Unders and overs: APM's askew market price estimates upsetting Domain agents' listings aplenty

Market price estimates that now appear on Domain property listings are causing havoc among listing agents.

Vendors are threatening to withdraw their advertising unless the service to buyers is ceased. The market price estimates that are appearing on Domain within paid vendor offerings are often advising market price estimates that are at distinct odds with the selling agency/vendor expectations.

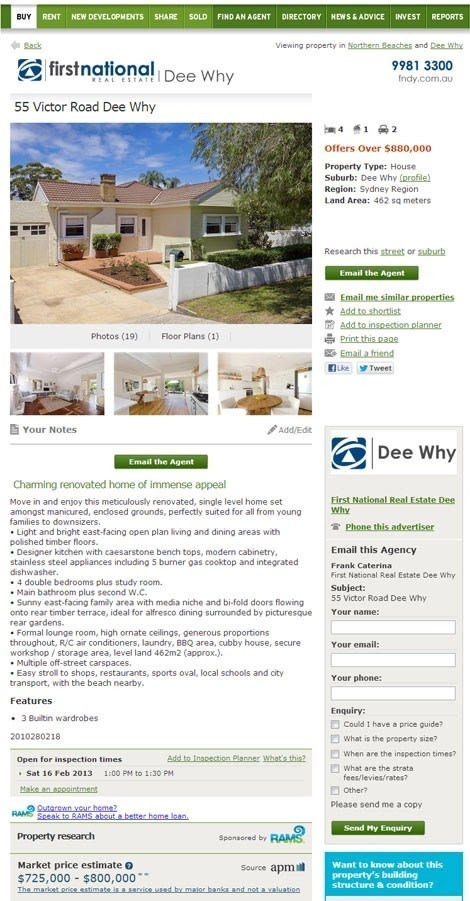

A Dee Why, Sydney, property (pictured below) listed with $880,000-plus hopes has been given a $725,000 to $800,000 market price estimate by the Domain website, sponsored by the RAMS "Borrow up to 97%" marketing campaign.

Click to enlargeIt's the market price estimate from Australian Property Monitors, the Fairfax own data company, that are being published on the Fairfax-owned Domain site across the country in a new initiative.

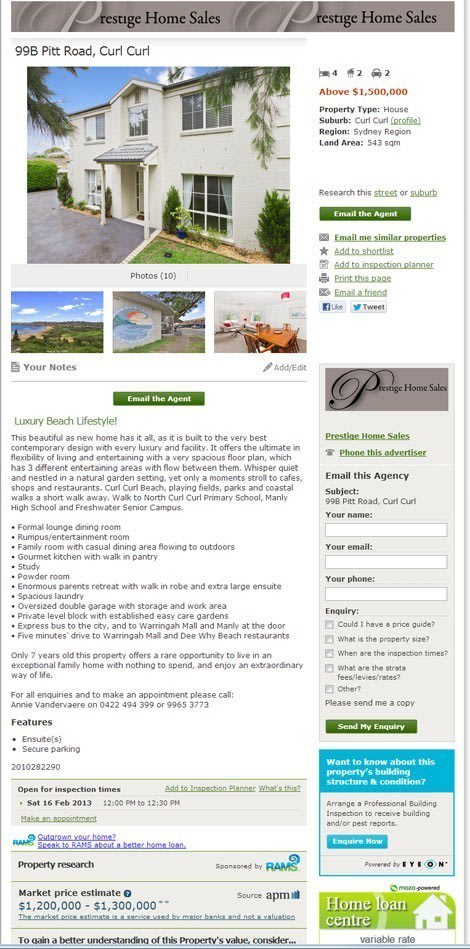

A Curl Curl, Sydney, property (pictured below) listed with $1.5 million-plus hopes has been given a $1.2 million to $1.3 million market price estimate.

