WA best placed for housing market recovery, Victoria the worst: First National survey

Western Australia is the only housing market where optimists outweigh pessimists, according to a survey of members of the First National Real Estate network.

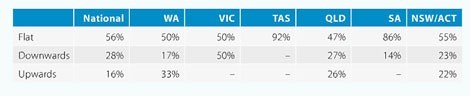

A third of the more than 400 First National estate agents expect WA house prices to rise over the next six months, compared with 17% who expect them to fall.

Half expect WA prices to be flat over the next six months.

Queensland has the next highest number of optimists – 26% of agents – but they are just shaded by pessimists (27%), with 47% expecting no change in prices.

Just under a quarter (22%) of agents are optimistic that prices will rise in NSW/ACT, compared with 23% of agents who are pessimistic. The majority (55%) expect no price change.

Tellingly, no agents expect house prices to rise in Victoria, Tasmania and South Australia.

Nationally, pessimists (16%) outweigh the optimists (28%), with the majority expecting house prices to remain flat.

House price expectations

Click to enlargeThe picture is similar for units, although a small percentage of agents (6%) expect Melbourne unit prices to rise.

The outlook is strongest for Perth (33% of agents optimistic), followed by NSW/ACT (20%) and Queensland (16%).

Unit price expectations

Click to enlargeCommenting on the findings of the survey, Ray Ellis, chief executive of First National Real Estate, says there is an “overall sense of optimism among our members that the current prime buying conditions will stimulate activity in the property market in the coming six months”.

“There are many positive signs already that the market has turned a corner in some areas, however, any recovery will be slow and gradual.”

According to Ellis, NSW prices fell during the GFC, but are now in an ideal position to bounce back quite quickly.

“However, interest rates, buyer confidence levels, the global economy and lower levels of new listings will be the key influencing factors for the state over the next six months.

An improvement is also expected in Queensland, with this market driven by interest rates, confidence, the wider economy and job security.

“As will the Western Australia property market, which will also benefit from the onset of planned infrastructure projects and better buying conditions,” says Ellis.

“In South Australia, the market should begin to rise, after steadying in the first half of the year and sales activity is already strengthening.

“Tasmania and Victoria are the states where recovery could take a little longer. Tasmania's market is still suffering with low levels of confidence in the state's economy. Rising unemployment levels is leading to a higher number of properties coming onto the market,” says Ellis.

“Victoria's property market held up quite well during the GFC, so it has to experience some decline as the market plays catch up with the rest of the country, although some parts of Victoria are already stabilising and are primed to turn at any moment.”

According to the survey, the strongest growth will come from the upgrader and investor sectors, for all states except Western Australia, where first-home buyers are expected to be in the best position to capitalise on bargain properties.

However, Ellis says weak consumer sentiment and nervousness around job security may keep the housing market soft and any recovery slow and gradual.

“Healthy supply rates run at about 200,000 homes for sale at any given time and Australia currently has 301,414 homes for sale,” Ellis says.

“Even a 1% or 2% drop in interest rates is unlikely to make an impact on their saleability unless it is combined with sharp market pricing and aggressive marketing.”