A land tax would leave Australia a lot better off: David Collyer

GUEST OBSERVATION

Treasury recently released its submission to the federal Tax White Paper. It has found a tax that actually confers a benefit on Australian citizens. That is, using it actually leaves us better off.

It isn’t a new tax - it is land tax.

Unbiased economists have always known a broad based nil exemption land tax has a marginal excess burden of zero. They have continually urged government to use it ahead of every other conceivable tax instrument available.

The net benefit comes about because foreign and domestic landowners must pay it yet it is spent solely on Australians.

Or, as Treasury describes it:

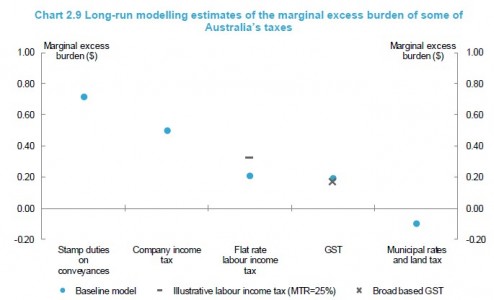

"Modelling also suggests that broad-based land taxes, such as municipal rates, have a low economic cost (Chart 2.9). This is because land is immobile (unlike other capital) and cannot be moved or varied to avoid tax. The model applies this assumption to both domestic and foreign ownership of land. Land taxes paid by foreign and domestic landowners are only redistributed to the domestic households, providing a benefit to Australian households and generating a negative marginal excess burden for a broad-based land tax shown in the chart."

There is much unrest at the high and growing level of foreign land ownership in Australia. We have abandoned the settler compact that all political parties once held as sacred: that every Australian citizen, no matter how humble, should enjoy the freedom, independence and privacy of land ownership.

Now, the share going to first home buyers is at historic lows yet there is no let to the foreign investment in Australian property, according to a recent NAB survey:

I urge a debate on land tax, not because it takes from foreigners – although that is certainly a positive feature – but because we would be richer, more active and freer with it.

If a tax exists with a positive excess burden, we have an obligation to examine its features and shortcomings with a microscope.

The only genuine negative I have ever heard about land tax came from nobel laureate Milton Freidman, who observed: “It’s the only tax left on the books for which people have to write a big cheque.”

David Collyer is policy director of Prosper Australia.

David ran as a Senate candidate for the Australian Democrats in the 2013 federal election.

This article first appeared on Prosper's website.