Four reasons shopping centre incomes will continue to fall below inflation: BIS Shrapnel

Shopping centre income growth is expected to be steady but falling behind CPI for the next five years, according to BIS Shrapnel’s Retail Property Market 2014 to 2024 report.

According to senior project manager and report author Maria Lee, there are a number of factors that are constraining income growth prospects. These fundamentally relate to economic growth and household spending in aggregate.

Lee pointed to these four reasons:

- Modest GDP growth as the economy transitions away from resources investment to more broadly-based growth.

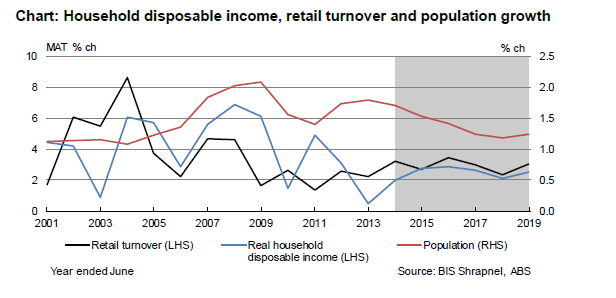

- Slowing population growth as 457 visas decline and net long term departures increase.

- Household disposable income growth averaging just 2.6% per annum compared with a 25 year average of 3.3%.

- Retail turnover growth averaging 2.9% per annum—slightly ahead of income growth due to an easing in the savings rate, but well below the 3.8% long-term average.

Source: BIS Shrapnel, ABS.

Lee also pointed to factors that impact the distribution of aggregate expenditure between physical shops and online, as well as between differnet shopping centres. Online shopping, for instance, was estimated to be set to remove 0.5% per annum from turnover growth to shopping centres and retail building commencements hitting a new high over the next financial year having an effect.

“Add all these factors together, and we predict that shopping centre incomes will average around 2.6% annual growth over the next five years, failing to keep pace with inflation," she said.

“The saving grace for shopping centres is that the bulk of their income is subject to fixed annual escalations, putting a support under the rate of growth and reducing volatility from year to year."

The report suggested that retail investors work to mitigate the impact by changing tenancy mixes, marketing in smarter ways to consumers and even adding attractions.