Industrial property support from large retailers and transport occupiers

Large retailers and transport and logistics occupiers are supporting industrial demand, taking advantage of the competitive pre-commitment market to improve and consolidate their supply chains, according to Dexus Property Group’s latest quarterly report.

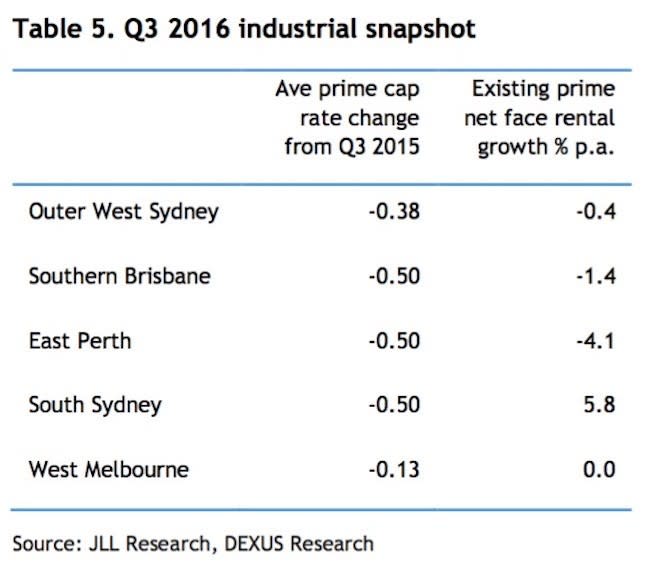

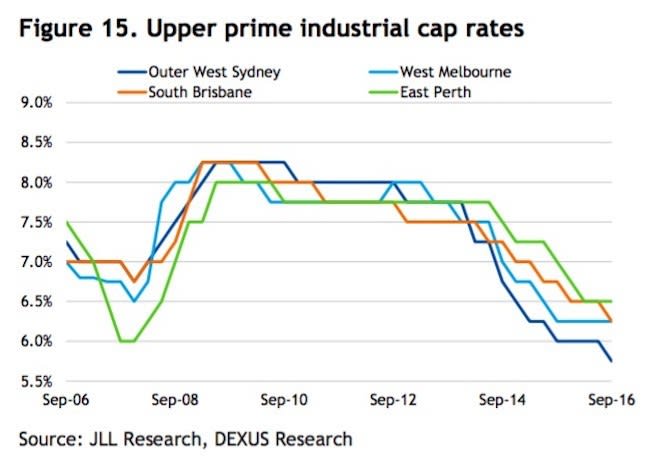

Occupier demand varies widely between states with Sydney and Melbourne solid, Brisbane improving and Perth remaining weak.

The manufacture of core stock is a primary focus for many institutions, particularly in Sydney and Melbourne, due to the solid pre-lease demand in these markets and the strong values that can be achieved for fully leased buildings.

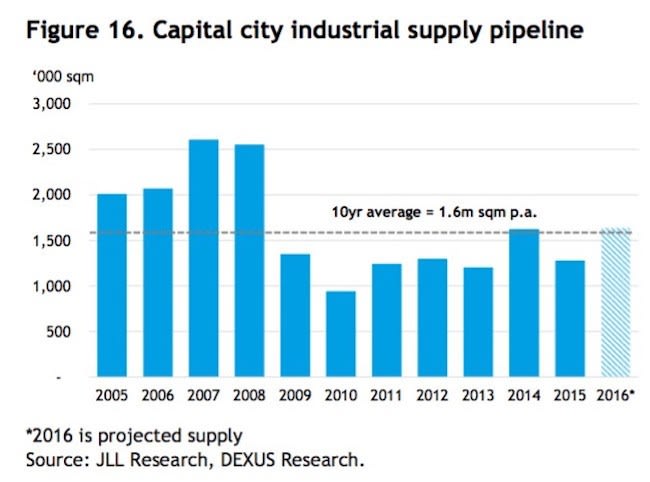

The industrial supply pipeline will be solid in 2016, in line with the 10 year average, however 2017 is likely to be more subdued following a reduction in planned projects in Brisbane and Perth.

Consequently, rents are likely to remain relatively subdued and stable in the short term as the pre- commitment market remains competitive.

Land constrained markets are the best placed for rental growth in the future.

The key themes for this quarter include:

- Demand for assets with a long WALE remains strong, however prime investment stock is limited as owners hold income producing properties

- The closure of the Ford plants in Geelong and Broadmeadows (VIC) could result in these large industrial sites being released to the market in the coming years after site remediation. Holden and Toyota are expected to close in 2017

- The privatisation of Australian ports has continued with The Port of Melbourne sold on a 50 year lease to Lonsdale Consortium (consisting of QIC, Future Fund and Global Infrastructure Partners) for $9.7bn