National office vacancy rate hits 10% for first time since 1999: PCA

A slowing economy and shrinking white collar jobs market has pushed the national office vacancy rate into double figures for the first time since July 1999.

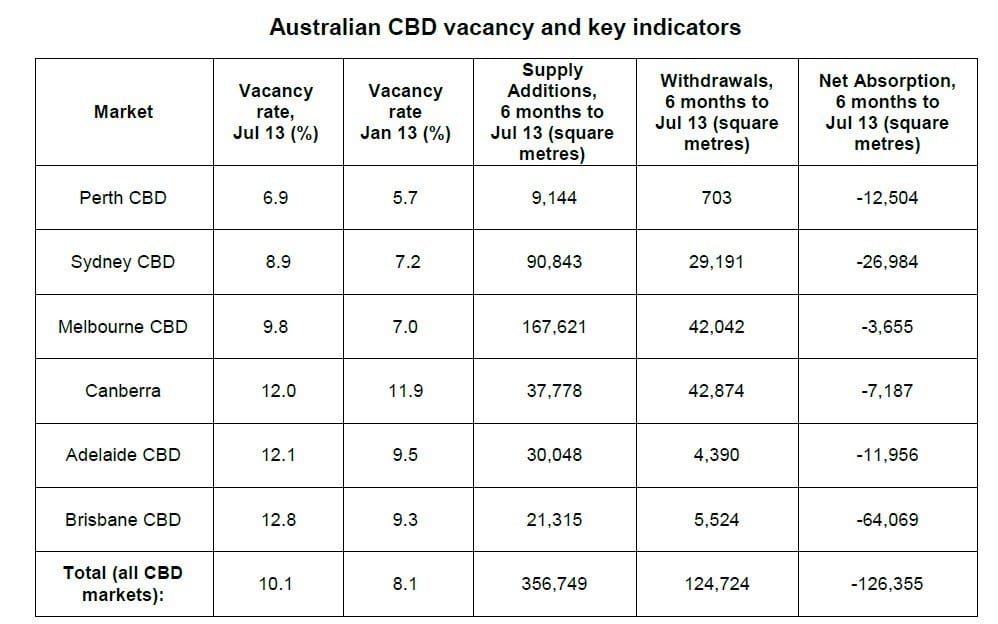

The national office vacancy rate increased from 8.4% to 10.1% over the first six months of 2013 with an additional 126,000 square metres of CBD office space becoming vacant over this period, according to the latest Property Council of Australia office market report.

Including fringe office markets - some of which performed better than their CBD counterparts - total net absorption (the amount of space leased minus the amount of space vacated) was negative 172,000 - the lowest since July 2009.

“There is no surprise that weak office space demand mirrors Australia’s lacklustre economic fundamentals,” says PCA chief executive Peter Verwer.

“Stubbornly low business and consumer confidence is impeding job growth and new investment, which translates into dwindling demand for office space.

“The decline in white collar jobs growth to a third of the level experienced prior to the GFC has severely blunted demand and business expansion plans.”

However, according to Colliers International's director of office leasing, Simon Hunt, there is no need to hit the panic button with a low supply environment forecast post 2013 due to a shift in global economic sentiment which will flow through to Australian office markets.

"The forecast for the next 12 months is for just over 93,000 square metres of new supply added to Australia’s CBD office markets (of which approximately 66,000 square metres or 71%, is pre-committed), and only 152,000 square metres (approxiametely) for the whole of 2014 (of which 95,760 square metres, or 63%, is pre-committed).

“To put this in perspective, during the first six months of 2013, Melbourne added a substantial 165,000 square metres of which approximately 140,000 square metres was pre-committed.

"In comparison, Sydney had just 54,000 square metres (of which 97%, or just over 52,000 square metres, was pre-committed).

“Long term trends indicate that in cycles when we see limited supply, a decline in vacancy is also observed.”

The biggest spike over the first half of the year was in the Brisbane CBD where the office vacancy rate increased from 9.3% to 12.8% and with the city accounting for more than half (64,000 square metres) of the negative net absorption of CBD office space over the half year.

PCA chief executive Peter Verwer attributed the rise in the Brisbane vacancy rate due to “slowing population growth, an inert resource sector and competition from the Brisbane Fringe market”.

Vacancy in Brisbane’s fringe market also increased from 9.6% to 11.8%, largely the result of supply additions of 52,182 square metres – but is now a full percentage point below that of the CBD market.

The vacancy rate in Chermside in Brisbane north is around 7% with many fringe markets performing better than their big CBD counterparts.

The Sydney CBD vacancy rate increased from 7.2% to 8.9% over the first six months of the year with the premium end of the market, the only grade of assets to record positive demand.

The vacancy rate is below 8% in Parramatta and North Ryde, at or just above 10% in Chatswood and North Sydney, with the highest vacancy rate in Crow’s Nest at just below 12%.

Melbourne was the strongest office market over the first half of the year with a negative net absorption of less than 4,000 square metres despite 168,000 square metres of new office space becoming available to lease.

More than 72,000 square metres of office space was taken up in the Melbourne CBD over the six month period.

“During the first half of 2013, supply additions grew by more than two and a half times the historical average at 167,621 square metres leading to a modest rise in Melbourne’s vacancy rates. Yet despite this, Premium and A Grade stock experienced positive demand,” says Victorian executive director of the Property Council, Jennifer Cunich.

“North Eastern and Docklands precincts also performed strongly leading the way with a vacancy rate less than a third of the Melbourne CBD average. These results reflect the strong fundamentals unpinning Melbourne’s expanding office market.”