Childcare investment driving yields higher: Colliers

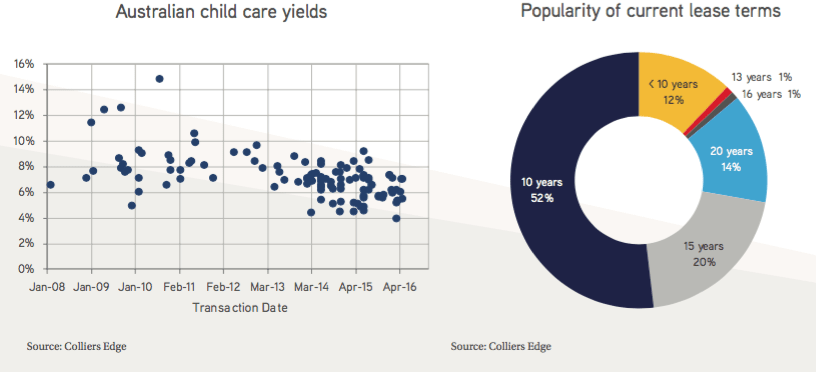

Market competition in the childcare space has seen yields sharpen over the last six months, ranging from 3.9 percent to 7.3 percent, according to a white paper from Colliers.

According to Colliers, sales in the childcare space were sporadic, and typically at higher yields than the retail and industrial market. The report noted a sale in September 2010 which transacted at a yield of over 14 percent, the highest since March 2007.

"Since then, yields have sharpened quickly, and this is not surprising given the newly created competition that has occurred amongst organisations keen to expand their portfolio," the report said.

"Yields have ranged from 3.90 percent to 7.30 percent in the last 6 months and while we can see further consolidation occurring, inconsistency is still apparent. The most recent transaction recorded in April 2016 attracted a yield of 3.90% percent Prior to this, the lowest yield achieved occurred in April 2014 at 4.32 percent.

"A heavy concentration of sales occurred on the east coast of Australia, especially in recent years with sales increasing from only 2 auctions in 2008 to 33 in 2015, most of which are tenanted with a 10 year average initial lease term. The first half of 2016 has seen 18 child care centres sold with the bulk of transactions occurring in New South Wales."

The report said most childcare sales now include longer least terms, previously ten years.

"However as sales activity increases within this new investment sector, we’re seeing lease terms of 15 to 20 years emerge, along with a further 15 to 20 years in options which are to be exercised 5 years in advance. Anything under a term of 10 years for a new lease is a rarity and not widely considered by landlords. "