Liquidity in property investments - direct v listed

The issues surrounding liquidity of property investments were highlighted in the credit crisis. Sale of securities was the only source of capital raising as bank lending froze and prospective buyers of property assets could not finance acquisitions.

Property investors who seek a liquid property investment access can purchase listed property securities on the ASX or through a managed fund. Alternatively, investors wanting to invest in property that do not require daily liquidity can gain exposure through the direct purchase of an asset or through purchase of units in unlisted property funds or syndicates.

Liquidity associated with listed property securities can provide a range of benefits to investors. Liquidity gives investors the flexibility to invest or divest from their property investments and invest elsewhere as opportunities arise in other investments. Liquidity assists investors in rebalancing their portfolios.

Return premium – compensation for illiquidity

Direct property is characterised by limited flexibility and liquidity. Investors’ expectations from investments in direct property are that these investments would generate higher returns than listed property to compensate for illiquidity. Investors in direct property typically have longer investment horizons.

An assessment of whether direct property investments generate higher returns to compensate for illiquidity relative to listed property securities, over 28 years to September 30, 2013 has been undertaken.

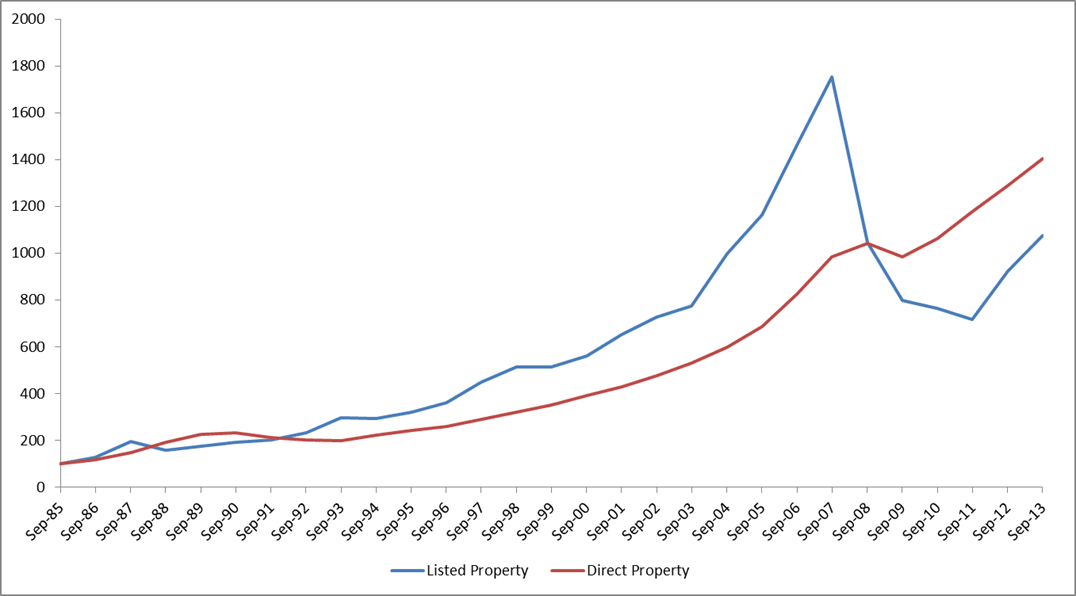

Chart one below shows growth in returns from an initial investment of $100 made in September 1985 in listed property and direct property.

Chart one – Growth in investment – Listed property vs direct property

Source: S&P/ASX, PCA/IPD

From Chart one, over a 28 year period to 30 September 2013, from an initial investment of $100, an investment in direct property would have generated a higher return than listed property. Direct property generated 9.9% and listed property generated 8.9% per annum.

Liquidity is valued by the market and can be determined and quantified through turnover, size and transaction costs. Analysis concludes that the required return premium for illiquidity ranges between 0.7% per annum and 1.0% per annum.

Over 28 years to September 30, 2013, a return premium of 1.0% per annum over listed property has been paid to direct property investors for the illiquid characteristics of direct property. Over the long term, direct property investors have adequately compensated for illiquidity.

Current environment

Total returns in the range of 10.0% - 11.0% per annum are expected for listed property over the next twelve months. Comparatively, total returns in the range of 8.5% - 9.5% per annum are expected for direct property over the next twelve months. Therefore a return premium, as a reward for illiquidity, from an investment in direct property is not expected.

Binesh Seetanah is an analyst at Atchison Consultants.