What is stopping residential property sales: Michael Matusik

Can’t let the day pass without saying happy 4th of July to my American friends – goodonya guys, watch the hotdog intake!

Matusik Pulse polls have been a regular feature of our missives for some time now, and it seems that you – our faithful followers – really enjoy putting in your two-bob’s worth and finding out what others have to say.

Results and a new poll appear each Saturday on Matusik Missive, but not everyone gets the time to explore them; so for those who may have missed our weekend reads, here’s a replay of our last five polls:

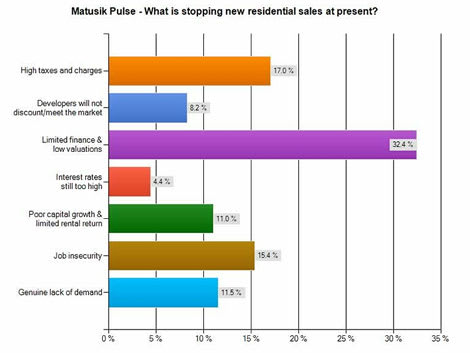

Click to enlargeHighlights:

Here’s what you said, in order –

- Limited finance/low valuations

- High taxes and charges

- Job insecurity

- Lack of demand

- Poor capital growth/limited rental return

- Developers will not discount/meet the market

- Interest rates too high

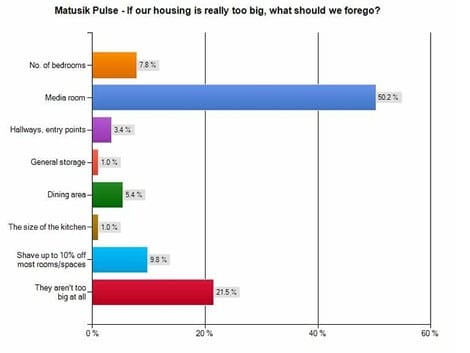

Click to enlarge

Highlights:

The majority would get rid of the media room. Very few would be willing to reduce storage space, hallways and entry points or size of the kitchen. One in five do not think our houses are too big.

Revisit this post for some interesting replies to house sizes.

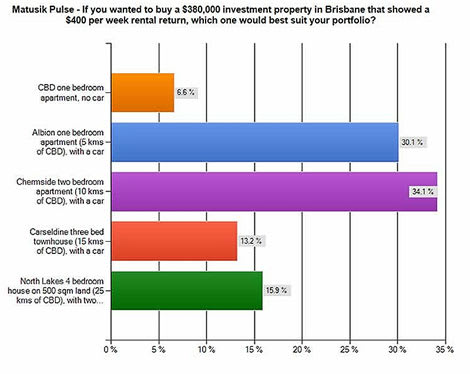

Highlights:

Here’s how you responded, in order -

- 2 bed apartment Chermside (10 kms of CBD)

- 1 bed apartment Albion (5 kms of CBD)

- 4 bed house Northlakes (25kms of CBD)

- 3 bed townhouse Carseldine (15 kms of CBD)

- 1 bed CBD apartment

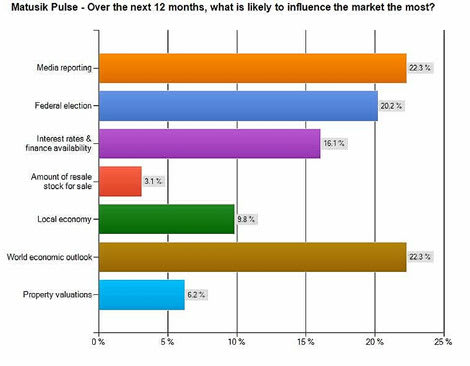

Highlights:

You responded, in order -

- Media

- Federal election

- World economic outlook

- Interest rates/finance availability

- Local economy

- Property valuations

- Amount of resale stock for sale

The tangibles – our local economy, property valuations, stock on the market, and even interest rates and availability of finance – are perceived to have little influence on the market.

Yet the media and the seemingly interminable wait for a federal election do. That says a lot about the influence of negative reporting in my book. Confidence is what is needed. Click here to read my full comment on this poll.Highlights:

You responded in order -

- Land supply

- Smaller product & land size

- Faster approvals

- Lower interest rates

- Smarter building practices/materials

- Government grants

Michael Matusik is the founder of Matusik Property Insights, which has helped over 550 new residential projects come to fruition. Readers can follow Michael's blog or follow him on Twitter – five tweets a day, some of which are on the property market.