Recovery in "expensive" A-REIT sector falters with 3.7% fall in May

Much has been made of the rebounding listed property sector in the past 12 months.

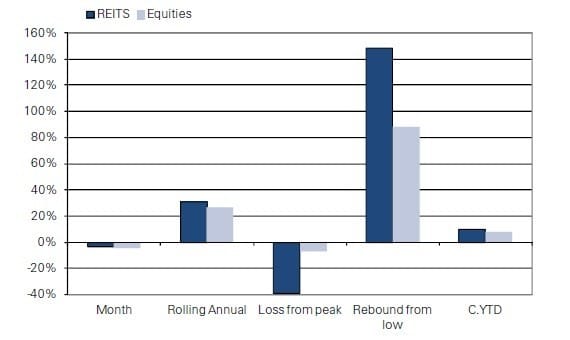

Atchison Consulting managing director Ken Atchison highlighted recently that A-REITs returned 30.7% over the year to March 31, outperforming equities by 10.7%.

“Over three years listed property returned 11.7% p.a. Industrial property was the strongest performing sector over three years at 20.4% p.a,” he said.

However, the sector is now 10% off its recent peak with A-REITs down 3.7% in May (compared with a 4.4% decline in equities).Further gloss was taken off the sector following Australand’s unsuccessful attempts to negotiate a sale of its non-residential business to GPT.

The worst performers over May were residential develop FKP Group (-13% cumulative return) followed by the CFS Retail Property Trust (-8.2%) ,Westfield Retail Trust (-6.9%) and Australand (- 5.9%).

Stockland, Australia’s largest diversified listed property trust, suffered a 4.9% fall in total returns in May with Goldman Sachs A-REITS analyst Simon Wheatley noting that it has been carrying a large cumulative balance of provisions since 2008.

Taking a longer-term view, A-REITS have rebounded 148.2% from their March 2009 (compared with an 88.4% rise in equities over the same period) but are still 40% down from their peak.

Returns comparison

Source: Goldman Sachs

Wheatley notes that the sector was looking “expensive recently” with some REITs having recorded price falls of 15% to 20% in the space of a month.

However while there was a “meaningful decline” in May, he says A-REITs “fared relatively well versus the broader equity market”.

Apart from an overall fall in market conditions and confidence – the May NAB Monthly Business Survey had business conditions at low levels with unchanged mediocre confidence levels – other factors contributing to the slide include A-REIT-focused funds now having little spare cash to invest in the sector following recent capital raising investments, better value offered by recently devalued Asian REITS, as well as the recent fall in the Australian dollar.

The Australian Financial Review notes that a recent spate of capital raisings from Mirvac Group, Stockland and Cromwell Property Group, which raised $1.5 billion having “given investors a severe case of indigestion”.

However analysts like Adam Fairfax at JP Morgan believe investors will return to the sector spurred on by better yields offerings, quoting CFS Retail Property Trust and Westfield Retail Trust offering yields of 7.25% and 6.6% respectively.