APRA strikes back to quell IO lending

Pete WargentDecember 17, 2020

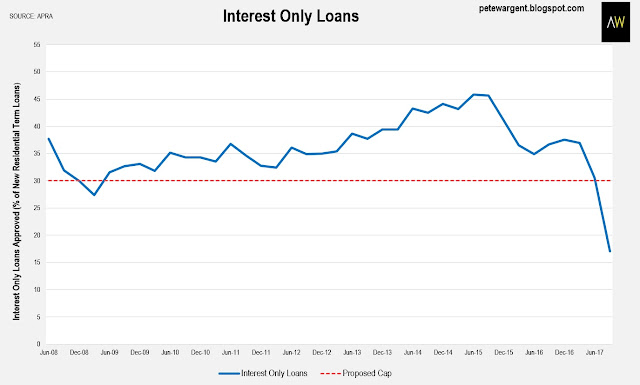

If anyone doubted APRA's commitment or ability to quell interest-only lending, then they definitely shouldn't any more.

New interest-only loans have been smashed to smithereens, down from 45.6 per cent of the market at the 2015 peak to just 16.9 per cent.

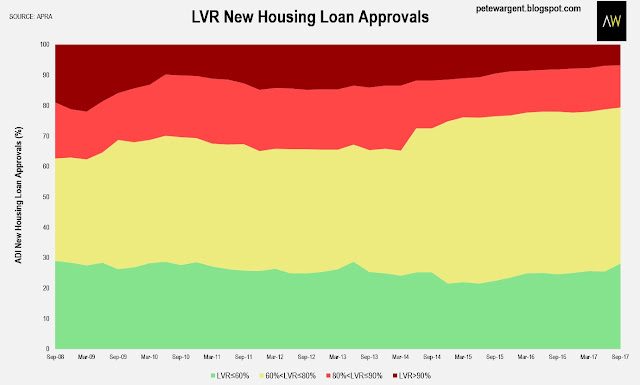

Banks continue to wind back high loan-to-value ratio (LVR) lending, continuing a trend that has been underway for 4 years now.

Property buyers will not only need to pay back principal, they'll need to have a decent deposit too.

Despite this, the total value of residential mortgages on ADI books rose by +6.9 per cent over the year to September, as the pendulum swings from investors to homebuyers.

A seismic shift in the market then, as more borrowers will now be compelled to pay back some debt.

With interest-only lending peaking in 2015, the greatest volume of rollovers will occur in 2020 - see here for my thoughts on what might happen then.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.