Australian office sales hit $18 billion in year to June; offshore buyers take 68 percent of CBD sales: Savills

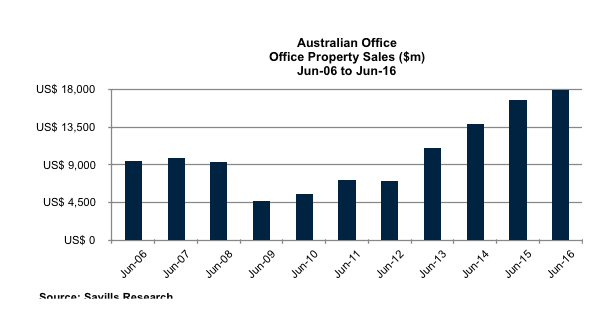

Investors splashed nearly $18 billion on Australian office property in the 12 months to June -- up almost 35 percent on the five-year average -- with foreign investors taking the lion’s share in CBDs, according to Savills Australia’s latest research.

Office sales in Australia have seen year-on-year growth since 2012 and the trend is likely to continue because of Australia’s safe haven status and high yields, says Savills.

Sydney had the most transactions by value at $4.6 billion, or 47 percent of CBD office sales nationally, while Melbourne led on the number of deals at 28.

The $17.9 billion total, comprising $9.8 billion worth of CBD office transactions and $8.1 billion worth of non-CBD transactions, was up $4.6 billion on the $13.3 billion, five year average, with the sale of 253 properties, also up on the five year average of 234.

Savills national head of Research, Tony Crabb said “there is no reason to believe we won’t see the upward trend continue given the current global economic and political status quo”.

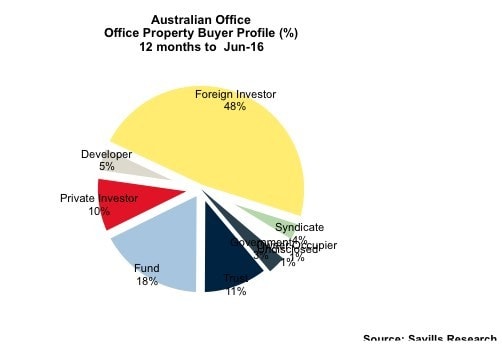

He added that off-shore investors further stamped their footprint in the Australian office market with $8.6 billion of the total sales (48 percent) and 68 percent of CBD purchases - $6.6 billion – from 44 transactions.

Foreign investors also figured prominently in non-CBD sales purchasing 25 percent of the stock sold for $1.9 billion.

Crabb said market yields averaged 6.15 percent for CBD premium grade buildings, 6.9 percent for CBD A grade buildings, and 8.3 percent for CBD B grade office buildings while yields averaged 7.28 percent for CBD fringe A grade buildings and 8.3 percent for CBD fringe B grade buildings.

Savills director, Cross Border & Capital Transactions, Ben Azar, said Australia would continue to see massive foreign investment.

“In an extremely low interest rate environment with global capital starved for yield, Australia is seen as a transparent secure market with some of the highest yields in the world. Sydney and Melbourne, especially, are seen as global gateway cities offering very good lease terms and strong covenants.

“As long as Australia’s economic and political environment remains stable, any turbulence in the US, UK and Europe will mean more offshore capital will be attracted to Australia because of its safe haven status, transparent market practices and growth potential,’’ Azar said.

Further yield compression expected

He said with interest rates forecast to stay lower for longer and with a huge amount of capital chasing very few opportunities, he expected further yield compression and for bond-like property yields to remain very tight.

“As long as interest rates and bond yields are low or dropping, the scope for further yield compression is real. The thirst for yield will drive money into property and simple demand and supply laws will mean yields must compress,’’ Azar said.

He said while Sydney and Melbourne remained investor favourites, the cities like Brisbane, Adelaide and Perth are also gaining importance as investors chase yield.

Azar said rapidly improving leasing fundamentals, especially in Sydney, meant the income side was set for vast improvement allowing scope for more aggressive pricing from vendors and potentially driving further investment demand.