Food-based retailing is the standout retail performer: JLL survey

JLL’s latest retail survey shows food-based retailing strategies continue to be top of mind for shopping centre managers looking to improve performance of their centres.

Food-based and non-discretionary retailing has been a top performer in shopping centres and centre managers have been devising strategies to encourage the trend to improve overall performance, according to a recent JLL survey.

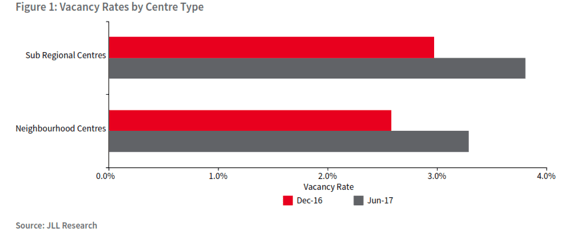

Retail vacancy rates in neighbourhood shopping centres, which strongly feature food-based and non-discretionary based retailing, increased in the first six months of 2017 – from 2.6% of vacancy in December 2016 to 3% in June 2017.

However, vacancy rates remained below the long-term average of 4.5% reported across the 17 Centre Managers conducted to date, according to JLL’s 17th Retail Centre Managers’ Survey.

The survey, undertaken in August across 119 Australian shopping centres under JLL management, also found the performance of anchor tenants was key to maintaining high occupancy levels to combat retail vacancy in centres.

JLL’s head of Property & Asset Management – Australia, Richard Fennell said attracting additional anchor tenants or mini-anchor stores was highlighted as improving the occupancy rates and rental income of some shopping centres.

“This is a strategy that works, along with changing the tenancy mix to include food-based retailing and services such as medical centres, financial services and travel agencies. Shopping centre owners are reconfiguring and refurbishing centres to provide upgraded and expanded services to attract customers,” Fennell said.

“Owners and managers are constantly refining their strategies to address the key concerns identified in the survey that are impacting on trading performance – competition, growth in online retailing, and a challenging economic outlook.”

The survey also revealed a slight improvement in sales growth expectations, with 53% of respondents expecting some sales growth in the year ahead, up from 47% in February 2017. But most respondents expected growth to be no more than 3% per annum.

JLL’s director, Strategic Consulting, David Snoswell said consumer sentiment has been weak for an extended period of time across the nation.

The Westpac-Melbourne Institute Survey of Consumer Sentiment has been below the 100 neutral mark between December 2016 and August 2017, dropping to a low of 95.5 in August.

“20% of respondents to our survey said they expected a decline in sales turnover in the next 12 months and gave a range of reasons for this, including strong competition in the catchment they operate in, the loss of a key tenant and the need for the centre to be refreshed/refurbished,” said Snoswell.

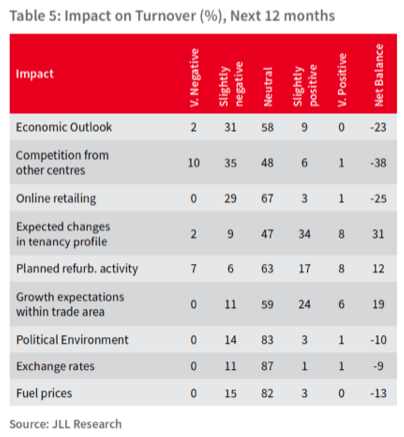

“When we asked shopping centre managers what factors were impacting turnover performance, competition from other centres remained the key area of concern (with a net balance of -38%), followed by online retailing (-25%) and the economic outlook (-23%).

“In contrast, the most positive factor for trading performance continues to be changes to the tenancy profile of centres to improve performance.”