Offshore money continues to flow into commercial property: Colliers

Commercial property continued to be a popular with foreign investors in the 2016/2017 financial year, in particular office assets in the Sydney and Melbourne CBDs, according to Colliers International.

Investment across the office, retail, industrial and hotel sectors was $28.99 billion in the preceding financial year, according to the 2016/17 Capital Markets Investment Review series.

Foreign buyers accounted for $8.19 billion, or with 28 percent, of those sales, according Colliers.

“Yield compression in each asset class will continue throughout the financial year ending (FYE) 2017, with limited stock creating competitive tension between investors and driving record prices,” says the report.

The states most in demand with investors are New South Wales and Victoria due to their thrust on infrastructure development, population growth, rising rental rates and tightening yields.

This has created opportunities for some of Australia’s premier developers to build the next generation of commercial assets, according to Colliers International’s managing director of Capital Markets and Investment Services, John Marasco.

“These development hot spots in Sydney and Melbourne will cement these cities’ reputations as globally competitive cities for both capital and tenants, and meet not only the current but also the future needs of occupants,” he said.

New South Wales grabbed the lion’s share of investment across office, retail, industrial and hotel sectors, totalling $12.51 billion.

It was followed by Victoria, which recorded $8.33 billion in investment across all four sectors.

“Not surprisingly, the eastern powerhouse states of New South Wales and Victoria have again dominated sales volumes, with generally more assets to offload and greater appetite from buyers for CBD locations,” Marasco said.

Queensland had $4.75 billion in total investments, followed by Western Australia with more than $1.02 billion, the Australian Capital Territory with more than $628.5million, and South Australia with $601.5 million.

Anneke Thompson, Colliers International’s national director of Research, said one of the most notable trends this year was the increase in investment from offshore private investors, particularly in the office sector.

“Throughout the past financial year, offshore privates purchased $2.09 billion worth of office stock, up 59 per cent from $855 million the previous year,” she said.

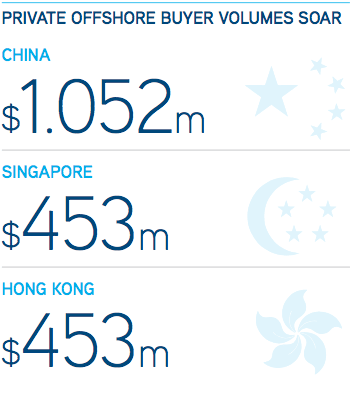

Not surprisingly, half of the offshore private capital invested in Australian office markets came from China at $1.05 billion. Private capital from Hong Kong and Singapore also surged, growing to $906 million in 2017 from $73 million in the financial year ending in 2016.

Thompson said the influx in private capital could be explained by both the continued search for yield and the growing perception in the global investment community that Australian office property offered a “safe haven” investment environment.

“The improving leasing markets, particularly in Sydney and Melbourne, are also helping drive investor confidence in the outlook for capital appreciation of core office assets,” she said.

Throughout the past year, Australian office markets have continued to build on their growing global reputation as a relatively high-yielding asset with solid long-term fundamentals, attracting more offshore capital.

According to Colliers International’s 2016/17 Capital Markets Office Investment Review, the total transactional value for the FYE2017 was $13.2billion, with about 75 per cent of sales taking place in New South Wales and Victoria and offshore investors making 44.9 per cent of purchases.

Although transaction value is slightly down on last year (by $2.7billion), the FYE2016 included the $2.45billion sale of the Investa portfolio to China Investment Corporation, Colliers said.

Marasco said it was important to note the impact population growth in Australia’s capital cities was having on transaction volumes, with the country growing by 1.89million people between the 2011 and 2016 Census.

“Both federal and state governments are now more focused on building infrastructure to help our cities cope with their growing size,” he said.

“These are key positive attributes for office markets, with both trends being felt most keenly in Sydney and Melbourne.”