Perth and Brisbane dominate record demand for CBD offices in first six months of 2012: Property Council Report

Demand for CBD office space over the first six month of 2012 has almost doubled the 20-year historical average, but is heavily skewed towards the resource-driven capital cities of Perth and Brisbane, according to the latest Property Council of Australia’s (PCA) Office Market Report.

Both the Sydney CBD and Canberra’s vacancy rates tightened over this period, but this was driven by a lack of new stock coming onto these markets rather than from strong demand.

Over the first half of 2012 of the year, the PCA calculated that net CBD absorption – the amount of space leased minus the amount of space vacated over a given timeframe – was 243,000 square metres compared to a 20-year historical average of 120,000 square metres.

Of this total, nearly half (115,000 square metres) was absorbed in the Perth CBD with 40,000 square metres absorbed in the Brisbane CBD, with both cities accounting for a combined 68% of total net absorption.

The Brisbane CBD’s net absorption of office space was just behind that of the much larger Sydney CBD office market, which recorded net absorption of 45,000 square metres.

Net absorption in the weak Melbourne CBD office market was 34,000 square metres.

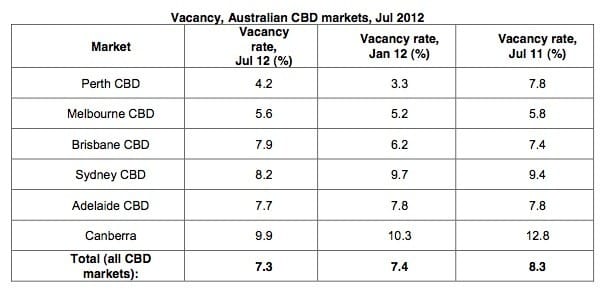

While the Perth vacancy rate eased from 3.3% to 4.2% it remains far ahead as the tightest CBD office market despite a big increase in available CBD office space following the completion of Brookfield’s 45-storey City Square office tower in June, which added 85,000 square metres of office and retail space to the CBD.

Mining giant BHP Billiton is the tower’s anchor tenant, taking 60,000 square metres of space.

The PCA notes that occupied stock in the Perth CBD grew by a “spectacular” 12% (net), posting record supply and record demand.

"In fact, Perth's net absorption was eight times higher than the city’s historical average," noted the PCA.

Furthermore, over the six months to July 2012, the Perth CBD posted the highest demand rate of all CBD markets surveyed of 8%. The demand rate is the amount of space absorbed as a portion of total stock.

The report also identifies the adjacent West Perth market as the tightest non-CBD market with a vacancy rate of only 3.2% followed by Brisbane’s Chermside (5.1%) and the Adelaide Fringe (5.5%)

“Australia’s multi-speed economy is driving office market fundamentals and shaping business confidence,” says Property Council chief executive, Peter Verwer.

“While demand for office space is a buoyant 50% above the 20-year historical average, three quarters of net CBD absorption occurred in just Perth and Brisbane.”

“The hard economics of the resources boom is tellingly reflected in the relative performance of the nation’s office markets.”

Overall the nation’s office vacancy rate was almost unchanged at 7.8% (down from 7.9% in January 2012) and is at its lowest level since 2009.

The Sydney CBD recorded the sharpest six-month fall in vacancies, dropping from 9.7% to 8.2% while the Canberra market also delivered a slight decline in vacancies, from 10.3% to 9.8%.

However, the PCA noted that in both cases, “low levels of new supply combined with stock withdrawals had a bigger impact on the vacancy factor than strong demand”.

Despite negative demand, Adelaide’s CBD also posted a vacancy decrease from 7.8% to 7.7%, due primarily to stock withdrawals.

According to the PCA report, substantially more CBD office stock was added across both CBD and non-CBD markets than was withdrawn over the first six months of the year.

Over 343,000 square metres of new office space was added over the six months to July 2012, more than 50% higher than the 20-year historical average of 211,000 square metres – while only 110,000 was withdrawn, compared to the 20-year historical average is 118,509 square metres.

There is a total of 388,917 square metres of stock due to be added to the CBD markets in the second half of 2012, but the addition of new stock will slow in the next three years with only 404,115 square metres due to come online in 2013, followed by 135,147 square metres in 2014 and 485,056 square metres in 2015.