The constrained medium term investment return outlook: AMP's Shane Oliver

For investors the key is to: have realistic return expectations; allow that inflation is also low so real returns aren’t down as much; focus on asset allocation; and focus on assets with decent & sustainable income.

But since the early 1980s the starting point in terms of investment yields has been moving progressively lower, resulting in slowing 10 year average nominal and real returns for superannuation funds as seen the chart above. Today the RBA cash rate is just 1.5 percent, 3 year bank term deposit rates are just 2.6-3 percent, 10 year bond yields are just 1.9 percent, gross residential property yields are around 3 percent and while dividend yields are still around 6 percent for Australian shares (with franking credits) they are around 2.5 percent for global shares. This note looks at the medium term return potential from major assets and the implications for investors.

Potential return drivers

In getting a handle on potential medium term returns from an asset class the key is its starting point valuation. For example, if current yields – say bond yields and dividend yields – are lower than “normal” then this will likely constrain returns relative to the past. Investment returns have two components; capital growth, and yield (or income). The yield is the most secure component and generally speaking, when you start your investment the higher it is the better. So our approach to assessing medium term return potential is to start with current yields for each asset class and apply simple and consistent assumptions regarding capital growth. We prefer to avoid a reliance on forecasting and to keep the analysis as simple as possible. Complicated adjustments just lead to compounding forecasting errors.

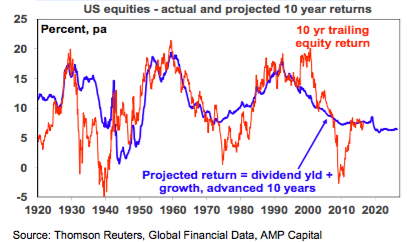

For equities, a simple model of current dividend yields plus trend nominal GDP growth (as a proxy for earnings and capital growth) does a good job of predicting medium term returns. This approach allows for current valuations (via the yield) but avoids getting too complicated.1 The next chart shows this approach applied to US equities, where it can be seen to broadly track big secular swings in returns.

For property, we use current rental yields and likely trend inflation as a proxy for rental and capital growth.

For unlisted infrastructure, we use current average yields and capital growth just ahead of inflation.

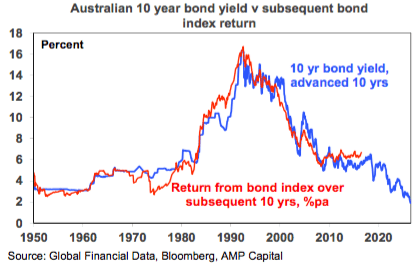

For bonds, the best predictor of future medium term returns is the current bond yield. If a 10 year bond is held to maturity its initial yield will be its return over 10 years. The close relationship between 10 year bond yields and subsequent returns from bonds is clear in the next chart.

Projections for medium term returns

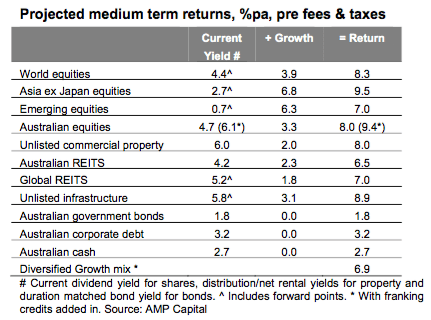

Return projections using this approach are shown in the next table. The second column shows each asset’s current income yield, the third shows their 5-10 year growth potential, and the final column their total return potential. Note that:

We assume central banks average around or just below their inflation targets, e.g. 2.5 percent in Australia & 2 percent in the US.

For Australia we have adopted a relatively conservative growth assumption below nominal GDP growth potential reflecting the headwind from weak commodity prices & the impact of this on resource sector profits & sales growth.

We allow for forward points in the return projections for global assets based around current market pricing – which adds 1.8 percent to the return from world equities.

The Australian cash rate is assumed to average 2.75 percent over the medium term. Cash is one asset where the current yield is of no value in assessing the asset’s medium term return potential because the maturity is so short. So we assume a medium term average. Normally for cash this would be around a country’s potential nominal growth rate, but we have adjusted for higher than normal bank lending rates relative to the cash rate and higher household debt to income ratios which have pulled down the neutral cash rate.

Combining the return projections for each asset indicates that the implied return for a diversified growth mix of assets has now fallen to 6.9 percent pa and is shown in the final row.

Megatrends influencing the growth outlook

Several themes are allowed for in our projections: slower growth in household debt; the backlash against economic rationalist policies of globalisation, deregulation and small government; rising geopolitical tensions; aging and slowing populations; low commodity prices; technological innovation & automation; the Asian ascendancy & China’s growing middle class; rising environmental awareness; & the energy revolution. Most of these are constraining nominal growth and hence investor returns. However, technological innovation is positive for profits and some of these point to inflation bottoming. (See “Megatrends ”, Oliver’s Insights, July 2016.

Key things to note

Several things are worth noting from these projections.

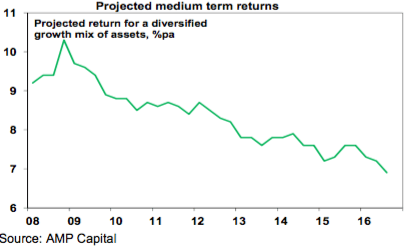

The medium term return potential using this approach continues to soften largely reflecting the rally in most assets of the last few years which has pushed investment yields lower. Projected returns using this approach for a diversified growth mix of assets has fallen from 10.3% pa at the low point of the GFC in March 2009 to 6.9% now.

The starting point for returns today is far less favourable than when the last secular bull market in shares and bonds started in 1982, due to much lower yields.

Government bonds offer low return potential thanks to ultra low bond yields.

Unlisted commercial property and infrastructure continue to come out well, reflecting their relatively high yields.

Australian shares stack up well on the basis of yield, but it’s still hard to beat Asian shares for growth potential.

The downside risks to our medium term return projections are referred to endlessly by financial commentators: namely that the world is plunged into another recession or that investment yields are pushed up to more normal levels causing large capital losses. The upside risks are (always) less obvious but could occur if global growth improves but inflation remains low which could see a continuing search for yield further pushing up capital values.

Implications for investors

There are several implications for investors:

First, have reasonable return expectations. The combinatinofof low investment yields & constrained GDP growth indicate it’s not reasonable to expect sustained double digit returns. In fact, the decline in the rolling 10 year moving average of superannuation fund returns (first chart) indicates we have been in a lower return world for many years.

Second, allow that this partly reflects very low inflation. Real returns haven’t fallen as much and are still reasonable.

Third, using a dynamic approach to asset allocation makes sense as a way to enhance returns when the return potential from investment markets is constrained. This is likely to be enhanced by continued bouts of volatility.

Finally, focus on assets providing decent sustainable income as they provide confidence regarding future returns, eg; commercial property and infrastructure.

SHANE OLIVER is head of investment strategy and economics and chief economist at AMP Capital and is responsible for AMP Capital's diversified investment funds.