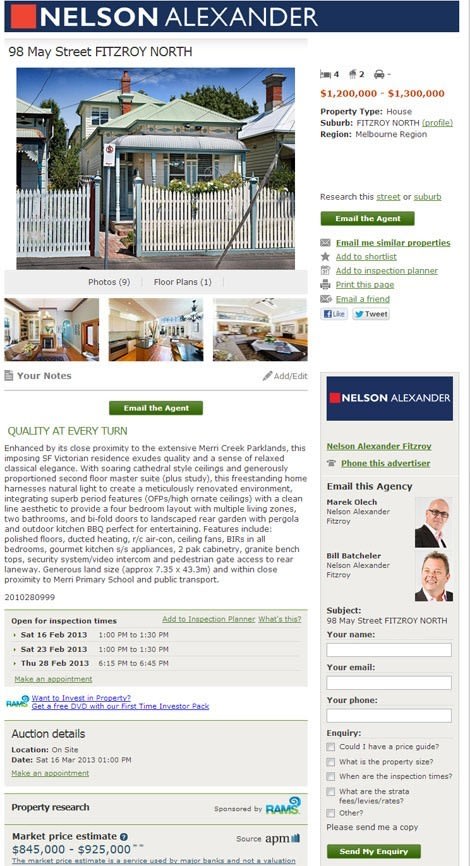

Click to enlargeThe biggest asking price to APM price estimate discrepancy found by Property Observer was in Fitzroy North in Melbourne.

The four-bedroom May Street cottage (pictured below) has been given a $1.2 million to $1.3 million price estimate in the lead up to its March 16 auction through Nelson Alexander. However, Domain's APM market price estimate for buyers is $845,000 to $925,000.

Click to enlarge

One agent told Property Observer after it was brought to his attention that "it would not surprise me if vendors withdrew their property listing from the Domain property portal".

'It was very client unfriendly – and not helping the mum and dad vendor one bit," he said. The fine print accompanying the APM estimate says its a market price estimate calculated by APM's Automated Valuation Model (AVM) and is not conducted by a certified practicing valuer. "The AVM evaluates property characteristics, comparable sales and local market activity and cannot take into account modifications made after the last sale date."

It says the model evaluates multiple and unique combinations of property characteristics for each local area to calculate the most accurate price estimate possible.

"Adaptive hedonics allows the model to use the underlying attributes of each property, in each location, to create highly specific price estimates."

Where a recently reported sale price for a property is available, the model will use this record as the basis for calculating the price estimate.

The sale price is indexed forward from the date of the historic sale, determined by prevailing local market price trends, and converted into current-day value.

Where a recently reported sale price for a property is not available, a pool of neighbouring comparable properties is selected and used as the basis for calculating the price estimate.

The following property attributes are assessed and evaluated:

- Property location: latitude & longitude,

- Property attributes: number of bedrooms, bathrooms and car parking,

- Additional features : land size, air conditioning, pool, polished timber floors, walk in wardrobes and entertaining areas,

- Geospatial: proximity to bodies of water and transport links, road classification and views.

"This pool of comparable properties is then ranked and weighted with each historic sale price indexed to current day value," APM says.

APM stress the figure does not take into account the potential impact of external influences such as a change in economic conditions, future planned infrastructure and environmental conditions.

"The model cannot take into account the effect of renovations or changes to the structure of a property made after the official reported sale date."

APM recommends our customers refer to the comparable sales data provided, inspect similar properties on the market as well as supplement this information with additional market research and advice from property professionals prior to making any decisions.

APM stresses it is "NOT an EXACT valuation for the property."

"It is highly accurate in the majority of cases but does not wholly replace the judgement of an individual making a carefully considered decision with the best information at their fingertips."

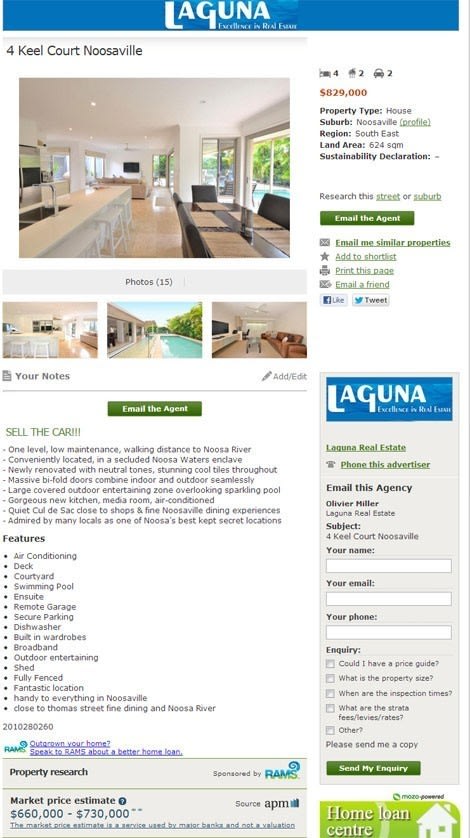

Queensland listings are similarly being given market price estimates well under the declared asking price. A four-bedroom Noosaville house (pictured below), which has an $829,000 asking price, has been given a $660,000 to $730,000 market price estimate.

