Units are driving dwelling approvals, but will they get built?

The Australian Bureau of Statistics (ABS) released building approvals data for August 2014 earlier this month.

At a headline level, dwelling approvals were 3.0% higher over the month and are now 14.5% year on year. With 16,810 approvals over the month there is clearly a strong level of residential development activity with monthly approvals just -5.0% lower than their recent peak.

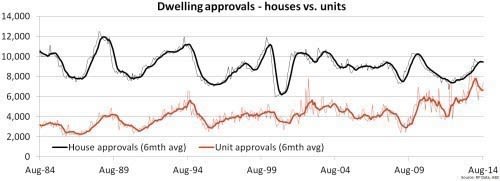

Of the 16,810 dwelling approvals in recorded over the month of August, 9,401 were for houses and the remaining 7,409 were mulit-unit dwellings (typically apartments).

Over the month, house approvals fell by -1.4% while unit approvals rose by 9.2%. Year-on-year, house approvals are 12.6% higher while unit approvals are up 17.1%.

As the chart above shows, the six month trend indicates a slowing of dwelling approval numbers and it also shows that monthly movements in unit approvals tend to be much more volatile. Also remember that a multi-unit development is more risky than developing a single house and ultimately less likely to ultimately be constructed.

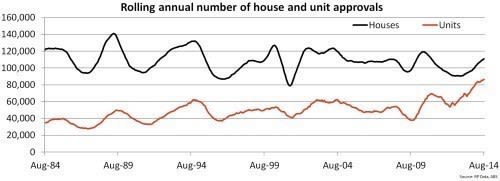

Focussing on dwelling approvals on an annual basis we have seen more house and unit approvals than ever before over the 12 months to August 2014. Over the 12 month period there were 197,571 dwelling approvals, of which 111,020 were for houses and 86,552 were units. The annual number of approvals has increased by 19.2% over the past year.

Although approvals have surged, as the chart shows it is largely due to a significant lift in unit approvals. Although the number of unit approvals over the past year was at a record high, house approvals are still -6.8% lower than their previous peak over the year to July 2010 and -21.2% lower than their all-time high of 140,832 over the year to April 1989.

Historically, units have been much less likely to move from approval to construction. Units also tend to be much more likely to be owned by investors than houses.

With the Reserve Bank flagging that deliberations are ongoing into the introduction of macroprudential policies to slow the level of investor activity in the housing market, there is potentially an even bigger than normal risk that these units won't make it to completion.

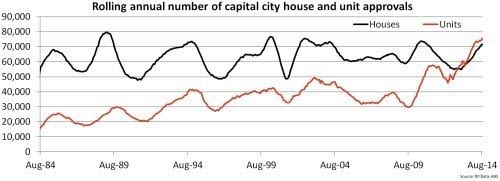

Across the combined capital cities, there was an all-time high of 147,122 dwellings approved for construction over the 12 months to August 2014. The number of capital city dwelling approvals has increased by 21.9% over the past year.

Over the year there were, 71,662 approvals for houses and 75,460 unit approvals with house approvals up 20.6% and unit approvals 23.2% higher.

Much like the national results you can see that unit approvals are at their higher levels while house approvals are only just approaching their previous peak levels.

This article continues on the next page. Please click below.

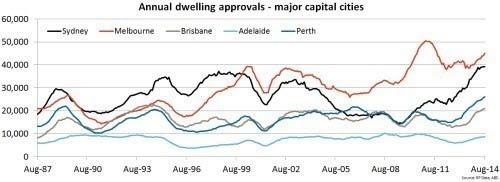

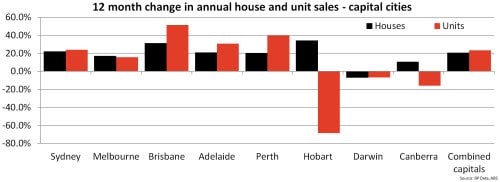

Across the individual capital cities, Brisbane has recorded the greatest increase in dwelling approvals over the year (41.8%) followed by: Perth (24.9%), Adelaide (24.0%) and Sydney (23.3%). Dwelling approvals are lower over the year in Darwin (-6.8%) and Canberra (-6.4%) while Melbourne (16.3%) and Hobart (19.4%) have recorded only moderate rises in dwelling approvals.

Despite certain cities recording significant rises in dwelling approvals, Sydney and Melbourne have accounted for more than 57% of all capital city dwelling approvals over the past year. With 26,123 dwelling approvals over the past year, approvals in Perth are at a record high while Brisbane approvals are just shy of their record high.

A key driver of the overall increase in dwelling approvals has been the rising prominence of the unit market. Over the past year, the increase in unit approvals has been greater than the increase in house approvals in Sydney, Brisbane, Adelaide and Perth. Although unit approvals have recorded greater increases in these cities, there has been a substantial decline in unit approvals across Hobart and falls in both Darwin and Canberra.

With more than half of all capital city dwelling approvals for units as opposed to houses, all individual capital cities except for Adelaide (31.8%), Perth (25.9%) and Hobart (7.0%) are seeing a majority of approvals for units. In Sydney, 67.7% of dwelling approvals were for units over the past year, elsewhere 53.0% were for units in Melbourne, 55.9% in Brisbane, 63.2% in Darwin and 57.9% in Canberra.

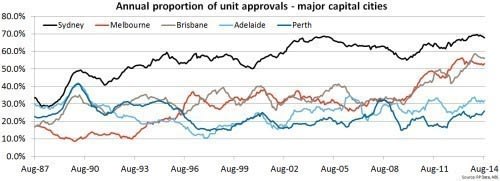

Sydney has consistently approved more units than houses since 1993 and Darwin has consistently approved more units than houses since 2003, while across the other cities it is a relatively new phenomenon.

Melbourne has only been approving more units than houses since mid-2012, in Brisbane it has occurred since mid-2013 and in Canberra since mid-2010. Of course, there is an increasing level of demand for units, but particularly in Melbourne and Brisbane the number of units in the pipeline is largely untested in the market.

Furthermore, units tend to be more appealing to the investor market rather than owner occupiers. While demand may currently be strong it remains to be seen whether there is enough investor demand to satisfy all of the supply in the pipeline.

Dwelling approvals remain at a very high level and with the rate of population growth slowing it is encouraging to see that supply is finally responding. With their lower price point compared to houses and superior rental returns no doubt we are seeing a rising level of demand for units, particularly in inner city markets.

Of course, the Reserve Bank of Australia has raised concerns about the level of investment lending which is most prominent for inner city units.

If controls are introduced to slow the level of investment there may be an adverse impact on demand and subsequently values of inner city units, particularly new inner city units which are a strong target from the investment segment of the market.