct allowed to become a free for all.

Underquoting is an entrenched practice that both bodies – the REI and the RE Institutes – seem to quickly dismiss and in turn blame the vendor.

Isn’t it about time we took full responsibility and acted like the professionals the public trust us to be? Now is the time to make the difference and stop blame-shifting, even if our REI leaders have apparently found it so easy to do.

EDWIN ALMEIDA is licensee in charge of Just Think Real Estate.

He is also the creator of Oz Real Estate.TV and a presenter for propertyinvestingvault.com.