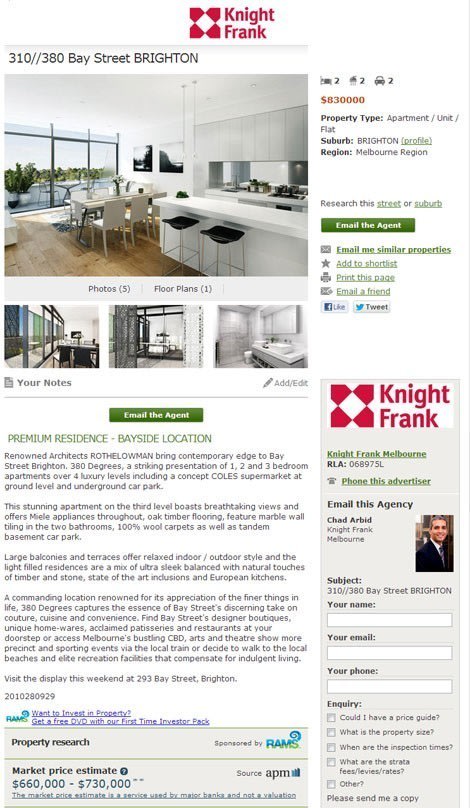

Click to enlargeA Brighton apartment (pictured below) with an $830,000 asking price through Knight Frank has been given a market price estimate of $660,000 to $730,000.

Click to enlargeA five-bedroom Somerville house that Nicholas Lynch is trying to sell for between $850,000 and $930,000 has been given an APM market price estimate of $690,000 to $765,000.

At Frankston South, a four-bedroom house comes with a price range of $980,000 to$1.09 million through Nicholas Lynch. But the market price estimate by APM is $805,000 to $875,000.

A five-bedroom Davidson house, given a $935,000 to $1.015 million market price estimate has been actually listed at $1.05 million through Christine Harrison at Smart & McKenzie Real Estate.

Market price estimate reports are typically bought by buyers seeking some price guidance, but only recently added to the Domain listings website in a marketing initiative between Fairfax Media and mortgage lender RAMS.

The most irate are agents whose listings with asking prices come with price estimates at a much lower guidance.

But agents also suggest the upwards variance could also play havoc with buyers and sellers.

At North Balgowlah a two-bedroom cottage has $825,000-plus hopes, but the market valaution from APM is $985,000 to $1.065 million.

There's a $765,000 suggested market price valuation on a Willaroo Avenue, Woronora Heights listing. It comes with $599,000 plus price indication.

A Balwyn North listing was given a estimate just above its $1.05 million-plus asking price.

At Morrisons Avenue, Mount Martha the price estimate and asking price narrowly overlap.

Market price estimates have been an emerging important buying tool for several years, with a degree of caution required especially with houses that have undergone substantial renovations that the price grooming capabilities of the research websites have failed to incorporate into their calculations.

Most market price estimates have been available only on a one-off payment, but some property websites in the competitive world of data sales have been made available for free.

Property Observer conducted a survey in April last year that concluded that buyers and sellers placing belief in free online web price estimates when estimating envisaged house price values are more often than not being misdirected – with serious over- and under-estimating being given.

A survey of weekend auction results across Sydney and Melbourne showed estimates by real estate portal OnTheHouse.com.au were askew 67% of the time.

Of the 80 auction results analysed, 54 estimate were incorrect, with some actual sale prices up to 55% off the pre-auction valuation range given by OnTheHouse.com.au.

Just 26 sales actually fell within the wide estimate band.

UPDATE:

Domain scrapped its Australian Property Monitors market price estimate offering the day after publication of this article.

The market price estimates were being published until mid-morning Friday February 15 on vendor-paid Domain property listings, but they were taken down after causing havoc among listing agents.

The offering is tipped to return to the Domain website in future weeks or months, but in a different format.It would be likely that free private access to the market price estimate was available without any very public damaging disclosure.