ACT and NSW lead “slight” improvement in housing affordability in March quarter but FHBs stay away: REIA report

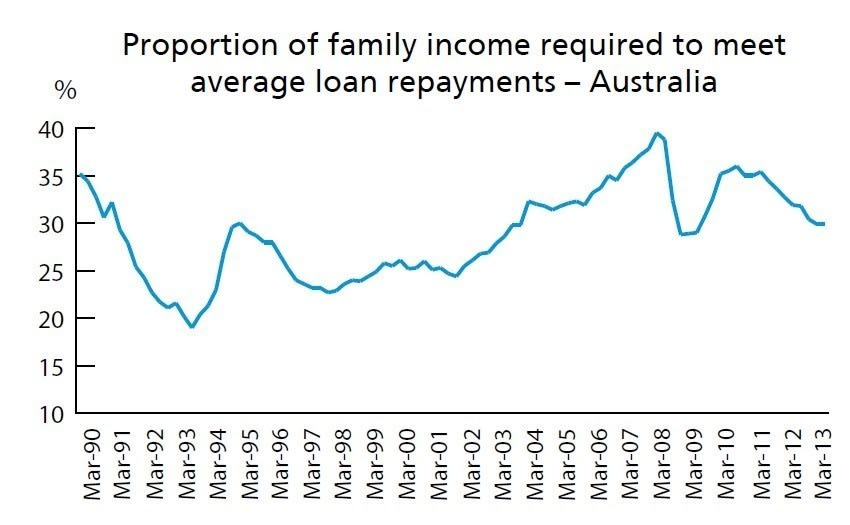

Housing affordability improved by 0.5 percentage points in the first three months of the year with the proportion of income required to meet loan repayments decreasing to 29.9%.

It was the seventh successive quarterly improvement in housing affordability as measured by the Real Estate Institute of Australia (REIA) in partnership with Adelaide Bank.

A year ago, the proportion of income required to meet loan repayments decreasing to 32.7%.

Housing affordability woes peaked at a ratio of family income to average loan repayments of close to 40% in March 2007 just before the start of the Global Financial Crisis when the cash rate hit 7.25%.

Source: REIA

Despite the continued incremental improvements in affordability over the past two years, first-home buyers as a proportion of the owner-occupier market dwindled to their lowest level since the June quarter of 2004.

First home buyers made up 14.5% of the owner-occupier market compared with 16.5% in the December quarter 2012, according to REIA figures.

“Affordability has been improving slightly now for seven consecutive quarters, with the proportion of income required at its lowest since the December quarter 2009 and compared to the same time last year, all states and territories saw improvements,” notes REIA president Peter Bushby.

"Investors are returning to the housing market with investment housing representing 36% of total lending in March 2013. Unfortunately this confidence is not shared by first home buyers with numbers plummeting since the First Home Buyer Boost was abolished," he says.

Click to enlarge

Source: REIA

The REIA blames the decision by state and territory governments in NSW, Queensland, South Australia, Tasmania and most recently the ACT to axe the $7,000 first home owner grant for the purchase of existing homes for FHB numbers falling sharply.

“The impact of the decisions by the state Governments is clear in the plummeting number of first home buyers. Despite cuts in the official interest rate by the RBA to levels not seen for decades,the proportion of first home buyers decreased to 14.5% in March 2013," said Bushby in a statement earlier this month.

Renting become slightly less affordable in the March quarter - declining from 23.9% of median weekly family income required to meet weekly rent for a three bedroom house to 24.4% - but is still more affordable than a year ago (24.7%).

The largest improvement in housing affordability was recorded in the ACT where the proportion of income needed to meet loan repayments dropped by 1.4 percentage points to 17.3% driven by weekly incomes rising by $10 to $2,992 while average monthly loan repayments fell by $161 to $2,249.

The second biggest improvement in affordability occurred in NSW with ratio of household income to monthly mortgage repayments improved from 36% to 34.5% - a year ago it was 37.8%.

However NSW, with its high median house prices, remains the least affordable state followed by South Australia (an improvement from 31.4% to 30.6%), Victoria (an improvement from 30.6% to 30.2% and Queensland (an improvement from 28.1% to 27.9%).

Western Australia (up from 22% to 22.6%) and Tasmania (up from 25.2% to 25.6%) where the only two state or territory markets where housing affordability worsened over the quarter.

REIA March quarter figures show the number of loans to first-home buyers in NSW fell 40.6% to 2,647.

“When compared to the figure recorded a year ago, that’s a 5 7.0% drop. This is the largest annual decline in the number of first home buyers’ commitments across the country,” says Bushby.

In Queensland, the number of loans to first-home buyers decreased 43.2% to 2,557 and this is the largest quarterly decline across the nation. When compared to the figure recorded last year, it’s a 49.2% drop.

“The proportion of first-home buyers in the number of owner-occupied housing finance commitments is now at 14.2% and remains persistently low compared to the long-run average proportion of 20.1%,” says Bushby.

Victoria recorded a drop in the number of loans to first home buyers over the quarter, down 15.4% to 6,053 while South Australia recorded the nation’s only increase, up by 1.8%.