Why aren’t dwelling values increasing like the last growth cycle?: Tim Lawless

As the housing market recovery continues in a fairly sedate manner, I thought it would be interesting to compare some of the key housing market metrics that we follow to observe the differences in the current market recovery compared with market conditions back in 2009/10 which was the previous recovery/growth phase post-GFC.

The analysis provides some explanation about why the rate of capital appreciation is so much lower over the current cycle compared with the previous growth cycle.

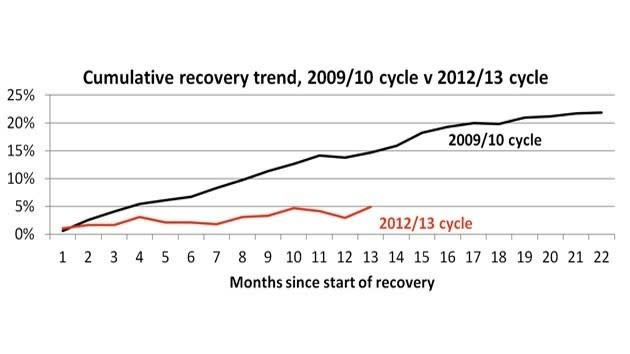

The series of graphs below trace each indicator from the commencement of the cycle in 2009/10.

The series commences from January 2009 (the first month where dwelling values started rising post-GFC according to the RP Data Rismark Home Value Index) through to October 2010 which was when the housing market broadly peaked.

The 20012/13 cycle commences from June 2012 which was the first month of value growth in the most recent cycle and goes through to the most recent data which is available for each indicator.

From the graphs below which track dwelling values based on the capital city RP Data – Rismark Index, it is clear there is a substantial difference in the performance of the housing market between these two periods.

Capital city dwelling values increased by 14% over the first thirteen months of the 2009/10 cycle compared with a 3.8% lift in dwelling values over the same period in the current cycle.

The lower rate of capital gains over the most recent thirteen month period comes at a time when vendors are still discounting their asking prices to a greater extent.

Over the past 12 months the level of vendor discounting has averaged 6.7% compared with a 6.2% rate of discounting over the same period of the previous growth cycle.

A year into the growth cycle during 2009, the average rate of vendor discounting was recorded at 5.5% compared with the current rate of 5.8%.

Clearly vendors are discounting their price expectations to a greater extent currently than they were at the same time in the previous cycle.

Looking at the trend in vendor expectation, which has recently been improving quite rapidly and we may see discounting conditions move in line with where they were over the previous phase over the next few months.

The average selling time over the current growth period has moved virtually in line with the previous growth phase apart from the seasonal hump which shows up in the most recent phase’s data (average selling time tends to blow out in January and February).

Twelve month’s into the current growth cycle we are seeing the typical capital city home sell in 43 days compared with 42 days at the same state in the 2009/10 recovery.

Clearance rates are also broadly in line with the previous growth phase indicators at the same time. Currently over the past few weeks the weighted average clearance rate has been recorded around the 67% mark while clearance rates were averaging closer to 70% at the same time over the previous phase.

There are going to be some seasonal difference in the comparison points here.

However, the rate of auction clearance suggests that buyer and seller expectations are converging similar to what occurred during the 2009/10 growth period.

Now for some of the big differences in housing market conditions.

Firstly, looking at the average loan size we can see that there hasn’t been anywhere near the same level of uplift in the value of home loans being committed to which helps to confirms the lower rate of dwelling value growth.

One point to make though is that the average loan size didn’t really start to escalate swiftly until the eight months into the previous growth phase (see second graph below, ‘Average loan size (indexed). We haven’t seen anything like that in the current phase to date.

The number of first home buyers in the market currently is also radically different, as is the level of market stimulus for first home buyers. Back in the early phases of the 2009/10 growth phase first time buyers were taking advantage of the First Home Buyers Grant Boost as well as stamp duty concessions and low interest rates.

Over the first eleven months of the current growth phase, according to ABS housing finance data, there were just under 83,500 first home buyer housing finance commitments.

Over the same period of the 2009/10 growth phase there were nearly 176,000 first home buyer commitments. That’s a big difference.

Arguably, first home buyers tend to push prices higher, not just because of the grants that were/are available, but also because their behaviour can be more emotional than other segments of the market.

First home buyers currently represent just 14.3% of the overall market compared with 24.8% at the same stage of the 2009/10 recovery phase.

Investors, on the other hand, are currently showing a larger presence in the housing market compared with the same stage of the cycle during the previous growth phase.

The value of investor loans is currently higher than what was recorded at the same stage of the market back in 2009/10.

Counter to first home buyer behaviour, investors tend to be more clinical in their purchasing and less emotional which is potentially another reason for the restrained level of value appreciation in the current cycle.

There is also the factor of fewer active buyers. Looking at the number of house and unit sales in the market, although there has been a decent uplift in numbers over the past year or so, there were substantially more home sales taking place at the same stage of the previous growth phase.

That additional level of buyer demand was also likely to be one of the factors that was pushing values higher at a faster rate compared with the current cycle.

Overall, many of the indicators are quite similar in the current market conditions when compared with the market at the same stage of the previous growth cycle.

The most significant difference is the more subdued rate of growth which can probably be attributed to lower overall demand, fewer first home buyers, more investors and less appetite for debt.

There are plenty of other factors I haven’t touched on there.

The federal election is probably having a dampening effect on demand and of course consumer confidence is shakier than it was in 2009 due to the current economic uncertainty, not to mention that consumer behaviour has seen a sustained change with household savings ratio averaging 9.8% for the past five years and private sector housing credit growth at near record low levels.

Tim Lawless is national research director of RP Data. This aricle orininally appeared on propertyupdate.com.au.