Centuria boss says unlisted funds had bumper year

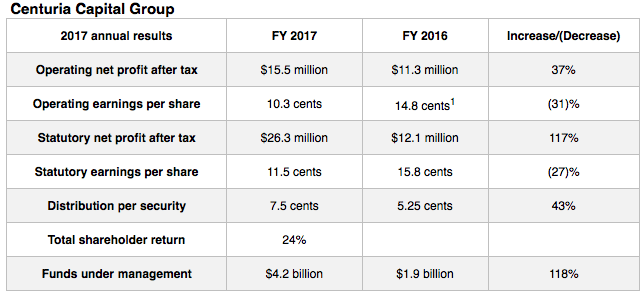

Property fund manager Centuria Capital Group’s operating earnings per share dropped 31 percent to 10.3 cents per share while funds under management more than doubled to $4.2 billion for the full year ended June 30.

It said the results were in line with its guidance.

Centuria also announced distribution of 7.5 cents per share for the financial year and up 43% on FY16 results.

Since financial year 16, Centuria has purchased 10 properties for $721 million across the listed and unlisted businesses, with $517 million acquired by unlisted funds.

Centuria said total shareholder returns were 24% and the group expects its operating EPS to grow nearly 5% during FY18.

Group CEO John McBain highlighted the acquisition of the $1.4 billion 360 Capital real estate platform.

“This acquisition was a very significant contribution to growth in funds under management and our consequent increase in scale and market presence. The result has been a step-change for Centuria Capital, bringing our business to scale and this activity should enable near-term ASX 300 inclusion.”

“In addition, the majority of 360 Capital’s funds were listed funds which were highly complementary to our platform which was previously skewed toward unlisted property funds,” McBain said.

He said the group’s unlisted business "had a bumper year", growing by 106% and has property assets under management worth $1.6 billion. It made the largest purchase in the group’s history – the Zenith office tower in Chatswood for $279 million in a joint venture with global investor BlackRock.

Last month, Centuria Property Funds said its listed office fund, Centuria Metropolitan REIT (ASX: CMA), has bought three commercial properties in Perth and Melbourne for a total of $150 million.

In Perth, Centuria acquired two new commercial assets: The Hatch Building at 144 Sterling Street (above), and 42-46 Colin Street, for a total of $91.8 million.

During the year, Centuria merged its two office Real Estate Investment Trusts: Centuria Metropolitan REIT (CMA) and Centuria Urban REIT (CUA); and acquired the management of Centuria Industrial REIT (CIP).

As a result, CIP is now Australia’s largest pure rent-collecting REIT, with a market capitalisation of $563 million.

Metropolitan office REIT CMA has a market capitalisation of $420 million.

Meanwhile, Centuria Property Funds has announced two leasing deals for its listed industrial trust, Centuria Industrial REIT.

“We are very pleased with the performance of both funds this year. The merger of CMA and CUA resulted in a larger and more efficient fund, which went on to acquire a further $150 million in assets since the merger,” said McBain.

The company will look to grow both funds with asset acquisitions, it said.

The Centuria Diversified Property Fund (CDPF) was also launched this year. It is an open-ended, unlisted diversified property fund which invests in office trusts.

McBain said the group would use its balance sheet strength to accelerate growth across its listed and unlisted property businesses.