Commercial property sentiment moderates for second quarter in a row: NAB index

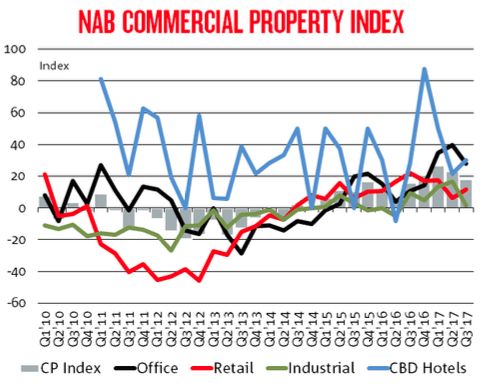

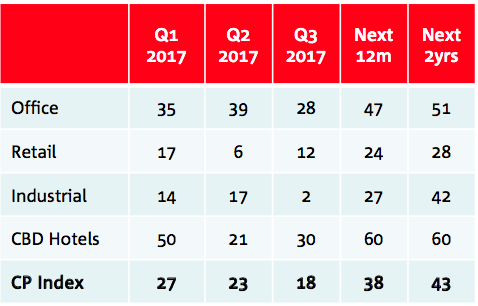

Commercial property sentiment moderated for the second consecutive quarter, according to NAB’s latest index, though overall confidence improved in the September and the index is expected to rise to +38 in the next 12 months.

NAB’s Commercial Property Index was down 5 to +18, but remains above long-term average levels.

“Although sentiment was above long- term averages in all markets (except CBD hotels), it continues to vary widely by property type,” said an accompanying release.

The uptrend in office that started in mid- 2016 reversed in Q3 (down 11 to +28), with weaker outcomes reported in all states except WA (but still negative).

NSW leads in office markets (with sentiment at very high levels), followed by Victoria.

CBD hotels re-emerged as the most positive sector (up 9 to +30). Retail market sentiment was also higher (up 6 to +12) and lifted in all states (bar WA & NSW) with QLD leading the way. Industrial sentiment softened (down 15 to +2) - with sentiment lower in all states except WA (but negative).

Overall confidence levels in commercial property markets improved in the September quarter - the index is now expected to rise to +38 in the next 12 months (from +30 previously) and +43 in 2 years’ time (+35 previously).

“Confidence levels among surveyed property experts lifted in all sectors - most noticeably in the CBD hotels sector - which is likely reflecting strong fundamentals in key CBD markets, especially Sydney,” it said.

Overall confidence levels in office were also slightly higher in Q3 as weaker (but still vey strong) outcomes in NSW and Victoria were offset by improvements all other states (particularly WA).

In retail markets, confidence increased, with gains in all states.

In the industrial property sector, gains were largely in WA and Queensland, with experts in the industrial property sector in Queensland also still the most confident of all states, and confidence levels in WA improving the most (but from very low levels).

By state, lower overall sentiment was dragged down by NSW and Victoria.

Sentiment lifted in SA/NT and WA (but negative) and was steady in Queensland. The state index for NSW fell (13 to 34), and was lower in all sectors.

In Victoria (down 13 to +29) the index fell in Office and Industrial, offsetting an improvement in Retail. Sentiment continued to recover in WA (up 11 to -29), recording its strongest read since late-2014 (but still negative). Property experts in NSW and VIC were also less confident in the Q3 survey - but remain the most upbeat of all states in the next 1-2 years.

Queensland is however bridging the gap, with confidence levels rising in all market sectors. Confidence in SA/NT also lifted solidly (from a small sample size) led by better outcomes in Office and Retail. In WA, confidence levels also improved - and in all sectors with a particularly big uplift in the Office segment.

On average, property experts have lifted their expectations for capital growth in the next 1-2 years in all sectors. Expectations are strongest for CBD Hotels (2.3% & 2.4%), followed by Office (1.9% & 2.3%), Industrial (0.9% & 1.9%) and Retail (1.3% & 1.1%).

Capital growth expectations for Office property were pared back but are still highest in NSW (3.4% & 3.2%) and Victoria (1.8% & 2.8%). They were revised up in Queensland (0.8% & 1.5%) and in WA (-0.1%& 1.9%). QLD is expected to provided the best capital returns in Industrial markets (2.0% & 3.5%), followed by NSW (2.1% & 2.8%).

Industrial capital values in WA are tipped to fall heavily next year (-1.9%) and grow in 2 years’ time (0.4%), with weaker growth also predicted for Victoria (0.9% & 1.2%). Overall capital growth expectations in Retail improved again in Q3 (1.3% & 1.1%), with Queensland and Victoria the stand out states.

The national Office vacancy rate was unchanged at 9.7% in Q3. Vacancy rates were reportedly lowest in VIC (4.3%) and NSW (6.3%) where strong tenant demand and take-up is continuing. Vacancy rates in SA/NT (12.3%), Queensland (13.0%) and WA (15.0%) were however still elevated. In Retail, overall vacancy climbed to 5.7% in Q3 to its highest level since late-2014.

Vacancy increased most in WA (8.0%) and was lowest in Queensland (4.7%). In Industrial markets, vacancy also climbed to a survey high 7.0%, mainly reflecting a significant increase in available space in WA (10.0%). Looking forward, Office vacancy is expected to drift down in the next 1-2 years, with market tightness most apparent in VIC & NSW. Vacancy is also expected to improve in Queensland, SA/NT and WA, but remain high amid large supply over-hangs in WA.