Canberra landlords seek higher rents in response to housing shortage

Canberra landlords, capitalising on the housing supply shortage, increased asking rents rising 6.4% in the final three months of 2011.

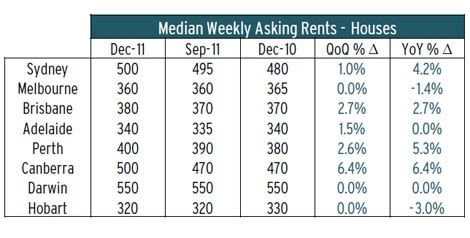

Data from Australian Property Monitors shows asking rents for Canberra houses rose $30 to a median of $500 a week.

The four other capital cities to notch house rental rises over the quarter were Brisbane, up 2.7% to $380, Perth, up 2.6% to $400, Adelaide, up 1.5% to $340, and Sydney, up 1% to a $500 median weekly asking rental for houses.

Melbourne, Darwin and Hobart recorded no increases in median asking weekly house rentals over the December quarter.

APM concluded that nationally rentals had resumed upward growth after flat results over the previous two quarters.

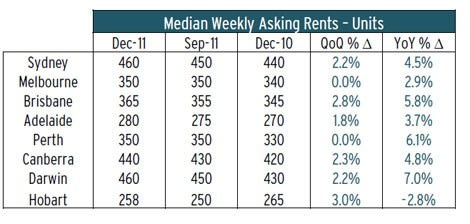

The national median weekly asking rents for houses rose by 1.1% in the December quarter, with rents for units rising by 1.4%.

The increased rentals over the December quarter for both houses and units indicated increased competition for accommodation particularly from first-home buyers struggling to secure property in the marketplace, APM senior economist Dr Andrew Wilson says.

“The Sydney, Perth and Canberra rental markets have been characterised by chronically low vacancy rates and, with ongoing low levels of new construction, this situation is expected to continue with upward pressure on rentals.

“The Brisbane rental market also remains highly competitive for tenants reflecting ongoing consequences of the devastating floods of early 2011 and the slow progress of reconstruction.

“Melbourne continues to be Australia’s most tenant-friendly rental market with a wider choice of properties courtesy of nation-leading dwelling construction and no growth in rentals for both units and houses over the December quarter.”

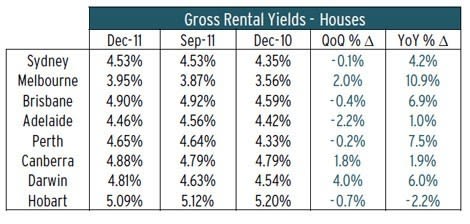

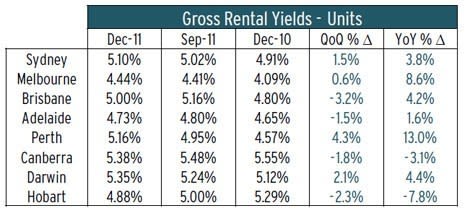

APM notes that rising rentals combined with a general softening in prices has resulted in increases in gross rental yields for most capitals over 2011.

Units continue to provide higher gross rental returns compared with houses in all the mainland capitals despite units generally outperforming houses in the sales market.

Capital city house rental yields range between 3.95% in Melbourne to 5.09% in Hobart.

Unit yields range from 4.44% in Melbourne to 5.38% in Canberra.

Canberra rental agents report there is always a much higher demand for properties over the November to February months, hence the increase in rents due to demand.

“This demand falls over the winter months, so there is a delicate balancing act with respect to price,” one managing agent suggests.