Australian cities among the most expensive for global retailers: CBRE

Sydney, Melbourne and Brisbane have maintained their ranking among the world's most expensive cities for global retailers, despite a backdrop of flat retail turnover figures and a weak domestic economic environment.

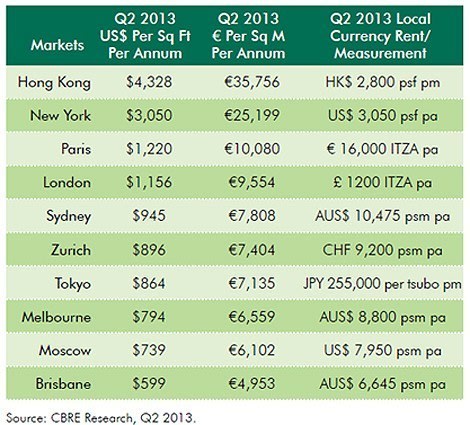

The three Australian cities all featured in CBRE Group's top 10 quarterly rankings, which was topped by Hong Kong with prime rents at US$4,328 per square feet per annum, followed by New York.

Prime rents in Sydney, which was fifth in the rankings, came in at US$945 per square feet. Prime rents in Melbourne were $794 per square feet and in Brisbane were $599 per square feet, the CBRE research showed.

Josh Loudoun, CBRE senior director of Retail Services Australia, said the Australian cities combined were tracking at a "steady growth" rate, but that the results varied from city to city. Prime rents in Sydney, he said had fallen, whilst in Brisbane rents had accelerated strongly and Melbourne had experienced steady growth.

Nervertheless, he said the overall results highlighted that Australia was showing steady growth at a time when the retail sector is in the doldrums.

Driving the local results , said Mr Loudoun, was the "limited number of new leases being signed as landlords have been more inclined to leave tenants on hold over or short term leases at the lease expiry, instead of putting the property to the market and crystallising a downgrade.”

However, he also said, Australia had continued to benefit from low vacancy rates and the limited new supply coming to the market, along with the influx of international retailers to our local shores.

US fashion label Brooks Brothers and UK retailer Marks & Spencer have recently announced they will be entering the Australian market.

Another consideration he points to is the upcoming Federal election.

"History shows that retail sales following a federal election usually show a strong short-term spike as consumer confidence lifts and this will translate to rental growth over the next 12 months. This will also coincide with a number of the ‘boom time’ leases of 2008/2009 coming up for their five year anniversary," said Mr Loudoun.

CBRE said that the top 10 prime global retail markets saw little change relative to previous quarters, however, four of the top 10 markets - New York, London, Zurich and Tokyo - saw quarterly increases in prime retail rents, compared with only one market during the previous quarter.