Household net worth and dwelling prices continue to fall: RBA

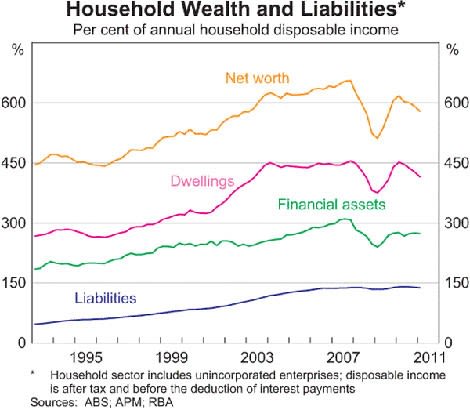

As dwelling prices fall, household net worth is continuing to decline, according to graphs released by the Reserve Bank of Australia.

It notes that household liabilities remain fairly steady.

The data release from the RBA comes the day after the bank took the unusual step of revealing it considered pushing up interest rates at its board meeting.

It noted it held off primarily because of “acute uncertainty” over debt problems in Europe and the US.

Peter Martin, the Age economic commentator, writes he believes the board had before it an open recommendation from governor Glenn Stevens, meaning it was able to make a decision at the meeting rather than simply accept or reject a recommendation.

Martin writes that the international situation dominated the board’s discussion and a consensus was reached that the outlook was too uncertain to make it safe to increase rates, as RBA staff believe will soon be necessary.

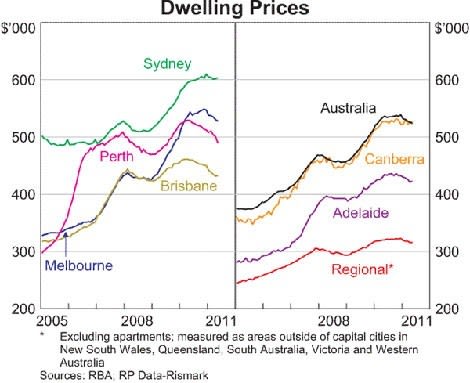

The statement released by the governor after the meeting expressed concern about inflation but noted employment growth was slowing, households were cautious, government spending was abating, credit growth was weak and house prices were soft.

The RBA believes inflation is lower than the official figures suggest, giving it more time before acting than market economists appreciate. The latest consumer price index had inflation at 3.6%, beyond the RBA's 2 to 3% target band. Underlying measures of inflation were also high, at a quarterly rate of 0.9%. But the RBA believes those measures were distorted by several unusual price measurements and puts the true rate of inflation at a more moderate 2.5% to 2.75%.

The data – a series of graphs that summarise macroeconomic and financial market trends in Australia – would have helped frame the recent speech entitled The Cautious Consumer by the Reserve Bank governor Glenn Stevens at his annual engagement for the Anika Foundation.

In his speech, Stevens said measures of confidence are down and there was an evident sense of caution among households and firms.

“It seems to have intensified over the past few months,” he says.

“There are a number of potential factors to which we can appeal for an explanation of these recent trends. The natural disasters in the summer clearly had an effect on confidence, for example.

“Interest rates, or intense speculation about how they might change, are said to have had an impact on confidence – even after a period of more than a year in which the cash rate has changed only once, the most stable outcome for five years.

“Increasingly bitter political debates over various issues are said by some to have played a role as well,” he says.

“The global outlook does seem more clouded due to the events in Europe and the United States.

“We could note, on the other hand, that the Chinese slowdown we have all been anticipating seems to be relatively mild so far – that country has continued to expand at a pretty solid pace as measured by the most recent data,” Stevens says.

“But these days, mention of the Chinese expansion reminds people that the emergence of China is changing the shape of the global economy and of the Australian economy.

“And structural change is something people rarely find comfortable in the short term, even though a capacity to adapt is a characteristic displayed by the most successful economies.

“So the description of consumers as ‘cautious’ has become commonplace.

“It is not one I disagree with. Indeed the RBA has made such references on numerous occasions over the past couple of years,” Glenn Stevens notes.