Australians emerging from hibernation, which will help commercial property

In various recent articles, I've tried to explain how Australia's underlying fundamentals are actually very solid.

And by most measures, our economy seems to be travelling at close to its full capacity.

However, the contradiction is that Australia's budget should now be running at a substantial surplus. And the reason it's not relates to a number of structural issues.

Even though the high dollar is causing problems for our manufacturers, unemployment is running at just 5.4% — less than 0.5 percentage points above what economists deemed to be "effective full employment". When it falls below 5%, this tends to put pressure on wages.

Source: AFR

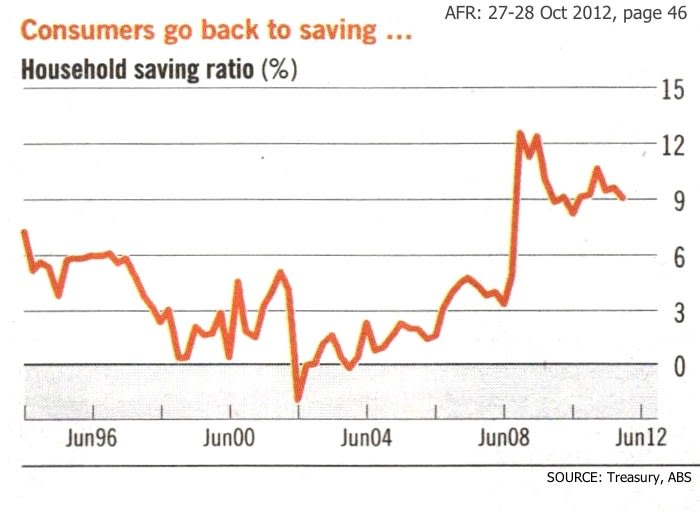

Anyway, it is the feeble retail sales (through a continued high level of savings) that seem to have become the most visible sign of general consumer conservatism. And this is what's top of mind with most people.

However, in his column in Saturday's Age (pg. 11) Harold Mitchell touched on the record level of betting that had recently occurred at the Caufield Cup.

And he then asked “What does that mean when most parts of the country have been stumbling along in the doom and gloom for months?"

But there are other pointers as well

Mitchell also highlighted the record level of new-vehicle sales, along with the considerable increase in overseas travel.

Clearly, the GFC frightened most people. But maybe they have now become bored with saving and are prepared to spend once again — provided it doesn't cause them to increase their personal debt levels.

Rather cleverly, the car industry seems to have plugged into this consumer sentiment — by offering "0% finance, and five years to pay" on any new purchases.

That way, you are able to buy your new car without having to create another interest meter ticking over.

Bottom line: You are now seeing a growing number of signs that people are finally stirring from their long hibernation.

Moreover, last weekend's strong auction results (with clearance rates for Sydney at 68%, and 66% for Melbourne) have further confirmed an underlying strength within the residential property market.

Chris Lang is an advisor to commercial property investors and gives keynote speeches and regular seminars on the best way to invest in commercial property. He maintains a blog, his-best.biz, which he updates regularly about the best way to get the most out of your commercial property investment.