CBD retail vacancy rates rising: Chart of the week

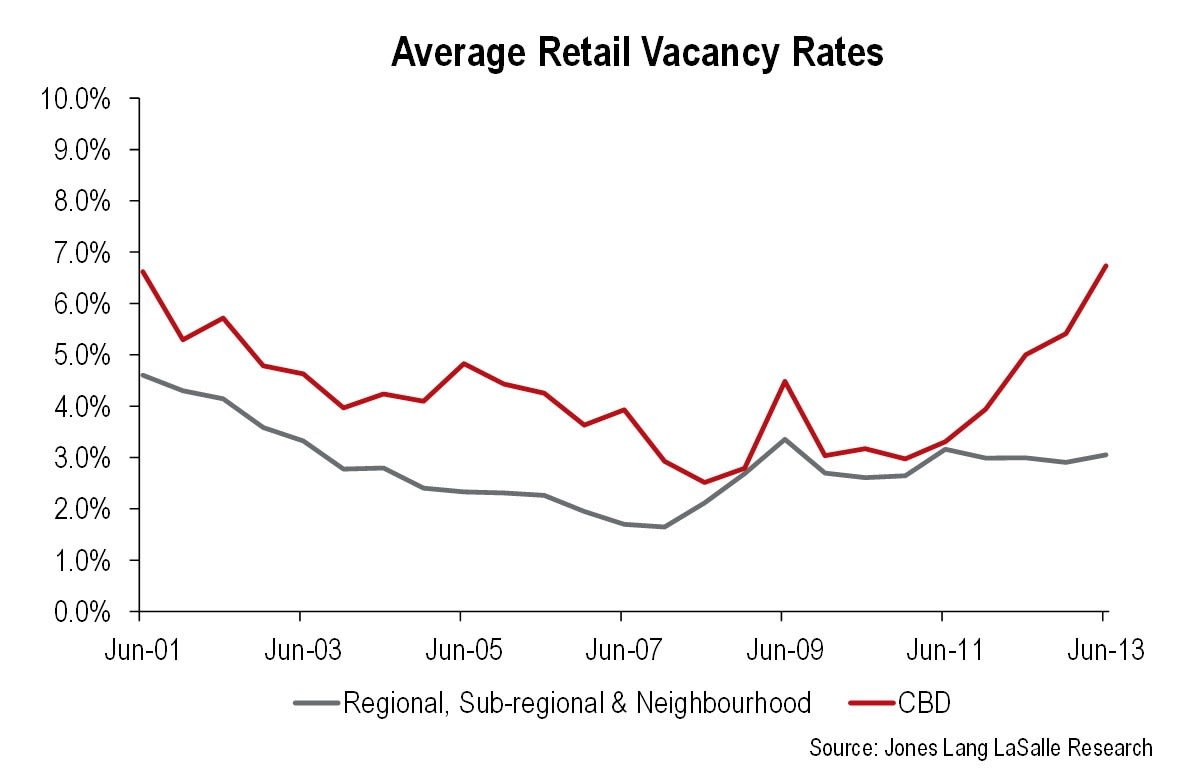

Second-quarter figures released by Jones Lang LaSalle show the average retail vacancy rate for the Australian market rose to 4% in the first half of 2013, from 3.5% in December 2012.

The average retail vacancy rate in the first half was largely driven by a notable rise in the national CBD retail category, which rose to 6.7% in June 2013 from 5.4% in December 2012.

In contrast, and as this graph shows, there have been only minor increases in average vacancy rates recorded across the sub-regional and neighbourhood centre categories:

“While vacancy rates have remained elevated leasing activity is rising, reflecting the higher rate of tenant turnover that is currently occurring as landlords go through the slow process of optimising their tenant mix at a time when demand is less than strong.”