Strong performance over past year for A-REITs: Mark Wist

Performance of the listed A-REIT market is shown in Table 1.

It shows that significant positive returns have been achieved over the past three years especially in the last year.

The five-year performance is negative reflecting the substantial falls encountered during the crux of the GFC.

Volatility is also significantly lower over three years than five years reflecting more stable markets.

The A-REIT sector has underperformed broader shares over the past five years. However, most of that underperformance occurred in year to 31 March 2009.

Over the past two years, A-REIT out-performance has been significant.

The average annual total return for broader shares over the past five years has been 3.1% compared with -3.7% p.a. for A-REITs.

Going in to the GFC in 2008, companies in the A-REIT sector had significantly higher levels of debt than had been employed in previous years.

Many significant companies owned property in overseas markets where asset values declined sharply.

Others were engaged in property development activities. Each of these components contributed to negative earnings. A-REIT prices declined partly as a consequence.

Listed property companies have recapitalised balance sheets by raising new equity, selling property and reducing debt with the proceeds. As a consequence, the earnings outlook is more secure.

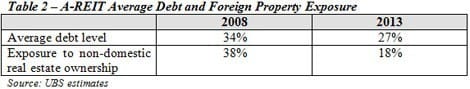

Table 2 shows the average debt holdings and exposure in overseas property between 2008 and 2013 for A-REITs.

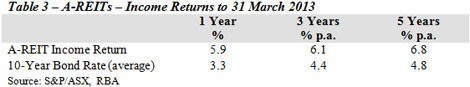

Table 3 shows the income return from A-REITs, along with the average Australian 10-Year Government Bond yield.

The current listed property distribution yield is 5.9% which sits significantly above the 10 year bond rate as at 31 March of 3.3% giving a premium of 2.6%.

A-REITs have lower debt levels and reduced exposure in overseas property.

This more stable investment structure combined with high relative income yields has attracted investor interest.

As a result returns have been very strong. At present price levels the income yields and growth prospects are attractive.

Mark Wist is senior asset consultant at Atchison Consultants.