Listed property trusts help super funds to best returns in 16 years: Chant West

The 2013 financial year delivered a 15.6% return for members of median growth superannuation funds, equalling the best performance in the past 16 years, according to research firm Chant West.

Funds oriented more heavily to listed shares and property delivered the strongest results.

It equals the super return generated in 2007 – just before the GFC sent returns plummeting into the red –and was not that far short of the previous highest return of 19.4% in 1997, achieved five years after compulsory super was introduced by Paul Keating.

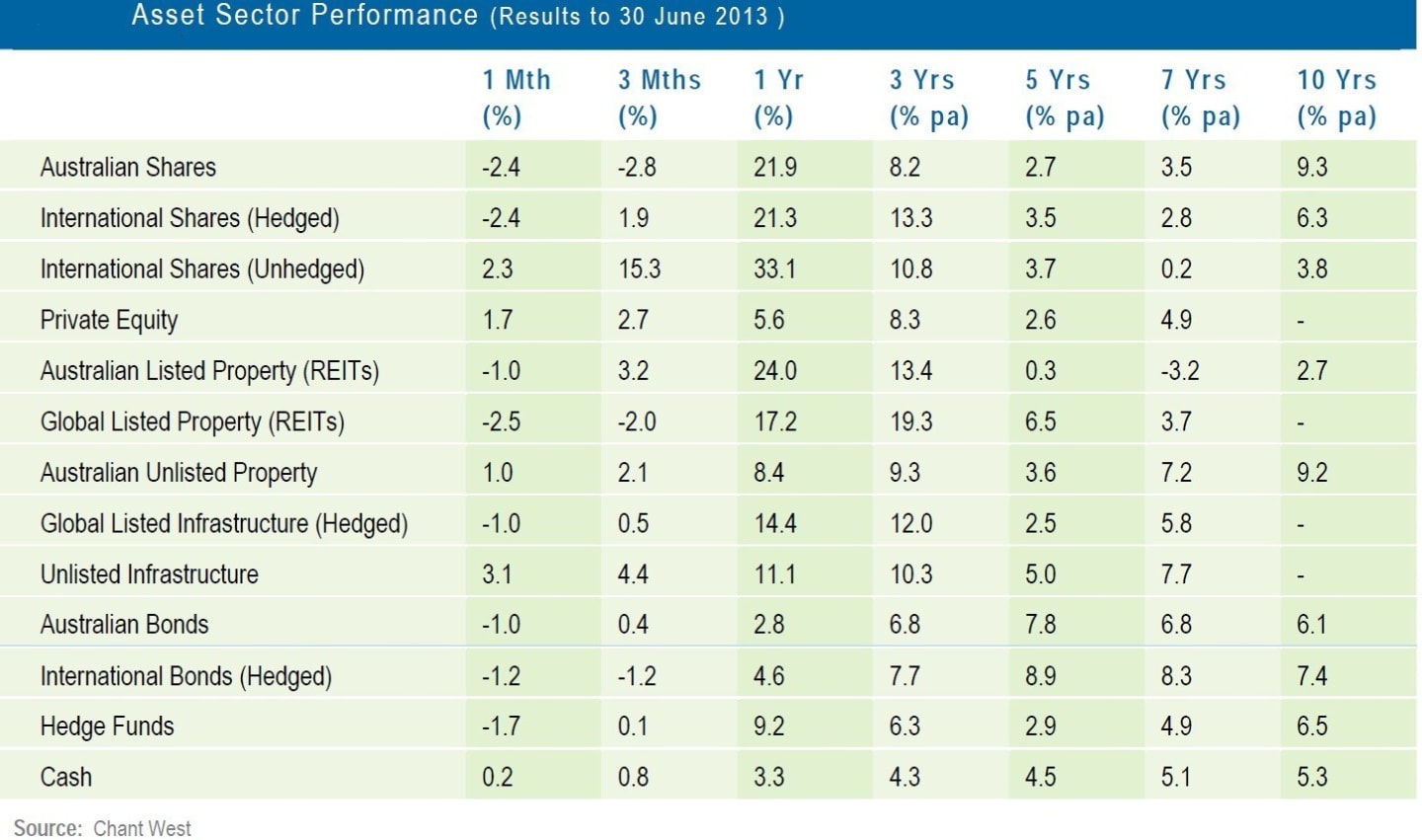

Unhedged international shares delivered the strongest return over the past year of 33% but the second best performing asset was Australian listed property (A-REITS) with a return of 24% with global listed property returning 17.2%.

Unlisted property returned 8.4%.

Australian shares returned 21.9% and international hedged shared returned 21.3%.

The top-performing fund for the year was BT’s Super for Life 1960s Lifestage, which returned 18.6%, while even the worst-performing fund in the growth category returned a healthy 10.2%.

Master trusts, with their higher weighting to listed shares and listed property (59% versus 55%), finished the financial year ahead of industry funds, returning 16.1% versus 15.9% - only the third time that master trusts have finished ahead in the past ten years.

Over the longer term, however, industry funds maintain their dominance.

Master trusts are super funds that allow financial advisers to be more personally involved with clients in their super fund asset allocation.

Chant West director Warren Chant cautioned super fund members not to get carried away with a one year figure.

“You’ve always got to remember that superannuation is a long-term investment. There will be good times and bad times, and you certainly can’t expect returns like this every year,” he said.

He says the typical return objective for a growth fund is to beat inflation by 3 to 4% (after investment fees and tax) over rolling five year periods which, in the current low inflation environment, translates to 6% to 7% per annum.

“To judge whether funds are meeting their long-term objectives, you really need to look back as far as you can, and certainly well past the GFC.

“We now have reliable data for all the major funds going back 21 years to July 1992, which is when compulsory super came in, and if we look back over those 21 years we see that funds have achieved those objectives.

"The annualised return over that period is 7.5%, the annual CPI increase is 2.6%, so the real return above inflation has averaged 4.9% per annum.

“As for the risk objective, there were three negative years out of the past 21 which averages out to one in seven, so that target was also met. The bottom line is that, over the 21 years in which we’ve had compulsory super, Australia’s major funds have done what they set out to do,” Chant says.